Intraday Market Thoughts Archives

Displaying results for week of Jun 02, 2019Peso Perspectives and Primed for Payrolls

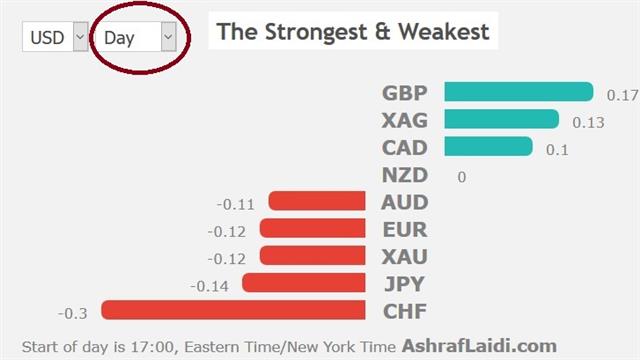

The Mexican peso is ground zero in the latest round of the tariff fight and yet other assets have fallen harder. We explain why and look at implications that most are missing. Non-farm payrolls are due on Friday. GBP is the highest performer on weakening odds of Boris Johnson becoming next PM after the Brexit Party lost yesterday's bi-electrions in Peterborough. Here's what Ashraf said about GBP and Johnson 2 weeks ago. US and Canada jobs are due next.

The most-notable aspect about the Mexican peso is how little it has fallen since Trump first threatened tariffs. On Thursday, he ramped up warnings saying “not nearly enough” had been offered to stop them.

Peso dynamics suggest how minimal the expectations of Trump following through on tariffs on Monday. MXN is down only 2.65% against the US dollar since Trump's surprise threat on May 30. That's a relatively small move in the emerging market space and even when you consider that the US dollar has lost ground broadly in that same time frame, it's still surprisingly small when you consider that on the night Trump was elected it fell 12% and now it's facing escalating tariffs and a tight deadline.

One interpretation would be that tariffs remain a low-probability event or won't last long. But that doesn't explain why the broad market is expressing a larger measure of concern. Oil is down 12% since the announcement. Treasury yields are down 33 basis points at the front-end and more than a full rate cut has been priced in over the past week alone.

The market is thinking this isn't a Mexico-only problem. The message is that Trump is increasingly willing to turn to tariffs. On Thursday he said “the higher tariffs go, the higher the number of companies that will move back to the USA.”

Could markets be coming to terms with the idea that Trump really believes in tariffs and that they benefit the US? That sentiment is being extended to China and European autos and to any other potential dispute that might come up in Presidency. He really is Tariff Man.

He said Thursday that he will decide on more Chinese tariffs in two weeks and half his administration is going to try to talk him out of it but we have to assume a better-than-50% chance he does it. In the short-term, if a deal is done to avert tariffs on Mexico, watch for how he frames it. If he comes out afterwards and says 'tariffs work and that's why we got a deal' then the entire exercise starts to look like a PR campaign for tariffs – an effort to boost support for the tariff war to come.

First, the market will be looking to Friday's non-farm payrolls report. The economist consensus is +180K but the market is undoubtedly braced for something worse after ADP data showed the worst jobs growth in nine years. Anything better than 140K will be a sigh of relief for markets. At the same time, watch out if it's above 220K because a number that strong may rattle belief in a rate cut.

Onto the ECB

The pivot towards economic data is in full swing as the Fed and market participants try to figure out how the trade war is affecting the real economy. The US dollar rebounded Wednesday but it was a rough ride. The ECB decision is next and the main question is whether any more dovishness from Draghi will keep the euro capped (more below). A new Index trade was issued yesterday for Premium susbcribers.

The market's fresh focus on economic data was on full display Wednesday. The weakest ADP reading in nine-years sent USD/JPY to the lowest since early January but a solid ISM non-manufacturing survey 90 minutes later prompted a U-turn.

Even with the turn in data, the market isn't exactly sure what it wants. The bond market is entirely focused on the Fed and the front end of the Treasury curve rallied once again and yields touched new lows. Stock markets like the idea of rate cuts but hate the idea of weaker growth so that's a balancing act that can change day-to-day. The FX market is also caught in the middle.

USD/JPY and USD/CHF are straight-forward USD-negatives on bad news but other USD pair reactions depend on if US economic weakness is contained or another dynamic that will cause central banks elsewhere to ease. Generally, it's the latter but on tariff-specific news the dollar can suffer solo.

On that front, the first day of US-Mexico meetings ended without a deal as Lopez-Obrador's team asked for US help and funds to stem the flow of migrants, among other requests. Talks will continue and the come after Fitch downgraded Mexico and Moody's lowered its outlook.

Those headlines will be key late in the day but earlier the focus will be on Draghi's press conference. The market will be looking for TLTRO details and the possible introduction of a tiering system for deposit rates. Economic forecasts could also be trimmed but the reaction to that will depend on how Draghi frames it. Expect plenty of hand-wringing about global trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change | |||

| 27K | 185K | 271K | Jun 05 12:15 |

| FOMC's Williams Speaks | |||

| Jun 06 17:00 | |||

Ashraf en Madrid por El ForexDay

Hola todos - Nos vemos en Madrid este sabado por la séptima edición del ForexDay. Haga clic aquí para su registro.

Careful in Overinterpreting

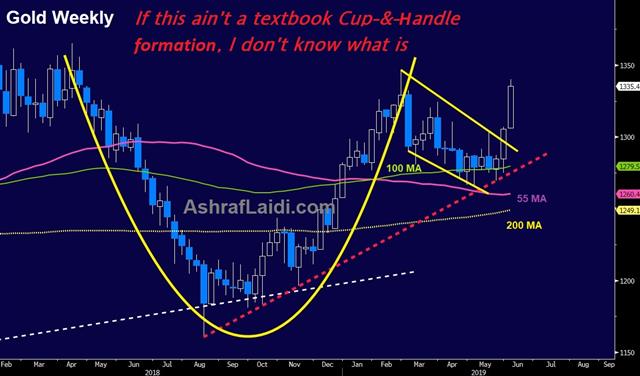

Encouraging words from Powell and Mexico's president were the main catalysts to the rally in stocks. Yields climbed and US indices shot to the best day in five months on Tuesday but the US dollar continued to sag. But stocks bulls are warned against overinterpret Powell's words. More on this below. May ADP is up next (exp 185K from 275k), followed by the ISM non-manufacturing index (exp 55.4 from 55.5). The chart below speaks volumes about the gold note issued from 2 days ago.

Two factors were behind the rebound in risk assets. The first was the commentary from Powell who said the Fed was 'closely monitoring' the trade war and will 'act as appropriate'. He also noted that inflation has undershot forecasts and left out any mention of that being a temporary phenomenon. The comments didn't justify the aggressive pricing of a 50% chance of a July rate cut but was certainly a signal about a Powell put.

More important may have been comments from Mexican President Lopez-Obrador ahead of US-Mexico talks on tariffs and migration Wednesday. He said he's optimistic about a deal before June 10. Congressional leaders on both sides also frowned at the possibility of tariffs on Mexico.

It all added up to a 2.1% rally in the S&P 500 and a finish at the highs of the day. The index recovered a week of losses and rose back above the 200-day moving average.

The bond market was torn because the dovish comments from Powell mean rates are probably headed lower. The 2-year yield rose 5.4 bps to 1.89%. That was partly because of comments from Fed vice chair Clarida who left the impression that it will take another round of tariffs to spark a Fed cut.

But careful.

Not only the Fed chairman stayed away from hinting at rate cuts like Bullard did on Monday, but Powell also cautioned against using policy to boost inflation, which he stated may "risk market excess". Today, Dallas Fed's Kaplan said it is too early to make judgment on rate cut call, needs to see "further deceleration" in economy. Ashraf tweeted earlier this morning: "If such rhetoric dominates Bullard & Powell's receptiveness for easing, then June 19 could be ugly..especially if services ISM & AHE join batch of recent data fails"The FX market was more in line with bonds as USD/JPY climbed only fractionally. Elsewhere the dollar was mostly pressured with commodity currencies strengthening including a 9-day high in CAD.

Looking ahead the ISM non-manufacturing index is a release to watch on Wednesday, along with the similar index from Markit. The ISM measures is forecast at 55.4, down slightly from 55.5. A strong report today would likely strengthen the hawks' resolve, thereby providing a good excuse for stocks to dive back into risk off.

The Fed and the market will increasingly pivot towards economic data in the weeks ahead in order to get some feedback on how companies are dealing with tariffs and uncertainty. Any surprise weakness would weigh on the US dollar and stock markets.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change | |||

| 185K | 275K | Jun 05 12:15 | |

| FOMC's Clarida Speaks | |||

| Jun 05 13:45 | |||

Yields Squeeze Dollar Bulls

The tumble in Treasury yields continued on Monday and began to take a toll on the US dollar as the Fed's Bullard shifted on his rates rhetoric. The greenback's tumble is also magnified by the 1.5% rise in gold--the biggest daily % change since late January. The Fed's Powell speaks Tuesday at 9:55 am Eastern (14:55 London) on what will be a closely-watched event. In the weekly video for the Premium subscribers (below), Ashraf highlights key "cyclical" developments in the Fed-Markets reflexivity layout and the existing trades, identifying the important implications for the June 19 FOMC meeting.

The White House fanned the flames of protectionism more on Monday by removing a designation that helped India avoiding tariffs. A separate report said the President had considered tariffs on Australian metals. A weekend white paper from China also hinted at an unwillingness to back down to the US.

The S&P 500 fell 8 points but that doesn't tell whole story. Equities have benefitted from plunging rates and that's cushioned the fall. The severe worry is in rates as US 2-year yields fell another 9 bps to 1.83%. On May 22, they were at 2.26%. The Fed funds futures market is now pricing in a 50% chance of a rate cut at the July 31 FOMC meeting.

The market is hanging on signals about negotiations with China and Mexico but an economic toll is beginning to weigh. The ISM manufacturing index fell to 52.1 from 52.8 and is now at the lowest since October 2016.

The Fed's Bullard shifted further towards the dovish camp on Monday by saying a cut could be needed soon. Late last month he had said a cut could be needed before year-end, so he moved up the timeline. He also acknowledged the signals from the bond market.

The day ahead features a speech from Powell in Chicago. The topic is monetary policy strategy and communication and there is no Q&A so this may not be a market-moving speech. Yet, it would be a prime opportunity to crack open the door towards rate cuts. If so, the dollar will be primed for another day of selling as the crowded USD-short trade lightens up.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams Speaks | |||

| Jun 04 12:30 | |||

| Fed Chair Powell Speaks | |||

| Jun 04 13:55 | |||

| RBA Gov Lowe Speaks | |||

| Jun 04 9:30 | |||

Gold: Is it Different this Time?

Is the ascent in gold another example of its many unsustainable rallies? Or will the current rally last for some time? Gold rose 1.7% in May, posting its biggest monthly gain since January, thanks to a helpful combination of safe-haven flows from tumbling global equities and a broadening rally in metals at the expense of energy. We won't go through the powerful textbook technicals justifying the yellow gold as we have mentioned this numerous times over the past 6 weeks for our Premium subscribers. But there are other dynamics.

Resurfacing market expectations of a Fed rate cut this year (86% chance of a rate cut by September and according to Fed funds futures and perhaps as many as 2 rate cuts from the Eurodollar futures) have provided gold bulls with an essential source of confidence, especially as USD faltered.

USD Recurring Failures & Stagflation Risks

The recurring failures of various USD pairs to retest and break recent highs have served as a vital fillip for gold's recurring support near 1266. Whether it is USDCNY's failure to break 6.0, EURUSD's holding above 1.10 or USDJPY's cap at 112, the FX message is loud and clear.Today's release of US May manufacturing ISM hitting 2 ½ year lows and the prices paid edging higher could be the start of stagflationary consequences of the US-China trade war. Last week, the PMI version of manufacturing hit a 10-year low. Perhpas "stagflation" is a little exageration, but slowing growth and price burden on consumers is the inevitable result of the trade war.

Silver's striking signal?

What about silver? Is it time for gold's cheaper cousin to finally wake up? One striking aspect is that despite having fallen for 4 straight months, silver preserved its multi-year trend of higher lows.All these fundamentals factors are well and good. You probably have read a similar narrative 6 months or 2 years ago. The key here is to figure out whether the price action will enter a new wave of momentum and how to build a trade around it. And that's what I'll cover in tonight's Premium Video.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Manufacturing PMI [F] | |||

| 50.5 | 50.8 | 50.6 | Jun 03 13:45 |

| ISM Manufacturing PMI | |||

| 52.1 | 53.0 | 52.8 | Jun 03 14:00 |

| PMI | |||

| 50.2 | 50.0 | 50.2 | Jun 03 1:45 |

| Eurozone Spanish PMI Manufacturing | |||

| 50.1 | 51.4 | 51.8 | Jun 03 7:15 |

| Eurozone Final PMI Manufacturing [F] | |||

| 47.7 | 47.7 | 47.7 | Jun 03 8:00 |