Intraday Market Thoughts Archives

Displaying results for week of Jan 24, 2021How we shorted Indices كيف بعنا المؤشرات

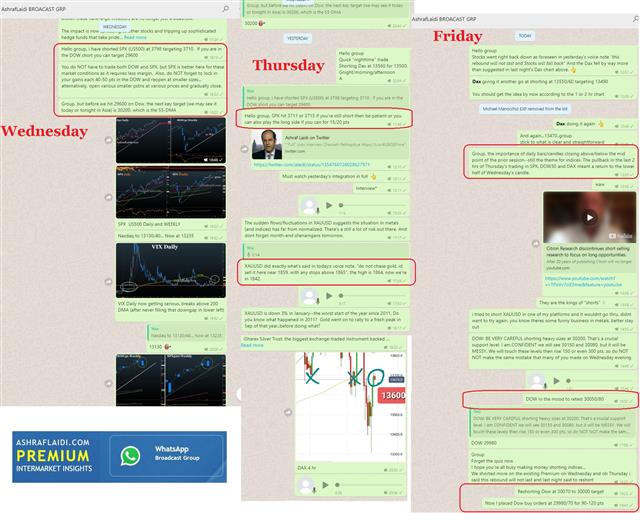

Here is a recap of what and how we approached shorting the DOW, SPX and DAX over the last 3 days. We started abour 45 mins before Wednesday's FOMC announcement alongside the SPX for our WhatsaApp Broadcast Group. Please see the details of the last 3 days. تفضلوا بملخص محتوى صفقاتنا لبيع مؤشر الداو و الداكس من يوم الاربعاء الى اليوم واهم شيء التوجيهات التي ترافقها رسائل صوتية مفصلة صورة الواتساب العربي موجودة تحت صورة الانجليزي

من القروب العرب

Guess & Win إحزر المخطط و إربح

It's not because market participants are currently consumed by the meme stock madness. The flows around it have certainly caused some broader market moves but the FX market is largely unperturbed.

GDP in the $22 trillion US economy is certainly more consequential than a $25 billion short squeeze but only one moved the market on Thursday. Some are seeing the squeeze as indicative of vulnerability in the broader market and that may be the case but it's not going to change the path of the broader economy.

Q4 GDP grew at a 4.0% annualized pace compared to 4.2% expected. That's not a big miss but consumer spending was particularly soft, something we've seen in the Nov/Dec retail sales reports.

So why didn't it matter? Or why didn't the surprisingly strong German CPI report matter?

The market simply doesn't care about the current economy. What matters is the post-vaccine economy and current economic data simply doesn't tell us much about how consumers and businesses will behave in the return to 'normal'.

Central banks believe the major economies will take years to recoup losses and generate inflation. That may be the case. Some market participants think the release of pent-up savings and demand will cause problematic inflation.

What's priced in is a rosy economy but nothing too hot to push up rates. That's a reasonable expectation but so many things about the pandemic have been hard to predict. We've written recently about the questions about pent-up savings and about watching early-vaccinators like Israel for economic signs. We also think surveys showing rising inflation are telling and worrisome but it's early.What’s the Yields Signal?

Monday's 7-bp decline in US 10-year yields (from 1.10% to 1.03%) is considered a break below its 2-week range support, but keep an eye on the new foundation at 21-day MA (1.03%) and prior 1.0750% support as new resistance.

Normally, that would signal risk aversion or declining economic prospects but that's not necessarily the case at the moment. The Fed is buying $120B in Treasuries and MBS per month while re-investing maturing securities so that's a natural skew in the market. One force driving down yields was yesterday's remarks from Senate Leader Schumer saying Congress will try passing the stimulus bill in month or more, far longer than was expected by markets. This lingering disappointing may also explain why indices are reluctant to build on Tuesda's earlier gains.

Any further decline in yields would be likely accelerate selling in USD/JPY and USD/CHF as yield differentials narrow while boosting EUR/USD. The problem is that the opposite happened on Monday in what was a strange day in markets driven by unusual moves in equities.

Much of the broader discussion in markets is about bubbles and there are measures like the Citi panic/euphoria model, which is at an all time high; and the BofA fund manager survey showing record levels of risk taking.

Bonds might be giving us an early signal that it's all run too far. At the same time, bonds themselves will become the story on a fall back below 1%. That would signal more easy money for equities and we've little doubt that Powell will be supportive on Wednesday.

In summary, it's a market without a real theme right now besides anticipation of the post-virus boom. US stimulus talks have tried to fill the void but haven't been able to capture the market's imagination.

ندوة مساء اليوم مع أشرف العايدي

FX Priorities

All currencies ended the week higher against the US dollar, but on Friday, the greenback reversed corused and strengthened against all currencies (including gold and silver), with the exception for EUR.

The ECB has been clear that it doesn't want a stronger euro, especially with the eurozone expected to recover slowly from the pandemic. This week's ECB decision will be all about the levers it can pull to keep the euro from appreciating further.

EUR/USD has risen to 1.21 from 1.06 at the pandemic low and it's near a two-year high. More worrisome for the ECB is that if it rises another 400 pips, it will be at the highest since 2014.

The US has the ability to easily monetize debt but with eurozone deficit rules, it's much tougher. That leaves policymakers in the bloc with few options in the face of FX strength.

CNH Indication

China has shown it can be bullied by the US on the currency but with a less antagonistic President, they might attempt to weaken the yuan. We have already strarted to see USD/CNH pushing further, while DXY bounced off the neckline of its inv H&S seen in the above video. Ashraf highlighted last week that USDCNH is increasingly serving as parth foward for selected USD pairs.

Other countries will also have to continue to navigate US currency policy. Switzerland was named a currency manipulator in the latest Treasury report and that gives the Biden administration some leverage as they enter office.

With the presidential inauguration out of the way, we keep an open mind as the policies of the new administration start to unfold-- Tax decisions, energy policy and foreign/econ policy vis-a-vis China. The past four years has certainly taught everyone to be ready for anything.