Intraday Market Thoughts Archives

Displaying results for week of Apr 18, 2021Lagarde Cautiousness & Biden's Taxes

Expectations were for the ECB to leave PEPP purchases unchanged and that's exactly what they did. However there were some who thought the could pre-announce a return to a slower pace in June but that didn't happen and leaks from deliberations showed it wasn't even discussed.

What was more of a surprise was how somber Lagarde remained. Eurozone economic data has improved considerably since the start of the year and consistently beaten estimates. That was seen again Thursday with consumer confidence rising to -8.1 from -10.8.

Lagarde forecast that growth would 'firm' later in the year and said business investment had been good but there was nothing like the show of confidence we saw from the BOC. In offering a hint at why, Lagarde pointed to a lower level of fiscal support.

The euro sagged after the press conference and briefly broke below 1.20. Much of the decline was on risk aversion in large part due to risk aversion on a pending Biden proposal to raise capital gains taxes. That was something he campaigned on but it evidently took the market by surprise Thursday.

Biden's Tax Proposal

The preliminary tax announcement consists of raising the top income tax rate from 37% to 39.6% and levying income and capital gains tax rates for earners of more than $1mn. Combining these hikes with the those from Obama's health care reform, the cumulative capital gains tax rates on the wealthisest bracket would surpass 43%. Markets sold off on the announcement, but it is not inconceivable for markets to push back up to new highs, before a fresh wave of selling hits ahead of the new legislation. There's also talk that ultimately the new tax rate will settle at at 28%.The day ahead features most of the global manufacturing and services PMIs from Markit. The increases in these metrics in the past 2-3 months have been swift but what's particularly stark is the jump in pricing. Every comment in the KC Fed on Thursday was a nod to supply chain disruptions, soaring commodity costs and labour shortages. “It is very difficult to handle the increased business with supply chain issues across all materials and finding anyone who wants to work,” was one. "Entry level pay will need to be increased. This will create pressure on all other positions,” was another.موعدنا اليوم في غرفة شركة إكس أم لجلسة الأسواق

.ننتظركم الساعة الرابعة عصرا بتوقيت مكة في غرفة إكس إم مع أشرف العايدي .أنقر على الرابط للمشاركة

The Dam Cracks, ECB Up Next

As we warned here, the Bank of Canada dialed back QE to $3B/week from $4B/week and brought forward the timeline for when the output gap closes to 2022, which is another way of saying that's when they plan to hike.

The market was not expecting that and what was a true surprise is that BOC Governor Macklem didn't temper the moves with any anti-CAD jawboning or strong caution. There was nothing like a dovish taper. Instead, the BOC boosted its Canadian GDP forecast to 6.5% this year from 4.0% and increased 2022 as well, while also raising the global growth view.

At one point, USD/CAD had fallen 200 pips from pre-announcement levels. The market got caught leaning the wrong and the pair went from a one-month high to a one-month low in 70 minutes. There was a modest bounce late to put the pair back at 1.25000 but the spot to watch now is the 1.2470-60 support zone for further follow through. The positive risk tone the emerged Wednesday will help but the loonie might need some help from commodity prices.

In the bigger picture, the turn in central banking has arrived. The ECB decision is up next and that might include a hint (or commitment) to its own tapering in June when the latest forecasts are published. Eurozone data has far outpaced estimates over the past two months as the economy shrugged off lockdowns.

In the ECB's case though it will be seen as more of a technical move or unwind of the extra buying announced in early March following the bond tantrum.

The market will also be watching the Fed, RBA, and BoE to see who follows Canada. While this is a crack in the dam, it will break when one or two of those follow. When that happens, volatility in FX will dramatically increase.The Great Monetary Turn Begins

In just over one year, the Bank of Canada has accumulated more than 40% of government bonds outstanding. Even for a challenge like covid-19, the pace of bond buying has been too fast. In November, Macklem made the first move to slow purchases but combined it with a duration extension and successfully finessed it as a technical move.

In Wednesday's decision there is likely to be a true taper to $3B/week from $4B. Such a shift isn't entirely expected and they could wait a bit longer but the central bank has backed itself into a corner. Macklem said that owning more than 50% of outstanding bonds could affect market functioning and even a taper to $3B will put them over that limit in months.

A shift is also entirely justified by the fundamentals. New forecasts for GDP growth this year are likely to be boosted to 6% from 4% even with the latest lockdowns. On top of that commodity prices are high, the reopening timeline is moving forward, this week's Federal budget is stimulative, home prices are sizzling, global growth has been resilient and US stimulus will spillover.

In spite of all that, the consensus view is that Macklem will try to engineer a 'dovish taper' by jawboning on the loonie or moving the goalposts on the output gap to by pledging an inflation overshoot.

Both those things may happen but actions speak louder than words and a taper puts the BOC on the path to tightening.

USD/CAD hit 1.26 in a retracement this week on broader risk aversion but there's plenty to like about the loonie once markets settle.

The BOC decision is at 1400 GMT with a press conference an hour later. Also note that Canadian CPI will be released at 1230 GMT and with headline and two-thirds of the core measures expected above 2%, risks are towards something that could make the BOC think about earlier tightening.The Great Monetary Turn Begins

In just over one year, the Bank of Canada has accumulated more than 40% of government bonds outstanding. Even for a challenge like covid-19, the pace of bond buying has been too fast. In November, Macklem made the first move to slow purchases but combined it with a duration extension and successfully finessed it as a technical move.

In Wednesday's decision there is likely to be a true taper to $3B/week from $4B. Such a shift isn't entirely expected and they could wait a bit longer but the central bank has backed itself into a corner. Macklem said that owning more than 50% of outstanding bonds could affect market functioning and even a taper to $3B will put them over that limit in months.

A shift is also entirely justified by the fundamentals. New forecasts for GDP growth this year are likely to be boosted to 6% from 4% even with the latest lockdowns. On top of that commodity prices are high, the reopening timeline is moving forward, this week's Federal budget is stimulative, home prices are sizzling, global growth has been resilient and US stimulus will spillover.

In spite of all that, the consensus view is that Macklem will try to engineer a 'dovish taper' by jawboning on the loonie or moving the goalposts on the output gap to by pledging an inflation overshoot.

Both those things may happen but actions speak louder than words and a taper puts the BOC on the path to tightening.

USD/CAD hit 1.26 in a retracement this week on broader risk aversion but there's plenty to like about the loonie once markets settle.

The BOC decision is at 1400 GMT with a press conference an hour later. Also note that Canadian CPI will be released at 1230 GMT and with headline and two-thirds of the core measures expected above 2%, risks are towards something that could make the BOC think about earlier tightening.US Dollar Falls But Signals Mixed

The past month has included a series of sideways moves in a number risk barometers. In FX, AUD/USD and CAD/JPY have been good examples.

At the same time, the most risk-sensitive asset of all – equities – have been making new highs day after day. In the bond market, the yields have retraced but it's tough to disentangle that from the inflation debate. Finally, commodity prices have been mixed with things like lumber continuing to soar while copper and oil remain in recent ranges.

The theme for the year remains reopening enthusiasm but in the past month, the rise in cases globally is a setback along with vaccine hiccups. There have been some good recent signs in the breaks higher in AUD/USD but yen crosses continue to move sideways in general and CAD/JPY is threatening the bottom of the one-month range.

What comes next may come down to central banks. The ECB and BOC this week are spots to watch for tapering hints (or in the BOC's case, the possibility of outright tapering). The latest Canadian budget included $101B of fresh spending and a huge deficit with no slowing in employment support programs until September. However the loonie stumbled after hitting a one-month high early in the day.USD Retreat Ignores Stocks Pullback

If we rewind back to December, there was plenty to worry about regarding sterling. Brexit was still a mess, the virus was raging and the BOE had floated negative rates. Skip ahead and the UK has gotten the upper hand on covid, memories (nightmares?) of Brexit are fading and negative rates are off the table.

Yet at the lows last Monday, cable was trading exactly where it was on December 30. Now much of that is due to a broader US dollar rally but with Treasury yields fading, there was room for a bounce and that began to materialize last week with a double bottom at 1.3670.

On Friday, there was another positive signal after a stumble lower in Asia was picked up aggressively and cable finished at a 10-day high. The bullish outside reversal is an opening for further gains.

The big drama on the weekend was in crypto as bitcoin fell nearly $10,000 to $51,300 in a broad crypto wipeout. Many coins fell more than 20% in a liquidation-like move. There was some recovery early on Monday but the volatility will keep the crypto market off balance all week.

There was plenty of talk and rumours about regulatory crackdowns but no real news. A power outage in parts of China may have hit miners but it's a stretch to pin the drop on any one factor.

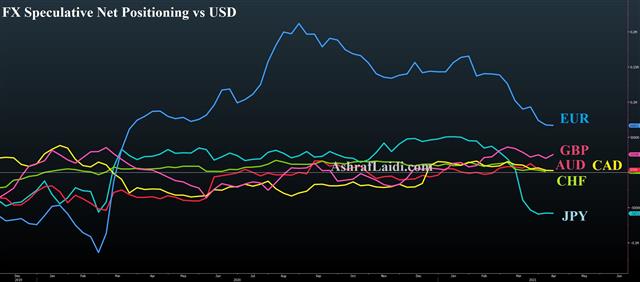

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +67K vs +68K prior

GBP +26K vs +20K prior

JPY -58K vs -58K prior

CHF +1K vs +3K prior

CAD +2K vs +3K prior

AUD +4K vs +4K prior

NZD +3K vs +3K prior

There isn't much to report this week aside from GBP longs edging higher.ندوتي و نقاش يوم الإثنين مع إكس تي بي

ننتظركم اليوم في ندوتي مع إكس تي بي الساعة 7:15 مساءا بتوقيت مكة ثم نقاش/مداولة حول الاسواق العالمية تديرها المتميزة لبنى بوظة.سجل مقعدك هنا