Intraday Market Thoughts Archives

Displaying results for week of Jul 25, 2021Dollar Dips, Complex PCE Next

The post-Fed slump in the US dollar continued Thursday in a steady fall that is beginning to leave a sizeable mark on the charts, particularly in cable and EUR/USD.

What's difficult to ignore in GBP/USD is that the turn in the pair came almost precisely when the sharp turn in covid cases began. It's another data point that suggests virus worries are increasingly a factor.

A new framework argues there has been a shift in market thinking from rewarding a fast vaccine rollout toward rewarding higher levels of vaccination. Powell argued Wednesday that delta won't be a major US drag and that's probably correct but the emerging risk is the next variant and the countries with lower vaccination rates will be at a perpetually higher risk of a dire outcome.

Another thing to consider is sequencing. The combination of bottlenecks and reopening are hitting the US at the same time while in Europe the slower reopening will shift the overlap. This may have created illusory inflation in the US that's prompted a Fed reaction. The market may be looking beyond the bottlenecks and towards a time when the reopening boom fades just as those bottlenecks finally clear up. That should come around this time next year and will add disinflationary pressure.

Finally, it could be as simple as growth expectations adjusting. In the past 24 hours, we've seen US GDP undershoot and eurozone GDP beat.

The next hurdle will be the US PCE report. Headline inflation was at 3.9% previously and if that begins to flatten out or turn lower, then the dollar can continue its slide.We're a ways away

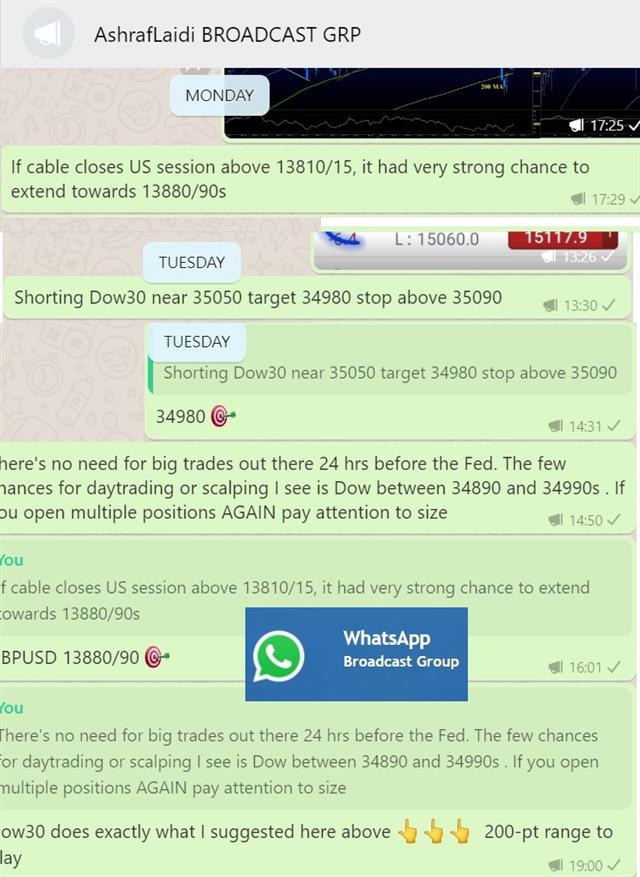

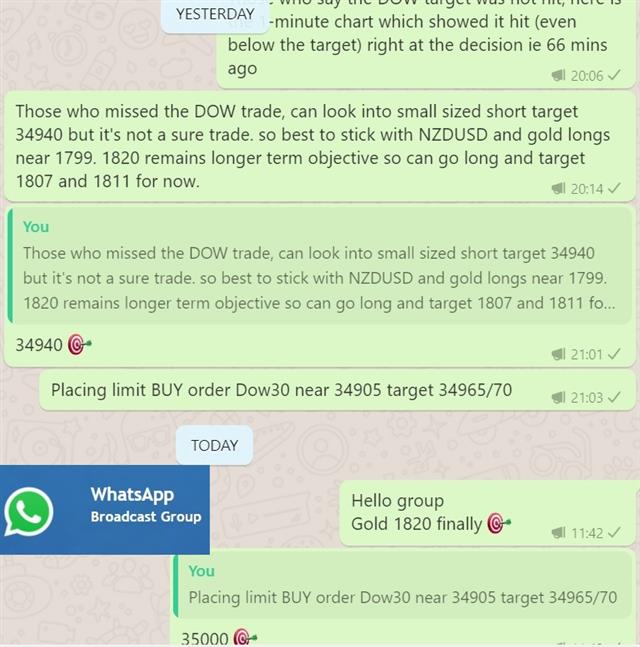

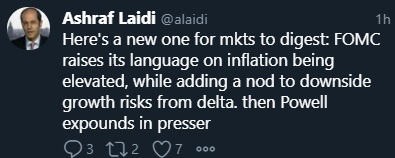

The first surprise came in the FOMC statement when the text was changed to say the Fed had made progress towards its goals. This was to reflect that that the US economy is closer to the 'substantial further progress' condition for tapering.

Powell underscored that in the statement by saying there was still 'some ground to cover' before hitting the employment goal, which lead him to make the "ways away" sentence mentioned above, which weighed on USD. He later repeated that same line, indicating it was planned. It's also a departure from two weeks earlier when he said they were 'still a ways off' from substantial further progress.

Powell also twice deferred to the committee regarding inflation and risks around the transitory baseline. That suggests there's disagreement on whether or not price rises will prove persistent or fade. Expect plenty of commentary along those lines in weeks ahead from the hawks and doves.

In terms of the market, the initial shift in communication boosted the dollar by 25 pips across the board but it later gave back double that amount. The thinking there may be that while a taper is inching closer, there's no rush. We will be carefully watching for any shift as the implications are digested.

Looking ahead, the advance look at Q2 GDP is up at 1230 GMT on Thursday alongside initial jobless claims. The consensus for GDP is an annualized pace of 8.6%, reflecting the reopening. Indications on business investment and inventories will be the place to watch. This week the IMF stretched out the timeline for the US recovery on some of those concerns. Ultimately that may be good news as it will keep the Fed from rapidly tightening.New Premium Trade & Pressure Lifts on the Fed

Markets in July have been consumed with escalating worries (not necessarily selloffs): 1) China 2) Delta variant 3) Equity earnings 4) Leverage. Inflation worries, however, have eased, albeit temporarily. Yet, falling Treasury yields and the sense that we've passed the peak of bottlenecks have proven to be a relief for the market.

So how do we incorporate the Fed's media blackout, with easing inflation concerns?

The best central banks are the ones that keep off the front pages, and Powell's goal today is strive for as little attention as possible. None of the questions the Fed is asking have been answered and pressure on them to act is low. The path forward here is to acknowledge risks around covid and inflation while emphasizing that the Fed is in no rush. The market will again want to hear there's significant work to do on employment and that any policy changes will be foreshadowed well in advance.

The dollar selloff on Tuesday was likely a shift in positions in expectation of a dovish Fed. Do not forget month-end adjustments over the next 2 days.

The risk is that Powell frets about inflation or puts a taper back on the table. That's not likely but it's what to watch for. Ashraf raised the possibility of the Fed mentioning the Delta varian in the policy statement. If it happens, expect USD selling and a push-up in gold and silver.

China in Flux & Tech Tuesday

The Hong Kong Hang Seng fell 4.1% on Tuesday after a similar decline on Monday, erasing the gains for the year while the Shanghai Composite fell 2.5% after shedding 2.3% the prior session. The trigger was a new set of regulations banning education tech firms (that teach school curricula) from making profits, raising capital or going public. Those particular companies were crushed, but the move sparked fear of regulations hitting elsewhere.

For broader markets, Chinese regulation isn't yet a worry, which is why they shrugged off the Chinese news. But observers are increasingly worrying about the downdraft spilling onto Western markets. Don't forget the Fed decision tomorrow.

What could undermine sentiment in the days ahead is the increasing difficulty in controlling the delta variant. The city of Nanjing – population 8.5m – went into a strict lockdown on Monday after an outbreak of 76 cases, with about half transmitted locally. Officials have mandated mass testing to stop the spread.

The fear is that every country will have to transition to a strategy for living with covid, rather than completely suppressing it. Australia is struggling with this right now that has weighed heavily on AUD, which is just above the lowest levels since December. China has more tools in the toolbox to control the virus but everything we learn about delta highlights how tough it is to contain. If lockdowns like in Nanjing begin to spread, it could spark a rethink on global growth.

We will continue to watch that front but the economic calendar will offer plenty to monitor in the day ahead with a busy slate and the Fed on Wednesday. From the Tuesday releases, consumer confidence may have the most impact. It's impressively rebounded from the start of the year to 127 from 87 at the turn of the year. There's a chance it could get back to the pre-pandemic level of 132. That could draw a line under the dollar ahead of the FOMC.

Pivotal Week Ahead

Economic data was a mixed bag on Friday and so was the market response. The US Markit services PMI disappointed at a five month low of 59.8 compared to 64.8 expected while the manufacturing numbers were slightly stronger than anticipated. In Canada, both May and June preliminary retail sales beat estimates.

G10 FX was largely flat to close out the week but US equities ran to fresh all-time highs. Those gains came without the support of higher Treasury yields or a positive impetus.

On the covid front, UK daily cases have fallen by nearly 20K in just eight days in a sharp turnaround that has puzzled modelers. In any case, the market appears to be taking it at face value. An Israeli study also drew some shudders as it showed Pfizer's vaccine just 39% effective against delta variant infections (though still 92% against hospitalizations). Again, the quality of the data was questioned with other studies showing much better efficacy.

That front bears watching in the week ahead but the main focus will be on a busy economic calendar. The main event is the Fed decision on Wednesday but we also get:

Monday:

New home sales, Dallas FedTuesday: Durable goods orders, Consumer confidence, 5-year note auction

Case-Shiller house price index, Richmond Fed

Wednesday: FOMC decision, Advance good trade balance

Thursday: Initial jobless claims, Q2 prelim GDP

Friday: PCE, Final UMich consumer sentiment

On top of all that, it's the peak of equity earnings season with all the mega-cap tech firms set to report. When the dust settles, expect lasting trends to emerge.