Intraday Market Thoughts Archives

Displaying results for week of Jul 26, 2020Some August Seasonals

US GDP fell a record 32.9% on an annualized basis in Q2 but as we warned yesterday, that was slightly better than the 34.5% consensus. Initial jobless claims were close to the consensus but remain stubbornly high at 1434K. Continuing claims also missed the 16.2m consensus with a rise to 17.0m. That comes with emergency unemployment benefits set to run out today.

Congress may be shifting towards a short-term extension of those benefits and that's something to watch in the day ahead.

Another thing to watch is the turn of the calendar. August is a poor month for risk trades historically (meaning indices usually selloff); it's the weakest month over the past decade for the S&P 500 and Nikkei. It's also a strong one for bonds (that's negative for yields). US 5-year rates hit a record low Thursday and 10s are now flirting with the April low. It's held a number of times since the pandemic and a break below 0.54% would pave the way to return to the March sell-everything low of 0.30%.

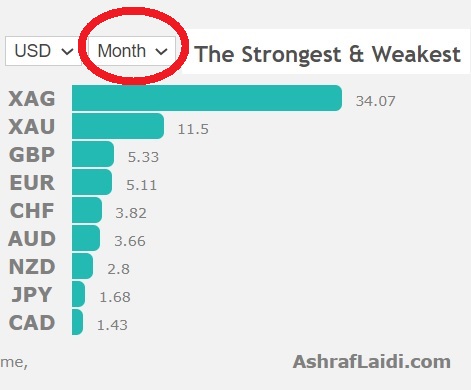

With the weak risk averse tone, it's no surprise that August is a negative month for the commodity currencies. It's the softest for AUD/USD and NZD/USD second-softest for the loonie. The Australian dollar has easily been the best performer since mid-March, up more than 17%. Be wary of a pause or worse.

Another strong seasonal trend is in sterling where it's the second-weakest month in GBP/USD and the strongest month for EUR/GBP. Cable has been on a sparking run to 1.31 but there is some resistance at the 1.32 and that will be a tough test after the one-way trip from 1.25.

From Fed to Q2 GDP

The largest kneejerk reaction to the FOMC decision was on Powell warning that the pace of improvement in high-frequency indicators had slowed. That sparked a momentary drop in risk trades and a recovery in the US dollar.

The other message was a strong reiteration of what we've heard before: That the Fed is prepared to do whatever is in its power to stimulate the economy during the pandemic. What was missing was anything specific about what that might entail.

Looking ahead, Fed watchers will await how the central bank uses forward guidance using inflation or unemployment.

In terms of overall price action, the trend was towards more US dollar weakness. USD/CHF hit a five year low after the eighth straight day of declines. The euro has made another one-year high as it touched above 1.18.

The main risk for the US dollar in the day ahead is the Q2 GDP report. The consensus is for an astounding -34.8% with estimates ranging from -25.0% to -40.0%. Risks are a touch to the positive side because the advance trade balance was surprisingly strong on Wednesday.What Does the Fed See?

Also watch how Powell answers questions on the US dollar -- as Ashraf alluded to below.

There are increasing signs of a retrenchment in the US economy. Another came Tuesday with consumer confident falling to 92.6 from 98.3. Economists were forecasting 95.0 but the miss was probably priced into markets after a similar miss in the University of Michigan. The drop in the 'expectations' component was particularly worrisome as it dipped to 91.5 from 106.1. It's one of the better leading indicators and is now only modestly above the pandemic low of 86.

The change in tone isn't an aberration. There are an increasing number of high-frequency indicators that show a flattening in activity, if not backtracking. In terms of that data, the Fed has access to some of the best numbers available.

The market is hungry for that kind of analysis and the risk is that the statement or Powell's comments indicate a souring of the outlook. If so, the market could recoil unless it's accompanied by strong reassurances the Fed is willing to do more. The danger is that vague hints of more action won't be enough for a market that's going to want more than forward guidance or yield curve control.

With all that, the Fed may end up deferring to Congress and the need for fiscal support.

Another main axis for the decision will be the response of precious metals. The recent run-up is in danger of a retracement if the Fed isn't explicit enough about plans to do more. The decision is at 1800 GMT followed by Powell's press conference 30 minutes later.تغيرات فنية وهيكلية في الدولار الأمريكي

بعد التراجعات الكبيرة التي شهدناها في الدولار الأمريكي بسبب زيادة عدد الإصابات وعدم قدرة الولايات المتحدة، الاسيطرة على الوباء، دعونا نتعرّف مع خبير الأسواق العالمية أشرف العايدي على التغييرات الهامة في فنيات و أسس الدولار بالأضافة الى تطورات حاسمة داخل تمويل الديون الاميركية. الفيديو الكامل