Intraday Market Thoughts Archives

Displaying results for week of Apr 11, 2021Yields Stabilize on more Inflation Signs

Short bonds was a consensus and crowded trade in April after the Fed endorsed higher yields. In theory, a series of strong economic data points on Thursday should have added to the momentum. Retail sales rose 9.8%, initial jobless claims tumbled to 576K compared to 700K expected. Both the Philly and Empire manufacturing surveys were strong with Empire prices paid at a 12-year high.

All of that should have driven yields higher but that's not what happened. Perhaps the bond bears – seeing the failure of a catalyst to cause a move – decided to bail.

US 30-year yield fell 10 bps to 2.25%, touching the 50-day average for the first time this year. There was talk of position squaring, a rethink on inflation and Japanese buying but it's all tough to square.

The rest of the market cheered falling yields. US equities surged to another record and commodities climbed with copper breaking the mid-March high.

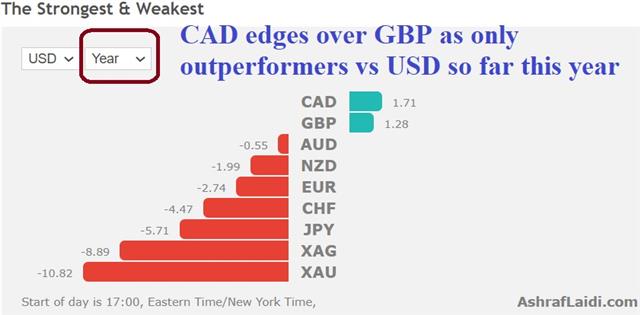

The FX market was more skeptical with commodity currencies consolidating. The dollar generally held its ground. On net though, we're starting to see some breakouts in charts we've been watching closely for the past few weeks.

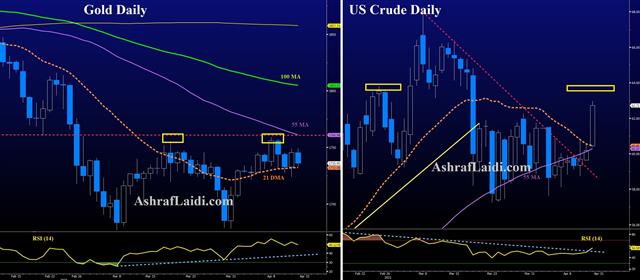

Metals Spring to Life on Yields Breakdown

A series of sideways moves and some brewing head-and-shoulders patterns left market participants watching AUD/USD, CAD/JPY, copper and oil uneasy. Particularly concerning was the break lower in Chinese stocks in March.

One factor standing in the way of USD declines is EURUSD, which failes to break its 55-DMA at 1.1993 as did DXY respected its 55-DMA at 91.50. But the more crucial support stands at the 100-DMA of 91.00

Aside from the virus – which the market has consistently looked through for many months – it was tough to find a catalyst for a big risk-off move but the charts argued for prudence. At the same time, a period of consolidation after the large moves since November was warranted.

Given some of the breakouts Wednesday, we may have reached the end of that period. The anxiety about bonds is fading and enthusiasm about the reopening is building. The sense is that lockdowns in Europe and Canada will be the last ones as vaccine rollout increases dramatically in May/June.

That's a dynamic that we highlighted last week and the euro has since responded. It flirted with 1.20 on Wednesday before finishing just below.

The larger breaks were in commodities and commodity currencies. The kiwi led the move higher despite no real news from the RBNZ. USD/CAD is flirting with a break of 1.25 and that will be a spot to watch in the day ahead, especially if oil extends further above its three-week range.

موعدنا الآن في غرفة شركة إكس أم لجلسة الأسواق

.ننتظركم الآن الساعة الرابعة عصرا بتوقيت مكة في غرفة إكس إم مع أشرف العايدي .أنقر على الرابط للمشاركة

Onto Fed's Vaccination Guidance

Looking ahead, Fed Chair Powell speaks at 1600 GMT (1700 London, 1800 Dubai). In an notable comment on Monday, the Fed's Bullard said he would leave it up to Powell to start the conversation on tapering. But Bullard also raised the idea that a 75% vaccination rate in the USA may signal a clear end to Covid-19 and allow the Fed to consider tapering. At times, other FOMC members float ideas and Powell confirms them (like Brainard's comments on higher rates last month) but in this case it appears the strategy is to leave it to Powell. For now, it's premature for him to tee-up a taper but some time in the summer he will have to wade in.

Looking back at Tuesday's CPI report, it revealed just how concerned markets are about inflation. It rose 2.6% y/y compared to 2.5% expected with core and m/m readings also one-tenth above consensus. Markets were clearly fearing worse and the market reaction highlights the focus on inflation. The knee-jerk trade as higher in the US dollar but very quickly afterwards that reversed and continued in that direction throughout the day.

The takeaway is that the market breathed a sigh of relief that it wasn't a blowout like the PPI report last week.

Yields began to slide after the report as well, something that was compounded by a 1.8 bps stop through in the 30-year Treasury auction. Tally it all up and yield fell 4-5 bps on the day and US equities hit fresh records.

In FX, the slump in the dollar and growing optimism about the European vaccine rollout (despite the latest J&J setback) boosted EUR/USD to the highest since March 18. USD/JPY is also flirting with the April low and cable is trying to form a double bottom.

BoC Highlights Upside, UK Reopens

Canada entered some new harsh lockdowns, but the lesson from 2021 so far is that economies have learned to cope with the virus as sentiment shifts towards reopening optimism. That was clearly the story in the Q1 Business Outlook survey from the BOC. It showed expectations for future sales at the highest since 2009 with investment intentions also surging. The overall survey was the third highest since it began in 2000.

A worrisome sign was in the input and output pricing numbers, which both hit records. The commentary citing raw materials as the main source of rising costs but also highlighted wage pressures.

All central banks are united in the view that prices rises will be temporary but with investment jumping, wages on the rise and house prices out of control, Canada is a good bet to be the first to break that wall. Add in that the BOC overdid it on QE and they're already on the brink of a taper.

In the day ahead, the market will be dialed into inflation in the US with the CPI report due at 1230 GMT. The consensus is for a 2.5% y/y rise and 1.5% ex-food and energy. The first metric might get the headlines but the Fed will be watching the second one more closely and the component breakdown will matter.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +68K vs +74K prior

GBP +20K vs +25K prior

JPY -58K vs -59K prior

CHF +3K vs +4K prior

CAD +3K vs +7K prior

AUD +4K vs +12K prior

NZD +3K vs +4K prior

Euro longs have been scaled back over a number of weeks but the currency has found a footing since the start of the month. The latest numbers suggest a swift vaccine rollout from May through July so some optimism could begin to creep back into the euro.

UK Offers a Glimpse Into Herd Immunity

The sharp decline in UK covid cases and deaths is a reminder of how primed economies are. The pound is the best performer to start the week while the loonie is the laggard. Bonds are in focus this week as the US sells 10-year notes.

Vaccines work and people are eager to get them. The UK announced Monday that it will open up vaccines to people over-40.

At the same time, the rollout so far is showing a remarkable effect on cases and deaths, particularly in contrast to its European neighbours. Cases have dropped dramatically while deaths fell to just 7 on Sunday with none in Scotland and Wales.

Cable struggled late last week and remains below 1.38 but is holding the March lows so far. That will be a key support area for bulls in the week ahead. This week we get industrial production, trade balance and GDP – all for February. That's data at this point so we will wait for April numbers. On the speaker front we hear from Haskel and Cunliffe. The market would welcome hints of optimism.