Is that it for Oil?

Keeping the fundamental basis for assessing oil aside, let's look at both US crude oil and Brent oil. Using 200-day moving average extensions, we find that today's high in US crude oil of $119.48 stood 88% above its 200 DMA, well above the 79% during the 1990 GulfWar, when it peaked at $40. Meanwhile, Brent oil hit a high of $119.50, equivalent of 80% above its 200-DMA. This compares to the 92% > 200-DMA in 1990. Does this mean Brent will not retrace until it matches the 92% > 200-DMA? Considering Brent's 200-DMA of $64, adding to it 92% we get $123. Will oil rally stop when Brent hits $123?. It is possible. US officials insist on finishing off Iran's arsenal, while reports of intercepted missiles in the Guld region continue.

Most importantly: Notice how gold is now behaving like a risk-asset, rising and falling along with indices. 5000 has proven to be a solid support and even fast pullbacks to 5030/50 have proven to precede violent rebounds.

Read More...Here's a 120 min video on extensions of Crude oil metrics and the risks to gold. Watch here.

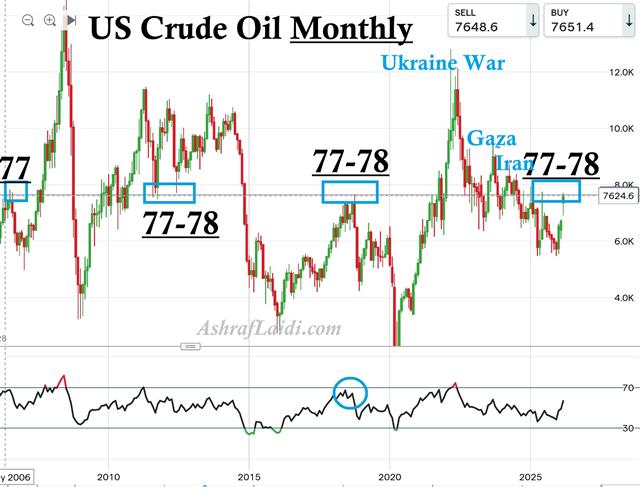

Read More...I usually do not trade oil, especially in uncertain times like these. It is foolish to speculate on a fast-changing market, especially when trading on margin. Nonetheless, for those of you who trade it, here is a MONTHLY chart of US Crude oil. Notice the current price is near $77-78 pb, which over the last 19 years, has proven to be a key inflection point. The level worked as repeated resistance in July 2006, October 2018, July 2021 and June 2025. Increasing reports and statements that the crisis could extend for weeks raise the probability of a breakout above $80. The weekly RSI is above 70--the highest since the outbreak of the Russia-Ukraine war in February 2022. Daily oscillators appear over extended, but this means a pullback may only be temproary. While $74.78 appears as temporary support, the ceiling of the Gapup around $69 is the more important foundation. I avoid oil for now, with clearer opportunities in USDJPY, US100 and XAUUSD. Be careful out there. More detailed levels sent for the English & Arabic WhatsApp Bdcst Group.