Intraday Market Thoughts Archives

Displaying results for week of Apr 04, 2021A Glimmer for Gold: Double Top or Bottom?

Gold went from a post-pandemic darling to a hated asset in a hurry. The long-term implications of ultra-low rates and massive fiscal spending are being ignored for now as the market focuses on the reopening. At the same time, crypto is sapping would-be gold buyers as prices of alt-coins continue to climb.

Technically through, the chart is compelling at the moment. Gold put in a double bottom in March at $1676 but it won't be confirmed until a close above the mid-March high of $1755. It closed just below on Thursday after an $18 gain. If it breaks, the measured target is $1864/65 but if it fails, expect a return to $1680s or below.

Interestingly, the jump in PPI inflation triggered a knee-jerk drop in gold as attention fell on rising bond yields. This highlights the potential for further yields gains weighing on gold next week upon the release of CPI and 3-year, 10 yr and 30-yr Treasury auctions.

Canada unemployment rate plunged to 7.5% from 8.2%, while employment added 303K new jobs in March. CAD is in an interesting spot though. It's largely shrugged off the latest lockdowns, which are growing increasingly stringent. That's because the government now estimates that 75% of adults will have the vaccine by mid-June. The loonie is also piggybacking of strong US growth. We also keep an eye on chatter of a BoC taper.

The driver for the next leg is likely to be commodities. Oil has been narrowing since March 18 and is coiling up for a breakout. There are few obvious catalysts aside from Iran negotiations but watch WTI closely for a quick decline to $54 or a rally back above $65.FedSpeak Train & Unwinding Underway

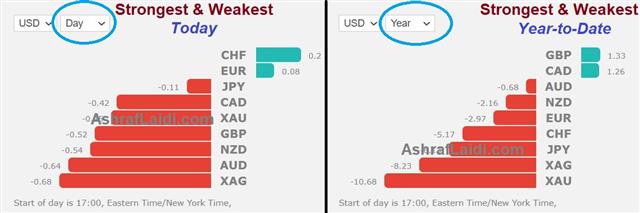

Little has changed in the underlying economic fundamentals this week but a potential unwinding is underway in indices, especially tech/Nasdaq. We will hear from 4 Fed speakers today (Evans, Kaplan, Barkin & Daly) see more below. More US data strength emerged yesterday with the JOLTS job openings at 7367K in Feb compared to 6900K expected. The US dollar stabilises against most currencies following a 2-day retreat, but remains weak vs EUR and CHF. The charts below show that since the start of the day (after 10 pm London), CHF and EUR are the only currency strengthening via USD, while the Year-to-Date chart shows GBP and CAD are the strongest currencies of the year, while gold and silver are weakest. Today is an opportunity for the Fed to make waves.

The IMF yesterday upgraded its global growth forecast on Tuesday to 6.0% from 5.5% in the January forecasts. That's mostly due to US stimulus but it's also important to note that European forecasts ticked higher despite further lockdowns and Canadian growth was the strongest upgrade despite a third wave. That speaks to the resilience of growth so far this year.

Both news items are a continuation of recent macro strength, yet markets are moving in the opposite direction. US yields fell below pre-NFP levels and a number of unwinds are way in FX, including EUR/USD and USD/JPY.

Beyond Stimulus Impact

Skeptics will point out that March was likely boosted by stimulus payments but a picture of a better-than-anticipated year is crystalizing. The question is whether inflation will rise too high and if the Fed will be good on its word in letting it run hot. The prices paid component in the ISM survey was the highest since 2008.Looking ahead, the highlight will be Fedspeak with Kaplan, Barkin, Daly and the minutes of the March FOMC meeting. There's a détente at the moment with the market pricing in Fed hikes in 2022 and the Fed insistent that's not going to happen. The Fed has pushed back on the idea but Powell also conceded that the only way to prove you're going to let inflation run hot is to do it. Meanwhile the bond market also hasn't pushed beyond what the Fed will tolerate so it's turned into a waiting game that will likely last the remainder of the year.

What could change? The Fed could indicate an early withdrawal of stimulus but that would set of a flurry of bond market selling and reinforce the lack of credibility that they're trying to counter. At the moment though, none of that is in play, though Dallas' Kaplan (at 1500 GMT) is one to watch because he's admitted his dot is one of the earliest ones to show a hike. Still, even if he doubles down on that idea or pushes harder, he's in a decided minority.

Risk on Right on Time

We wrote about positive April seasonals earlier in the week and that trade delivered with markets in a great mood to start the new month. The S&P 500 rallied 1.2% to a new record high and above 4000 for the first time.

US services ISM shot up to a new record of 63.7 vs exp 59 after manufacturing ISM hit 64.7 compared to exp 61.5. The surveys from Markit were also strong, including a survey high (since 2011) in the Canadian measure. Importantly, all the surveys highlighted shortages of raw and intermediate materials, suggesting pricing pressures in the months ahead.

OPEC+ appeared to do its part to loosen the oil market with a surprise decision to raise quotas in May. They also pre-announced higher production in June and July, adding more than 2mbpd total. Initially the market balked but had a re-think and crude rose 3.5%, perhaps owing to the slow paces of increases, along with the certainty three months out.

In FX, the dollar slid as 10-year Treasury yields back off by 7 bps to 1.67%. That led to a relief rally in the euro and commodity currencies.