Intraday Market Thoughts Archives

Displaying results for week of Aug 11, 2019The Week that was & Dashboard

What started as a week of gloom and doom in the markets, ended with a positive note from the US consumer and a cooling in rhetoric on the US-China trade war. This was supposed to be a quiet week, when central bankers are on holiday and economic data on the light side. But from the way the last exchanges occured, the US-China trade war is far from over. China is growing more vocal and its tack is changing as Ashraf pointed out here. More on this from is time last week, Ashraf issued a Premium short in the DOW30 when it was up 300 pts. The trade was closed with a 700-pt gain. No longs will be issued today despite the index being up 300 pts. There are two existing trades for now. We'll return next week with the FOMC minutes of the last meeting and the Fed's annual symposium for US and global central bankers at Jackson Hole conference, titled this year "Challenges for Monetary Policy" (more details here). Meanwhile, GBP is the strongest currency of the day and the week, in a week that was dominated by swings in indices. More on the market dahsboard below.

Reconciling Positive Retail Data w/ Market Turmoil

The data highlight of the week was the 1.0% rise in US retail sales (control group) compared to +0.4% expected. That makes the first seven months of 2019 the strongest seven-month period for the series since at least 1992. The strength in retail was underscored by by quarterly results and commentary from Wal-Mart. That data is in wild contrast to financial market moves this month. Treasury yields fell to fresh lows with 10-year notes breaking 1.50% and 30-year bonds falling below 2%. Both have fallen 50 basis points since the start of the month – a sign of extreme stress.How do we reconcile robust consumer data with violent market moves? For one, the economic data is backward looking while the market is looking ahead. This is especially the case for a late-cycle economy, when slowdown in manufacturing production, factory capacity and supply orders preceded changes in labour markets. Said differently, "labour markets are always the last to know" -- They're never described as leading indicators. It's also looking abroad to the eurozone, which is increasingly worrisome. On Thursday, the ECB's Rehn told the WSJ that at this point the central bank needs to beat expectations. The market is now pricing a better-than-even chance of a 20 bps cut (rather than 10 bps).

Market Dashboard

Here are some notable market notes sent to me by Ashraf. Despite today's gains:US indices posted the 3rd straight weekly decline, the longest since May.

US 10 year yield fell 11% on the week, the biggest decline since summer 2012.

VIX remains well over its 200-DMA of 17.00 and all 3 meain weekly MAs.

GBPUSD has its strongest week in 7 weeks.

EUR GBP USD Calculator

Everyone in FX these days has an opinion on GBPUSD (parity, below 1.15, 1.35); on EURGBP (parity or beyond) and on EURUSD. Do you really think EURGBP will hit parity? And if cable breaks below $1.20, what would it mean for EURUSD? Use our NEW EUR-GBP-USD SCENARIOS CALCULATOR, found on the lower right part of this homepage.

High Frequency Trade War

The last 12 hours have seen more swings and reversals than in any recent 12 hours and more is yet to come. Just as markets were licking their wounds after Wednesday's slump (800-pt plunge in the Dow), a new selling wave emerged in late Thursday morning London after China stated that Trump's tariff delay was not enough to stop retaliation --without specifying how it would retaliate. 2 hours later, markets erased all of the morning's losses with JPY losing broadly on reports that Beijing was willing to meet the US halfway in negotiations. Markets pushed further higher after US retail sales posted their biggest rise in 4 months and US jobless claims as well as Philly Fed survey came in all stronger than expectations. US industrial production contracted unexpectedly. Ashraf's closed the Premium DOW30 short 700-pt gain, before opening a new trade (non-FX non-index). There are 2 existing trades currently open. Separately, EUR sells off ater ECB remarks. More below.

بين الداو، النفط و الإسترليني(فيديو للمشتركين جاهز الآن)

All of this is a fresh reminder why traders must stay relatively small in their positions and exercise extreme care when leaving positions overnight.

Wednesday's violent sell-off was all about the spread between 2-year and 10-year treasury yields -- A classic recession signal with a sparkling record of forecasting contractions in the two years ahead. It was triggered Wednesday in the US, UK as well as Canada as a massive bid gripped the long end on economic fears. The US 30-year yield fell 15 basis points below 2.0% for the first time on record.

It led to 2-3% declines in equities in North America and Europe. The damage wasn't quite as dramatic in FX as USD/JPY sank 80 pips and didn't close the prior day's gap. Commodity currencies were hit a bit harder but not enough to break the ranges for the year. It may only be a matter of time. At turning points in the economy sentiment can be as important as hard data. The relentless trade war headlines are sure to take a bite out of business investment and consumers may soon retrench.

Euro Falls on Rehn

EURUSD broke below its 2-week range, shedding half a cent on dovish comments from ECB Governing Council member Olli Rehn telling the WSJ: "It's important that we come up with a significant and impactful policy package in September”. The comments send a reminder of the ECB's counterweight to any Fed easing.Meanwhile, President Trump has taken to relentless criticism of the Federal Reserve. He attacked Powell on four separate occasions Wednesday and his deputies did the same. The Washington Post reported that it's part of a strategy to prop up the economy by lowering rates. We see it as more of a sign that the President can't stomach a deep fall in equities.

In this week's English and Arabic videos for Premium members, Ashraf tackles the following questions as well as pave the way for new trades:

1.Will equity indices return to the June lows or stabilise at the Aug 5 low?

2.If the June lows are to be seen, how high could the bounce be?

3.What are the trading implications and key levels for USDJPY, gold, oil and GBPUSD?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 0.2% | -0.3% | 0.9% | Aug 15 8:30 |

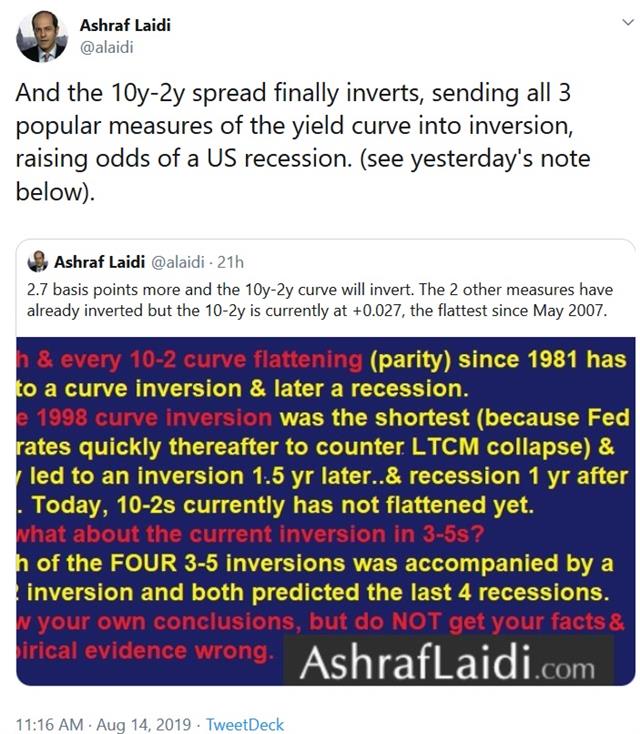

Curve Inverts Despite Trump Reverse

Trump gives it, market takes it away. Less than 24 hours after markets rallied 1.5% on Trump's announcement to delayed US tariffs on a portion of the items due to be hit on Sept 1st, markets tumbled (624 pts or -2.2% for the Dow) after the most popular measure of the US yield curve (10y-2y) entered negative territory for the 1st time since May 2007. The other reason (if these matter to you) is related to China's reaction. More detail on how this YC measure differs from other measures and its implications. Ashraf issued a video for Premium subscribers last night (posted below) on the 3 reasons he was sticking with DOW30 shorts despite Tuesday's 1.4% rebound.

Trump explained the reason to delay tariffs on many consumer products until Dec 15 was to avoid dampening on Christmas shopping. He also hinted that he was expecting agricultural purchases in exchange.

Chinese reports gave less on an indication of a thaw. They highlighted that it was the US who made the call and press reports took a victory lap on the US climbdown. Those aren't the actions of a country who is looking to compromise.

A Few Pointers on the Yield Curve

Here is a series of tweets Ashraf made on the topic. Bear in mind it took about 6-12 months on average for the US economy to dip into recession after the start of YC inversions.Chronicles of a Fed Error

Contributing to the sell-off in indices were remarks from St Louis Fed's Bullard saying in a podcast that economic outcomes were "quite good" for the US as far as their frameworks were concerned. And so as long as the Fed find no reason to cut rates further and markets are distracted by daily stock market fluctuations & Trump's tweets, the macro picture will go on deteriorating (impacted supply chains, slashed imports, job cuts) until it's too late.Adding to the angst in bonds was the July US CPI report. Prices rose 1.8% y/y compared to 1.7% expected but that modest number disguises a near-term jump in core inflation. Ex food and energy, prices rose 0.3% m/m; combined with the same rise in June, that's the fastest two-month rise in the core since 2006. The flipside was the wage growth was dismal.

EM Risks Bubble Over

Just as US-China trade talks move in reverse, a new EM crises moves forward. The worst day in the history for Argentine stocks, coupled with continuing protests in Hong Kong added to a risk off tone on Monday. Silver are gold are soaring at 17.50 and 1535 respectively. CFTC positioning data showed just how hated the pound has become as well as further stabilizing of sentiment in the euro. The Premium trade issued late Friday to exploit the bounce is now +400 pts in the green. US CPI is due next.

Unease about China-US trade was the biggest factor in the round of risk aversion on Monday but some emerging market risks are beginning to catalyze. Argentina's primary elections ended in disaster for local markets. The vote is largely indicative, but showed that Peronists have a nearly insurmountable lead ahead of October elections. The Merval Index fell 38% in the biggest one-day drop on record, while the Peso fell 17%. Argentina is ring-fenced from the global financial system and the contagion in neighbouring countries was modest, but it served as a stark reminder of political risk.

Protests in Hong Kong continue to draw massive numbers and on Monday they shut down the airport, which is the seventh-busiest in the world. Social media videos showed Chinese police conducting large-scale drills in neighbouring Shenzen. If Beijing intervenes, it will spark an international incident in what will be a test of China's power and resolve.

The resulting moves led to modest risk aversion in FX but larger moves in bonds. US 30-year bond yields fell 12.6 bps and touched a fresh low since 2016. Gold also hit a fresh six-year high.

Italy Politics back in Disarray

League leader Matteo Salvini is attempting to force a snap election and that would trigger memories of euro risks in past votes, but there are reasons to believe that this time is different. The ECB's bond buying has essentially sanitized political risk in the eurozone, at least on the fiscal side. Italian 10-year yields rose 30 basis points on Friday but hit just 1.80%. That's a distant cry from the +7% levels in the eurozone debt crisis. The tide is also slowly turning against austerity in the EU with Germany under pressure to spend as the economy stumbles.CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -44K vs -53K prior GBP -102K vs -90K prior JPY +11K vs -4K prior CHF -16K vs -14K prior CAD +24K vs +21K prior AUD -55K vs -53K prior NZD -12K vs -17K prior

The net short in the pound is at the most-extreme since April 2017. At some point the pound will overshoot – and we might be there already as talk about USD parity becomes widespread – but there needs to be some kind of catalyst to spark a reversal and it's difficult to envision anything positive on the Brexit front. Yen and euro shorts are shifting as carry trades unwind.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany Final CPI (m/m) | |||

| 0.5% | 0.5% | 0.5% | Aug 13 6:00 |