Intraday Market Thoughts Archives

Displaying results for week of Sep 12, 2021Swiss Mess

There have been abundant signs of SNB intervention recently and technical momentum could soon add to the moves. USD/CHF took out the June high early today and if it can hold above into the weekend, that leaves nearly 200 pips of open air until the 2021 high of 0.9471.

EUR/CHF also rose to a two-month high on Thursday. That pair had some help from a report saying the ECB's unpublished forecasts show inflation hitting 2% sooner than most economists expect. EURCHF could potentially hit its next iterim target at 1.10 after breaking the March trendline resistance.

US August retail sales rose 0.7% compared to -0.8% expected. The ex-autos and control group readings were equally strong, though all of them were tempered by negative revisions to the July numbers. Even with that, it was a roundly impressive report that led to a rally in the US dollar.

Especially instructive was the much different FX market response to this report compared to CPI earlier in the week. That report – which is a key Fed and market focus at the moment – was soft and yet the dollar held up relatively well.

Markets are choppy at the moment but there is some optimism about the reopening after US retail sales. We will get another look at spending with the UMich consumer sentiment report for September at 1400 GMT. The consensus is a slight improvement to 72.2 from 70.3.

Gradually, then Suddenly

The market's attitude towards China reminds of an Ernest Hemmingway quote about how bankruptcy happened 'gradually, then suddenly'.

It's the same with market reactions to other potential problems. The best recent example is covid, something we wrote about for five weeks before it rocked markets. The global financial crisis unfolded over a year before Lehman Brothers; which 'suddenly' went bankrupt 13 yeas ago yesterday.

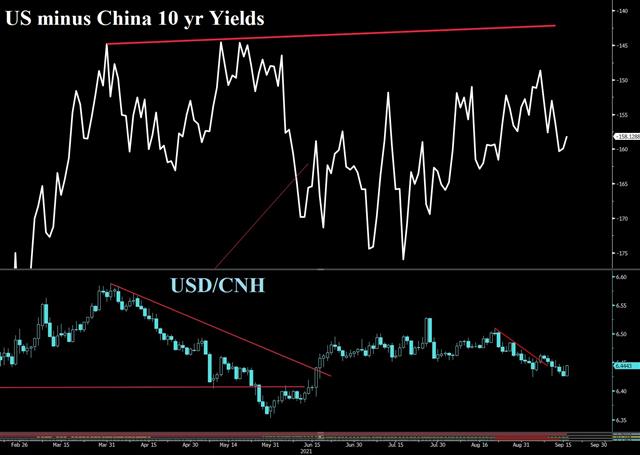

Many market observers believe China will stimulate to prevent a deep downturn or cushion the fallout from a looming Evergrande bankruptcy. That's a fair assumption but one that needs to be monitored closely. The next PBOC meeting is Sept 22, about 16 hours before the FOMC. It could very well steal the show. Ashraf tells me if the PBOC eases next Wednesday, it would be another reason for the Fed to supress the hawks--even if a Q4 is inevitable.

In the meantime, markets are tuned into another slowly unfolding crisis. Power and natural gas prices in Europe continue to soar and will now surely crimp spending in the months ahead while also causing some major political headaches. Add that to the reasons to worry about stagflation.

The day ahead features the US retail sales report and that's sure to have consequences in the market. The consensus is for a 0.8% m/m decline. Look to both the 'ex-autos' category and the 'control group', which hare forecast at -0.2% and -0.1%, respectively. The market already knows that auto sales are soft, something we detailed in a note earlier this week.Aussie Gets no Break

We wrote about China and global supply chain risks this week on here , and we got more evidence on Tuesday that those are curently the real market drivers -- not the Fed or inflation quirks.

Core US CPI in August rose just 0.1% compared to 0.3% expected. In year-over-year terms, it slowed to 4.0% versus 4.2% expected.

Initially, the FX market reaction was what you would expect with the dollar dipping 30 pips then extending that to around 50 pips across the board. Treasury yields sank, led by the long end.

Right around the time of the US equity open though, the theme changed as a broad risk off move unwound equity futures gains and reversed the dollar losses. As sentiment continued to sour, the dollar made further headway except against JPY and CHF.

What exactly the market is seeing (if anything) is unclear at the moment. The moves so far aren't big but they've been consistently in the same direction. That puts us on high alert for something the consensus is missing.

For non-CAD traders, we see more value than ever in following global data, particularly inflation. The pandemic kicked off at the same time nearly everywhere and the supply chain issues are global. Canadian inflation has had somewhat of a buffer from the rising CAD but what the market wants to know is the path forward. The US report Tuesday showed signs of a crest in inflation and that's likely to be globally synchronized, at least in developed countries.The China Challenge

It's a case of the 'the boy who cried wolf' and markets have become largely desensitized to China. Or at least global markets have.

The rout in Chinese markets has grown violent and persistent. Particularly worrisome are the $305 billion in Evergrande bonds. The securities of China's second-largest property developer are trading as if bankruptcy is imminent, potentially leaving millions of Chinese home buyers and many contractors with unpaid bills and unfinished projects. A protest from 100 disgruntled investors descended on the company Monday in Shenzhen.

Evergrande's problems coincide with crackdowns at Chinese tech and media companies as President Xi pushes to reform society. Officials have touched on a push for 'common prosperity' in a possible hint at wealth distribution or the formation of a stronger social safety net.

The shifts have come at the same time as China fights to restrain prices in commodity markets, including an announcement – without mentioning size of timing – of a release of strategic oil reserves.

All this has come at a period when Chinese economic data has consistently undershot negative growth. GDP growth has been the guiding star of Chinese policy for a generation but the shift to a consumer-led economy has been difficult and officials may try to ditch those targets to save face while reframing the goals towards common prosperity and social progress.

Along with these shifts, we worry that the recent softness in equity markets reflects risks around China. It's clear that Fed policy is less of a concern, with comments from top officials failing to move the market. Does it really matter if the taper is in November or December?

For now, there's no definitive trade on China but we will be watching very closely.

ندوة أوربكس مساء اليوم مع أشرف العايدي

Demand Destruction or Delay?

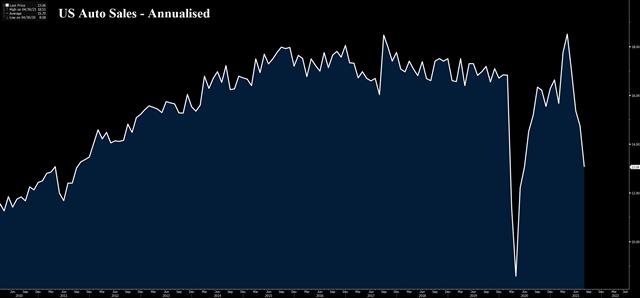

At the confluence of consumer-demand, covid-shutdowns and the supply bottlenecks is the automotive industry. Hardly a Fed speech passes without a reference to the 45% y/y jump in used auto prices but it's developed into an even thornier issue to deconstruct.

New auto sales also spiked during the pandemic and were on track for their best year in a decade before the chip shortage began to derail new car construction. As inventories were depleted, consumers slowly lost the ability to negotiate prices and companies dropped incentives.

If you arrive at a car lot today in the US, you'll almost certainly pay full price. If not, the next customer through the door will. Naturally, this continues to put pressure on auto prices but, instructively, it's also causing a rapid drop in sales overall. That drop – and similar declines in other durable goods – will be a large drag on GDP growth for the remainder of the year.

The question beyond that is whether the demand for those cars has been destroyed or simply delayed until inventories can be replenished. Moreover, at what prices will those transactions take place.

Naturally, that's a sliding scale but for the Fed, the answer is clear: Consumers believe prices will go down. That makes perfect sense because if they believed prices were going to stay flat or continue rising, there would be no reason to delay purchases.

So we're seeing a real life example of how inflation expectations are anchored.

It will be crucial to watch the industry and how pricing evolves. In an extremely competitive industry like autos, with spare manufacturing capacity (once the chip shortage is alleviated), it's reasonable to expect prices to come back down and incentives to return. Yet, the longer the shortages last, the more that's jeopardized.

More broadly, not every industry is as competitive as autos. In other industries where there are shortages, companies may try to boost margins and that could also lead to sustained inflation, particularly once consumers normalize the higher prices and seek higher wages in response.

In short, inflation is perhaps the most-difficult economic force to predict, understand and control. There are plenty of good reasons to expect a higher inflation regime and even more to trust the collective judgement of global central banks. The answer will be in the data and the automotive industry is the single best spot to monitor.