Intraday Market Thoughts Archives

Displaying results for week of May 02, 2021Gold Glows Ahead of US & Canada Jobs

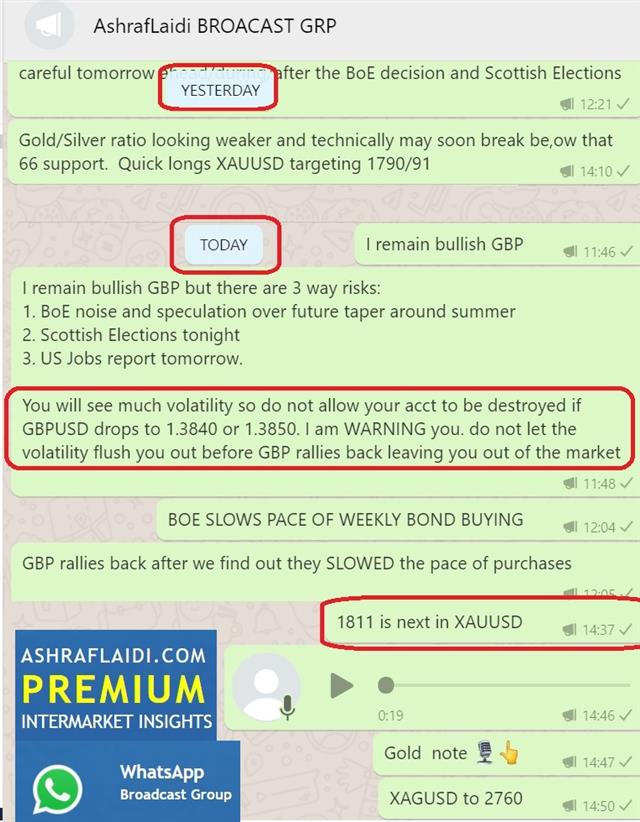

Cable traded in an 80 pip range in minutes after the BoE announcement as traders and algos were left confused by a statement that was more or less unchanged followed a minute later by the monetary policy report, which said the pace of QE purchases could be slowed somewhat. Cable initially dropped to 1.3858 then spiked to 1.3940 – both session extremes.

It was a communication mess, largely because Bailey was frightened (no other way to put it) to admit to anything like tightening or signal that it's on the horizon. There appears to be a strong school of thought outside of the Bank of Canada that markets and the economy can't handle any taper talk. Given the enormous improvements in the global economy, it's all getting a bit ridiculous.

Outgoing chief economist Andy Haldane dissented in favor of a real taper. His comments with it emphasize a different possible approach, noting that there's evidence of a rapidly recovery economy and good reason to believe it will be maintained.

The risk is that by being overly cautious, central bankers will fall behind the curve. A brighter outlook along with associated inflation risks are a big part of the gold recovery. It rose to the best levels since February on Thursday, rising $30 to $1815.

Further evidence of economic strength could come in jobs reports from the US and Canada up next. Non-farm payrolls are expected at exactly 1 million but digging through the estimates, there's a clear skew higher. There's every reason to believe there was massive hiring in April, notwithstanding the disappointing ADP print (it also underestimated March jobs by nearly half). Economists tend to get gun shy when predicting extremes so there's room for an upside reading, with some bolder economists calling for 2m jobs. The unemployment rate is expected to ease to 5.8% from the prior 6.0%, while average hourly earnings edging up to zero from -0.1%.

In Canada, it's a different picture as many parts of the country went in a tight lockdown in April that has continued. The consensus is between -150K & -160K. The loonie is trading at 4-year highs though, and is looking beyond this tough stretch, so this datapoint is likely to be ignored.موعدنا الآن في غرفة شركة إكس أم لجلسة الأسواق

مجموعة الواتساب الخاصة

تفضل الى الفيديو الإرشادي لتكوين إسم مستخدم لأكتمال عملية الإشتراك

فيديو عن الإسترليني و أحداث يوم الخميس

كيف يمكن تداول الإسترليني مع قرار البنك المركزي الانجليزي والانتخابات الاسكتلندية؟ وماذا تعني أغلبية حزب اسكتلندا القومي و قرار مشتريات الأصول للجنيه الإسترليني؟ التفاصيل في هذا الملخص مع فيديو أشرف العايدي

A Taste of Tapering

In a bizarre episode of a former Fed official lacking self-awareness, Janet Yellen said on Tuesday that rates might have to rise to keep the economy from overheating. As current Treasury Secretary and former Fed chair, that comment carried weight and it sent risk trades reeling and the US dollar higher.

Yellen later clarified her inflation statements, saying "it's not something I'm predicting or recommending...If anyone appreciates the independence of the Federal Reserve, I think that person is me.”

Some of that unwound later in the day. The context of her comments was that spending was going to rise and that higher borrowing costs are a side-effect but her line was poorly delivered, particularly from a Fed chair who was cautious with her words.

The market reaction was telling as the dollar spiked to session highs and equities – particularly tech – were at one point in line for their worst day of 2021.

Powell no doubt understands that he's about to enter a minefield. The odds-on date for a true tip towards a taper is Jackson Hole in August. However we should expect a trickle of Fed Presidents and perhaps a governor signaling that before it comes. What's daunting is that signaling a taper is just the first step; the time lag before execution is vital. Then the challenge will be on rate hikes.

Of course, the Fed has sketched out a rough plan via the dot plot and its communication but rarely in economic history have plans worked out. Things happen and forecasting is hard. The Bloomberg commodity index hit its highest since 2011 on Tuesday and inflation talk is non-stop. Expect many more hiccups like the one we saw Tuesday in the months ahead, and some that are much more severe.

Supply Crunch-Time

The ISM manufacturing index was at 60.7 in April compared to 65.0 expected. That's still a healthy level but it's a significant miss and led to a round of US dollar weakness.

However we would caution reading this report as a sign of faltering demand. Repeated comments in the report highlighted supply chain problems including semiconductors, steel and workers. The survey showed 11 positive comments for every negative one compared to an 8:1 ration in March.

“In 35 years of purchasing, I've never seen everything like these extended lead times and rising prices,” one comment in the report said.

A big drag in the Q1 GDP report released last week was falling inventories. This report highlights the ongoing contraction there with companies unable to restock and continuing to draw down supplies. That will be a further headwind in Q2 but those will eventually be rebuilt.

In the meantime, companies are finding increasing pricing power – something Warren Buffett highlighted on the weekend.

It's still early but we sense that we're heading into a new chapter in the reopening where shortages are the main problem. It may have started with Ford last week who said it would miss production targets due to the semiconductor shortage. If those shortages hit at the same time as demand reopening creates more price-insensitive buying, it could lead to a spike in inflation to above the Fed's comfort zone.

May Marches In

Economic data continued to point to economic strength on Friday as the expectations component of the UMich consumer sentiment survey was strong while the income line in the PCE report rose 21.1% in March on stimulus payments.

Month end flows may have led to some profit taking but a study showing a single vaccine shot may not offer adequate protection from covid variants also weighed.

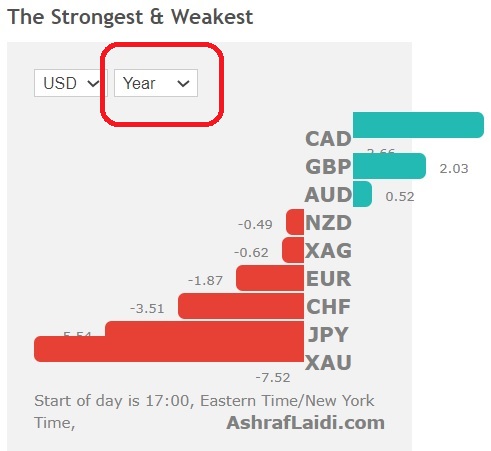

The new month kicks off with some strong seasonal patterns. Cable is a particularly notable one – it's fallen in May for 11 straight years. We may have seen some front-running of that with Friday's drop down to 1.3810.

Another theme is dollar strength. At the start of the year, everyone was a dollar bear and that turned out to be a terrible idea, especially after the Georgia primary. The dollar gave back some ground in April but May has been the best month for the DXY for the past 20 years.

On the soft side, it's the second-worst month for the kiwi. For equities the traditional 'sell in May and go away' doesn't hold up. The S&P 500 has risen in May in 7 of the past 8 years.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +81K vs +81K prior

GBP +29K vs +25K prior

JPY -49K vs -60K prior

CHF -1K vs +2K prior

CAD +16K vs +13K prior

AUD -1K vs -2K prior

NZD +7K vs +4K prior