Intraday Market Thoughts Archives

Displaying results for week of Jan 26, 2020One-Off Hits vs Lasting Impacts

Markets deepen their losses on traders' reluctance to hold on to gains ahead of potentially more virus-related revelations in the weekend. Ashraf tells me to watch the 3202/05 support on the SPX = 55-DMA, a level last reached in Oct 2019. If you thought today's market fall was ugly, then how bad would it have been without the FAANGs? Their contribution to the overall index has been among the biggest in over 20 years. The market is struggling to price in what's happening in China. There was a clear effort Thursday to 'buy the fact' as the WHO declared an emergency after a week of wavering. One main reason for the initial rally (in addition to the Amazon earnings) was that the WHO did not force any nations to restrict travel. Markets care about travel, transportation and demand but known unknowns could be in store over the weekend (More on the virus below). It's been a strong month all-round for USD except against CHF, but USD is struggled these past 2 days, especially as Chicago PMI hit a 5-year low. A new trade was issued yesterday evening backed by 4 charts. Wednesday's DOW30 short hit its final target at 28290 for 520 pt gain with the DOW chart issued at the moment of the trade shown below.

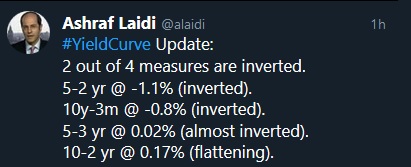

And what about the yield curve. 2 out of the main 4 measures are inverted.

In the big picture, it's important right now to emphasize the difference between a one-off hit to growth and a structural change. Right now, the market is treating coronavirus as a one-off event. So whether it curbs Chinese growth by 1 percentage point this year or 5 percentage points, it will eventually disappear. It's like an 'ex-items' line in an earnings report or an unscheduled one-time plant shutdown. Eventually it's fixed and the business gets right back on track. The equity market is powerful for pricing past those kinds of events, and is trying to do the same with coronavirus,while bonds and FX remain underpinned by US yields and scope for policy inflection points.

Other events can be lasting, structural changes. One of them is an increasingly clear stance at the Federal Reserve indicating they will allow inflation to run hot to make up for shortfalls. Powell said Wednesday that they're “determined to avoid” the downward spiral in inflation and inflation expectations like in the eurozone and Japan. That's led to a growing belief the Fed will institutionalize that kind of thinking in its policy review. The result is lower rates overall for the foreseeable future via inflation averaging.

Another example is the 5% deficit-to-GDP numbers in the US . A few years ago, we might have expect some path to a balanced budget – and the associated growth drag – but now there's almost no pretense of fiscal responsibility and nothing on the horizon. Eventually the bill will need to be paid but Japan has shown you can push that off for a generation if you have a global reserve currency.

They said last week it may be more than bulls versus bears -- this might be a case of some positive structural factors pushing back against one-off items.

The thing is, those one-off items can expose other faults. You see that time and time again in the stock market where some bad revelation is followed by a series of others. So aside from the coronavirus risk itself, there's the chance it exposes something else, like the large debt overhang in China or unseen political frictions.

Path of 2-week Incubation Period

Next week should be key regarding the spread of the Corona virus. Since we know that the incubation period is 14 days and that Wuhan had been quarantined since January 23rd, then the spread of infections should likely peak by middle of next week. If that is not the case, then the ominuous conclusion is that either the quarantine was not effective, or that the incubation period may vary at the risk of the outbreak of further cases.The charts below (not fully revealed) make up the rationale for Thursday's new Premium trade along 6 key bullet points. The trade is already in the green alongside all of the existing 7 Premium trades (5 in FX, 1 on crypto and 1 on commodities)

The 1% Pattern هدية يوم الجمعة

Understanding the Strategy & Rationale

The Bank of England left rates unchanged, lifting sterling across the board. It did not matter that I was expecting no rate cut. What matters, instead, is what we told clients. Here is the 2-part strategy I suggested to Premium subscribers on Tuesday + some key elements on USDX and EURUSD. Video is open to all.

Powell Keeps Bonds Bid ahead of GDP

The Fed cracked open the door to cutting rates later this year by emphasizing that the central bank is determined to avoid the kind of low inflation that's plaguing several developed countries. The dovish tilt dragged yields lower to as far as 10-yr barely standing 1% over the 2yr. The implied odds of a cut this year rose afterwards while the dollar edged lower. A close decision from the BoE is due at noon GMT, followed by the first reading for US Q4 GDP is up at 13:30 GMT. A new trade was issued after Powell's press conference, with the rationale for the trade detailed in a special bilingual Premium video below.

Powell said the Fed is “determined to avoid” the downward spiral in inflation and inflation expectations that's plaguing the BOJ and ECB. The implicit message is that they will cut if there's any stumble in growth. He also offered more hints that the Fed will move to a 'make up' strategy on inflation where they would let it run hot to counter periods of below-target inflation.

In the statement, the Fed also downgraded the assessment of household spending to 'moderate' from 'strong' in a sign that risks are tilted to the downside.

The overall message continued to be that the Fed was comfortable with rates but he acknowledged that coronavirus was a risk. The implied odds of a cut in March rose to 11% and they continue higher from there with a cut now fully priced in by September (compared to 77% a day ago).

In terms of market moves, US stocks finished slightly lower as they gave up gains late but the stand-out move is the fall in Treasury yields. The US 10-year note yield fell 6 basis points to the lowest close since April and is now just 1.3 bps from inversion with the 3-month bill. The disconnect between stocks and bonds can't last and USD/JPY is stuck in the middle as it trades at the midpoint of the three-month range.

The day ahead features the first look at US Q4 GDP and the consensus is for 2.1% q/q annualized growth. A sub-2% number would reignite growth fears but also be wary of risk aversion in the final hours of trading as investors shy away from weekend coronavirus risks. The BoE is also due--Ashraf details a 2-pronged trade strategy for GBPUSD ahead of the decision in Tuesday's Premium video.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance GDP (q/q) [P] | |||

| 2.2% | 2.1% | Jan 30 13:30 | |

Fed May Edge Off Sidelines

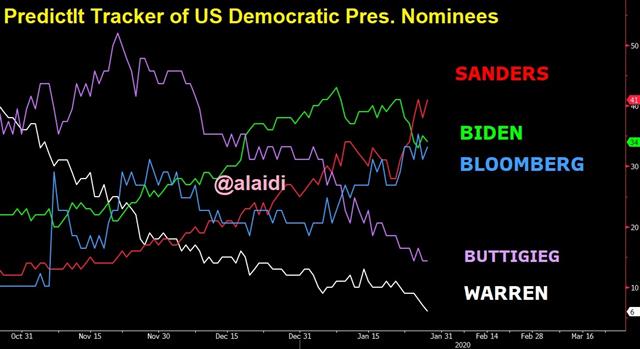

Markets resume their broad rebound, powered by strong Apple earnings even as the number of Corona Vorus cases in China exceeds that of SARS in 2002. Bear in mind that firms in the Hubei area are prevented from resuming work until Feb 13 at the earliest, which could further impact the national and global supply chain. As we move today's Fed decision, market is currently pricing in a 28% chance of a cut in June, rising to 77% in September. US interest rates haven't moved much in the past decade but the Fed has struggled most in one scenario: Doing nothing. Policymakers are clearly and explicitly on the sidelines heading into Wednesday's decision but if their past habit is any indication, then staying there will prove to be tough. Meanwhile, in US politics, Bernie Sanders regains the lead among his Democrat peers.

The USD is up against all major currencies, but lower vs gold and silver. NZD and CHF are the weakest.

Hard vs Soft Data

Tuesday's US data gave the Fed few things to think about: Consumer confidence and the Richmond Fed both beat estimates in a positive sign for growth but core durable goods orders in December were the weakest since April in a sign that businesses remain reluctant to invest.On net, the forward-looking numbers are good but they're also the more-volatile set and the Fed outlook depends on better business investment in 2020 with 'uncertainty' from the trade war diminished. The problem is that coronavirus has already replaced, if not surpassed, that uncertainty.

With China's economy at a virtual halt for at least the next week, the risks to global growth this year have clearly shifted to the downside. That presents the Fed with a difficult decision. If Powell takes a step off the sidelines, then the market may rush into pricing in rate cuts and that could put the Fed in an uncomfortable position.

The market is currently pricing in a 28% chance of a cut in June, rising to 77% in September. The timing of this meeting is especially tough with the next one not scheduled until March 18. In the interim, the coronavirus scare will either result in a full-blown pandemic risking a global recession or fizzle.

If the Fed does edge off the sidelines, it will once again reinforce that they have a hair-trigger to ease at the sign of any distress. That will be comforting to equities and keep the bid in bonds. The decision is at 1900 GMT with a press conference 30 minutes later. No new forecasts are due.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| -0.1% | 0.4% | -0.1% | Jan 28 13:30 |

| FOMC Statement | |||

| Jan 29 19:00 | |||

| FOMC Press Conference | |||

| Jan 29 19:30 | |||

| CB Consumer Confidence | |||

| 131.6 | 128.2 | 128.2 | Jan 28 15:00 |

إستراتيجية الإسترليني قبل قرار الخميس

لنكتشف أفضل استراتيجيات تداول الجنيه الإسترليني مع تصاعد احتمالات تخفيض الفائدة من قبل بنك إنجلترا و نلقي نظرة على نقاط الضغط في اليورو. الفيديو الكامل

Earnings Absorb Market Fears for now

Markets pare losses from Monday's global slide as traders divide their attention on US earnings and China's efforts to stem the spread of the Corona virus. The number of confirmed cases has now reached 106, up more than 100-fold since January 17. News of a planned 10% production hike by Apple has helped their suppliers and overall sentiment. USDJPY regains 109, US crude at 53.40s and US 10 yr yield at 1.62% from 1.57%. US durable goods orders and consumer confidence are due up next. The Premium Video below focuses on a 2-part trading strategy for Thursday's tight BoE decision as well as EURUSD.

China confirmed 4,515 cases of coronavirus on Wednesday, up from 2,744 a day earlier and just 41 on January 17. The pace of cases accelerated on the day but has been at just above 50% since the outset. That pace would surpass the SARS total by Friday and push it over 100,000 by next Wednesday.

What's especially worrisome is that it's not just Hubei province, the increase in other provinces is taking place at nearly the same pace. While it's certainly possible to believe that Hubei is too overwhelmed to get a correct count, that's less likely elsewhere.

Internationally, Thailand remains the place to watch for signs of an international outbreak with 8 cases there now confirmed. The baht was Asia's top performing currency last year but has fallen for four straight days as local stocks, especially those tourism-related take a fall.

The Fed meeting this week is suddenly more meaningful. US 2s/5s inverted on Monday and the spread between 3 month bills and 10-year notes is down to just 3 basis points. Judging by the Fed's recent playbook, there will be a dovish tilt in an effort to support stocks and calm volatility. All eyes will be on the surging debate about the Fed's repo injections.

It's early but the Fed is right to worry. SARS cut 0.8-2.0 pp of GDP growth from China in 2003. The economy is completely paralyzed right now and many shutdowns through the week of Feb 10 have already been announced. China railway traffic and passenger flights were down 42% y/y on Saturday, the first day of lunar new year.

First , the Fed will get some final pieces of data on Tuesday with durable goods orders due out at 1330 GMT and the consumer confidence report at 1500 GMT. Apple earnings are due after the bell.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| 0.4% | -0.1% | Jan 28 13:30 | |

| CB Consumer Confidence | |||

| 128.2 | 126.5 | Jan 28 15:00 | |

Yields Lead Slump in Virus-Driven Market Selloff

Risk trades deepen their slump as market react to weekend news of the growing coronavirus outbreak, claiming at least 80 fatalities and sending the number of confirmed cases to 2744. Markets were especially hit in early Monday Asia by the revelation that the virus has an incubation of as long as 2 weeks, raising the possibility that people carrying the virus but not yet aware of the symptoms could infect others. Markets were also concerned with news reports of rocket attacks on the US embassy in Baghdad (see below). The US crude oil short opened at 59.65 on Jan 8th will be closed today. Here is the rationale for entering the trade even after a sharp drop in oil.

A second city of 7.5 million people 70km away from Wuhan was put on lockdown with 10 cities placing curbs on travel. One startling fact is that Chinese foreign tourism has risen 8-fold since SARS in 2003 and the lunar new year holiday is an extremely busy time of year for travel.

Aside from oil, one other striking development is the breakdown in the 4-month trendline support of the US 10-year yield to 1.62%, which could clear the way for 1.51%, followed by the record low of 1.42% (Sep 3). JPY leads in FX, while the Aussie and kiwi lagging in a classic risk-off mood.

US new home sales are due up later but economic data will take a backseat to virus news.

The Baghdad Story

One story that could push its way into the limelight was a rocket attack on the US embassy in Baghdad. Reports from AFP says the dining facility was directly hit and that helicopters were removing casualties. It's not clear if they are Americans but if they are it could mark the start of another escalation in the region.That would put oil traders in a particularly tough spot as they weigh a Middle East flareup against the demand destruction of shutting down large parts of China. In early trade crude breke through the November low and sank to $52.15 even with an OPEC warning that it was watching closely.

The week ahead is filled with US earnings and a few economic data points including new home sales on Monday but it's tough to see how anything could steal the spotlight from the virus. Don't forget the Fed meeting/press conference on Wednesday and BoE decision on Thursday.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -47K vs -48K prior GBP +25K vs +31K prior JPY -45K vs -31K prior CHF +1.5K vs flat prior CAD +38K vs +33K prior AUD -19K vs -20K prior NZD +1.8K vs flat prior

The risk off mood related to the virus caught the market just as it was shifting away from risk trades and the safety of the US dollar. That means that more specs will be at risk of going underwater sooner if risk aversion persists.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| New Home Sales | |||

| 730K | 719K | Jan 27 15:00 | |

| FOMC's Williams Speaks | |||

| Jan 27 14:30 | |||