Reflationary Trade Here to Stay

The Fed's 50 bp-cut to 1.00%, adds to the 50-bps made less than a month ago, making the central bank in full pursuit of its full employment objective, while extending its policy U-turn away from its inflation bias. The combination of market and macroeconomic elements will maintain global monetary policy in a rare unison of easing mode (again typical of global recession), hence, paving the way for the reflationary trade (explained below).

On a side note, this is the first time in the current easing cycle that there is no mention of labor markets in the 6-paragraph policy statement, thereby, reflects the evident fact that the economy is in recession. The emphasis on slowing consumer expenditure in the same paragraph underscores the fluidity of the transmission mechanism from falling asset markets and dried up credit to households.

Reflationary Trade Here to Stay

In further highlighting the deterioration in the domestic economy, the Fed has introduced the element of slowing foreign economies as a new dynamic in its policy statement, a practice last adopted during the global economic slowdown of 2001-2. The foreign element of the US economic slowdown will be further compounded by the strengthening dollar acting on nearly a third of S&P 500 earnings, ranging from makers of consumer goods, technology and building materials.

Unlike the aggregate 125-bps easing delivered in a space of 7 days in January , which was primarily targeted at systemic threats provoked partly by Bear Stearns and Societe Generale, the 100-bps easing of the last 3 weeks have been targeted at dissipating credit, eroding interbank confidence and broadening contraction in macroeconomic activity.

Such combination of market and macroeconomic elements will maintain global monetary policy in a rare unison of easing mode (again typical of global recession), hence, pave the way for the reflation trade, namely quantitative policy easing eroding real interest rates to the benefit of commodities. The Fed's downgrade of inflationary concerns further plays in favor of the reflation trade. Policy easing aside, commodities will welcome any stabilization in global demand creation to get them to recall the interest seen over the past 3 years.

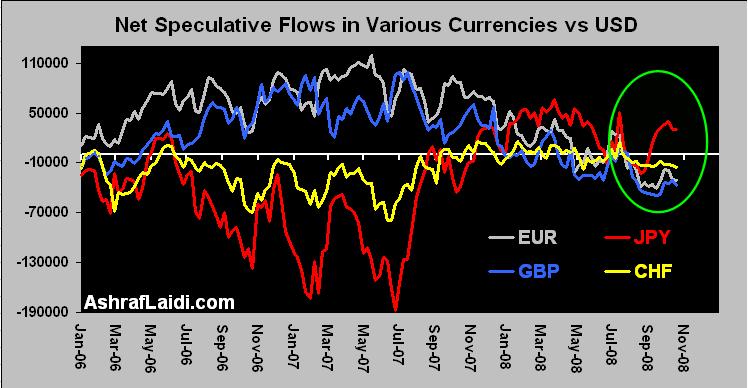

The above chart summarizes the positioning among forex speculators in the various currencies against the US dollar. While the individual charts clearly show accumulated bias in favor of the dollar, the chart above highlights the Japanese yen as the only currency (among EUR, GBP and CHF) standing in net long territory i.e. the only currency which traders are net long against the USD in light of rising risk aversion. The individual charts show futures positions in the Aussie and the Canadian dollar remaining in net positive territory, showing the long AUD positions vs the USD continue to exceed the shorts, despite the 40% plunge in AUDUSD of the past 3 months and the 60% decline in Aussie net longs. This suggests that the speculative element to this years Aussie ascent was not as considerable as that behind EUR and GBP. In contrast, CAD futures positions have turned net short against the USD since July, despite lofty oil prices prevailing at the time. The swift drop in CAD longs reflected the sharp sentiment downturn in USDCAD exchange rate and surging equity market volatility. More analysis to follow on FX spec futures

Loonie Flies On Reflationary Trade

After an earlier negative knee jerk reaction in equities, which pared gains in high yielding currencies and yen crosses, risk appetite is on the rise again, delivering sharp gains in the commodity-dependent AUD, NZD and CAD. In our earlier note today, I singled out the Canadian dollar as most likely to come out among the big winners in the event of protracted market gains. Indeed, USDCAD deepens its declines by more than 7 cents (5.8%) from 1.2870 to 1.2170 as gold and oil push higher on further expansion in the reflationary trade. USDJPYs chances of regaining yesterdays 98.50 yen remain slim as the pair is likely to drift back towards the 97.50-96.50 range, awaiting any signs of a potential BoJ cut later this week. EURUSD continues to face difficulty regaining the Oct $1.30 figure from Oct 30 amid markets anticipation of further ECB easing. Negative bias crops back up towards 1.2760. GBPUSD exceeded our resistance targets to call up the Oct 22 high of $1.6470 which is the 61.8% retracement of the decline from the $1.72 high to the $1.56 low.

Cheers

Fank

Ashraf

Thanks

Frank

Ed, short answer is YES, it has more to go. It's about time the selling has tapered off after 11 weeks of steep declines. It's too early in the bear cycle to to pronounce the end of the sell-off. We should soon get the much anticipiated rebound (at least for a week and not a 10% day move) that could lift the major indices by at least 20% before a resumption of the bear and fresh yen bullishness. Bull market rallies have typically lasted for weeks if not months (like between March and May). If one is expecting or hoping for prolonged equity selling to make money by buying yen and dollars, they should want a decent bear market rebound that will herald the next slide.

Thanks,

Ed