Intraday Market Thoughts Archives

Displaying results for week of Feb 22, 2026Grow an Account 5x

Is it is possible to grow a leveraged trading account by 5x or 6x? A former client based in the MidEast came to me for advice on what to do with his trading account. It was deeply in the red. I told him I will send him some trades but bear no responsibility whatsoever if the trades turn out badly. Take a look at the 45-second video and make some time on Friday evening.

USDJPY Jumps on Dovish Picks

USDJPY breaks above the 4-week trendline resistance to hit a 2-week high at 156.80 after Japan PM Takaichi appointed 2 dovish candidates to the 9-member policy board of the Bank of Japan. The candidates are professor Ayano Sato at Aoyama Gakuin University and professor Toichiro Asada of Chuo University. If they're confirmed, then these new members will likely provide material pushback to the BoJ's interest rate hike path, which could further weaken JPY vs major currencies. 2 days ago I reminded our WhatsApp Bdcst Group I was long USDJPY, targetting 156.40. The chart below suggests 157.70s could well be the next target.

Gold $5000?

Here are two technical possibilities for gold's return to $5000. Click here.

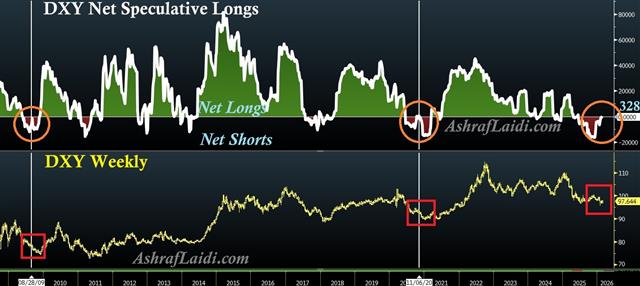

DXY Net Longs

The upper panel of the chart shows net speculative longs in the futures contract of US Dollar Index (formerly Chicago Mercantile Exchange now Intercontinental Exchange). See how sentiment has improved from net shorts to 328 net longs contracts (longs exceed shorts by 328), to enter positive territory for the first time since June 2025. There are 2 occasions when positioning entered positive before territory before dropping back to negative, dragging the US dollar--August 2009 and November 2020. Will this time prove the same and lead to fresh selling in the US dollar? Tenporary gains in DXY mean DXY will remain capped near 98 (55DMA), while EURUSD supported around 1.1750/70 also near the 55 DMA.

If you prefer to receive these daily analysis into your mailbox and not miss an update, then feel free to register (free) in "My Account" section in the upper rightcorner of the website. If you already have a username and forgot your password then email us to for a password reset, or use another username (email) and most importantly click to "Subscribe to Newsletter".