Intraday Market Thoughts Archives

Displaying results for week of Jan 10, 2021What's after the Stimulus?

Details of the stimulus package rolled out Thursday and it will include $1400 cheques, $350B for state and local governments, $440B for businesses, larger unemployment benefits and more for vaccines and testing. The only thing the market might not like is $15/h minimum wage, but that was a key campaign promise.

The price tag is $1.9T and that's less than the 'trillions' promised by Biden last week but this is also just a first step with a larger long-term infrastructure and green plan to come.

The details of the plan are important but equally important will be how lawmakers in both parties react. This is a tough plan to vote down for politicians on both sides but won't underestimate the partisanship and hypocrisy in Washington.

If something that largely resembles this plan sails through Congress, it's a strong sign of Democratic unity and spending. That will push up yields and drag the dollar with it, at least initially. If it's immediately bogged down in infighting, then it will dampen the US recovery.

موعدنا بعد ربع ساعة في غرفة شركة إكس أم لجلسة الأسواق

لل ننتظركم اليوم الساعة السادسة مساءا بتوقيت مكة في غرفة إكس إم مع أشرف العايدي .أنقر على الرابط للمشاركة

Escape Velocity

We have been waiting for a day of flat Treasury yields to see how the dollar would react. Early signs aren't encouraging for dollar bulls as it slumped across the board as the worst performer Tuesday. Maybe that was a simple retracement after a six-day move but maybe it was a sign that the dollar bid is fleeting.

We liken it to a launching rocket that needs incredible amounts of fuel to rise higher, rather than a spaceship that will coast along in orbit. Rising bond yields have been the fuel since the Georgia runoffs but they sputtered Tuesday after a strong auction and the dollar nosedived immediately afterwards.

For its part, Fed talk continues to be a modest tailwind. Comments continue to focus around better economic prospects and tapering. We will hear from Brainard and Clarida Wednesday but all the chatter about more QE or a WAM extension is gone.

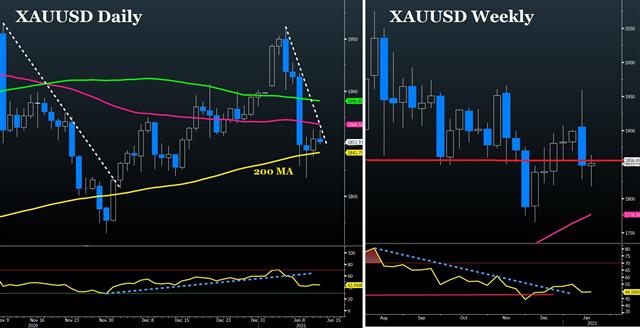

We will continue to keep a close eye on the dollar in the day ahead, along with a 30-year auction that could steer the next move. If this is it for the dollar bounce, it's a feeble one even by the standards of short squeezes.Chart Look at USDX, Yields, Gold & Bitcoin

The ongoing rise in the US dollar corresponds with a change in tone at the Fed. The talk of doing more is done and hints of tightening have begun.

Bostic on Monday angled to give the Fed more flexibility, saying policymakers aren't 'locked into a paradigm' and that changes are possible to the playbook if the economy recovers faster.

The Fed is also grappling with a looming bump in headline inflation in Q2. Because of base effects, year-over-year price rises in the quarter will be high and likely above the Fed's target. Looking through that is understandable but the pressure on the Fed will mount.

Yields Break Metals, Cryptos

President-elect Biden promised to reveal a new spending proposal worth “trillions” on Thursday in what might be the defining economic moment of his Presidency before it even begins. The new wave of spending combined with the $900B just issue threatens to upend the dollar trade at a time when CFTC positioning data shows a crowded short-dollar trade.

The US dollar has been the top-performing major currency since the Senate surprise and Biden's proposal underscores what has changed. Yes, the spending will create an enormous deficit but it will also lead to a boom in growth. Goldman Sachs is forecasting +6.2% GDP growth this year and that's before the details of the package on Thursday.

Another thing to consider is that the US (and UK) are receiving vaccine doses far quicker than elsewhere and that's going to lead to better relative growth.

On Friday, non-farm payrolls were soft but commentary from Clarida the same day highlighted diminished downside risks due to the vaccine. He also said policy is “exactly where we want it,” which likely kills talk of more QE, a WAM extension or anything else dovish. It means the next move from the Fed will be towards tightening. On QE he said he 'expects' to keep the pace through 2021 but he didn't rule out a taper.

Short-dollar is a strong consensus trade in 2021 and there are a multitude of reasons to expect long-term USD weakness but there are reasons to fear a squeeze in the near term, included in some of the crowded CFTC positions.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +143K vs +143K prior

GBP +4K vs +5K prior

JPY +50K vs +47K prior

CHF +9K vs +12K prior

CAD +14K vs +15K prior

AUD -4K vs -7K prior

NZD +12K vs +15K prior