Intraday Market Thoughts Archives

Displaying results for week of Jun 28, 2020Jobs Jump Fades

Strong US jobs & caveats

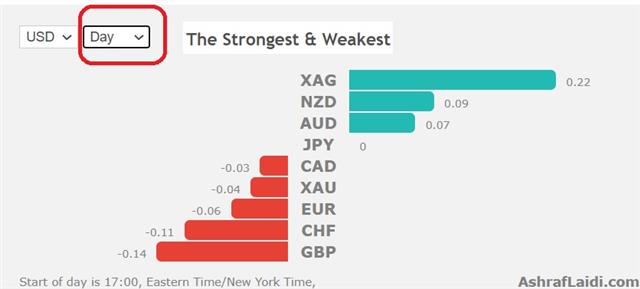

US June non-farm payrolls roundly beat expectations with 4.8m new jobs added compared to the 3.2m consensus. In addition, the prior two reports were revised modestly higher. Perhaps most impressive was the unemployment rate at 11.1% compared to 12.5% expected. The caveat that market participants had been watching surrounding that metric was in those absent from work for 'other reasons'. It had swelled recently and would have meant an additional 3 percentage point increase in May. The BLS highlighted that many of those probably belonged in the unemployed category were estimated at up to 3%. This month, they estimated that only 1 pp of them were likely miscategorized.Perhaps more interesting was how the market responded to the data. Initially it was strongly positive for risk assets but that faded, particularly late in the day. The tug-of-war between the virus and reopening continues and it was data from a growing number of problem states that weighed. In particular, 10,109 cases in Florida was a new record an exceed all the daily cases in the EU. The charts below were posted on Ashraf's WhatsApp Broadcast Group right after the release of US jobs report, highlighting intermarket backing of tapering risk appetite.

Looking Through Jobs Data Confusion

June NFP is expected to show a rise of 3.06 mln, but several prominent economists anticipate a jump to a new record of 4.0 mln, following May's 2.5 mln. The unemployment rate is expected to dip to 12.5% from 13.3%. Yesterday's ADP survey release of June private sector showed a rise of 2.37 mln, undershooting forecasts of 2.9 mln gain, following a jump in May revision to 3.07 mln from the initial 2.76 mln.

Date collection is among the issues at hand in today's reports as the collection rate is seen around 69%, well below the normal rate of 85% before the Covid19 pandemic. This opens the possibility for considerable revisions (upward and downwards), especially as several US states slowdown their re-opening.

Classification of workers is another major issue. The last 2 reports were said to be inflated by classifying employed people absent from work as unemployed or as a temporarily laid off.

As for the likely USD reaction, a higher than expected NFP may trigger a short-term bounce in the currency, before a gradual decline later on -- as was seen in the aftermath of yesterday's upside surprise in services ISM. The rationale behind USD declines following strong US data would be explained by the notion that stabilizing growth would mean less need for USD demand non-US corp and bank issuers in light of improved capital market conditions.

Gold stabilizes around 1767 after an earlier decline following the release of the FOMC minutes showing officials not a in a hurry to commit to yield-curve control.

As always, we watch oil's 37 support as one of our 4-point check list to assess risk-appetite and positioning in the major indices. Our Premium longs in DAX30 and DOW30 deepen in the green.

Virus Drug Optimism Kicks off Quarter

US consumer confidence continued to rebound in the June report at 98.1 compared to 91.4 expected. That continues a series of strong beats in US economic data. Particularly encouraging was a jump in the 'expectations' component to 106.0 from 96.9 a month earlier.

The data helped to launch risk trades higher, including a 1.5% rise in the S&P 500 and large gains in the commodity currencies. More broadly, the US dollar was under significant pressure, likely due to quarter-end flows.

In terms of COVID-19, cases in US hotspots remained at high levels but there was some leveling off in Florida. We warn that's likely due to weekly trends and is likely to reverse in the day ahead. In Texas, Arizona and several smaller states, cases hit record highs.

On the quarter, the Australian dollar was the best performer by a significant margin with NZD in second place. Clustered at the bottom were the yen, pound and US dollar.

Year-to-date performance, however, offers a clearer picture of impact of the virus with the Swiss franc on top and the pound lagging. Within all that, there have been dozens of major swings.

In equity markets, the moves were massive. For US stocks, it was the best quarter since 1998 and the the first time a +20% quarter marked a -20% quarter since 1932. Within US stocks, the divergence was stark with the DJIA up 17.8% and the Nasdaq up 30.6%. Elsewhere, the FTSE 100 rose a relatively modest 8.8% while the DAX climbed 23.9%.

The day ahead features more economic data and we remind readers that non-farm payrolls will be on Thursday rather than the usual Friday slot accounting for the US holiday. The market is likely to focus on the ISM manufacturing report for June. A series of regional numbers have beaten the consensus, some by a larger margin so risks to the 49.9 consensus are undoubtedly on the upside.الداكس ضد باقي المؤشرات

Special Effects, Gold Retests 1785

The breakout of a triangle in EUR/GBP on Monday (exploited by our Premium Insights' trades) and the S&P500's bounce from 3000 were tradable moves, but entirely technical. On the fundamental side, market pricing was less compelling.

The US dollar is rebounding across the board, attempting to breakout of the 97.70/80 barrier. US Crude oil deserves a close look as its $37 support remains in tandem with general foundation in the major indices. Yesterday, US pending home sales jumped 44.3% in another positive economic surprise, compared to +19.3% expected. There was some follow through in the market on the headlines but it's a second-tier housing indicator.

Virus-Count Monday Effects

In terms of the virus, cases in the hotspots were lower but that was surely due to the Monday effect, something we've warned about before. There is systematic undercounting and testing in many states/countries coming out of the weekend. The effect often extends through Tuesday before payback begins on Wednesday. By this point, markets should have factored that in but there were noticeable moves after the Florida numbers in particular.There were also noticeable divergences. The S&P 500 rallied 1.5% but Treasury yields were lower and the US 5-year hit a record low of 0.27%.

It's quarter end and it's always easy to point the finger at that for hard-to-explain moves. The lesson at the moment is to watch the technicals but the keep the fundamentals in mind for the turn of the calendar.

On that front, it will be a busy few days in the US starting Tuesday with consumer confidence from The Conference Board at 1400 GMT. It's one of the best forward-looking indicators and the consensus is an improvement to 90.5 from 86.6.حوار عن موجة الأموال الرخيصة المتداولة

Euro & Industrials Lead Rebound

US virus cases rose another 1.7% on Sunday, above the 1.5% average. But it's a few hotspots that are concerning the market. Florida, Texas, Arizona and California all hit records in the past week and high frequency data is increasingly showing fewer restaurant visits and hours worked in those states, which collectively represent almost one-third of US GDP. Formally, governors re-closed bars in Florida and Texas and cut restaurant capacity.

The mood on Friday slowly soured and that resulted in a 2.4% decline in the S&P 500 with a close below the 200-dma.

Today, DAX attempts to regain its 200-DMA of 12152, DOW30 manages to protect the 24070 base support (backed by 248300 confluence of 55 and 100 DMA) and XAUUSD remains underpinned at 1754, eyeing 1790.

See how the levels mentioned above compare to the levels we mentioned hours ahead of Friday's close.

In the FX market, the reaction has been uneven. Risk trades in commodity currencies are playing out more clearly but elsewhere quarter and month-end flows are a factor. GBP is also suffering on the risk trade but Brexit news and a potential COVID-lockdown in Leicester are compounding worries.

Note that China was on holiday late last week but is back to start the new week.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +118K vs +117K prior

GBP -19K vs -16K prior

JPY +27K vs +22K prior

CHF +1K vs +2K prior

CAD -21K vs -25K prior

AUD -5K vs -7K prior

NZD 0K vs -2K prior

After big moves into AUD and EUR last week, the shifts were much smaller in the last data. The lone notable shift was into JPY.