Intraday Market Thoughts Archives

Displaying results for week of Aug 15, 2021Bad Stop Placement

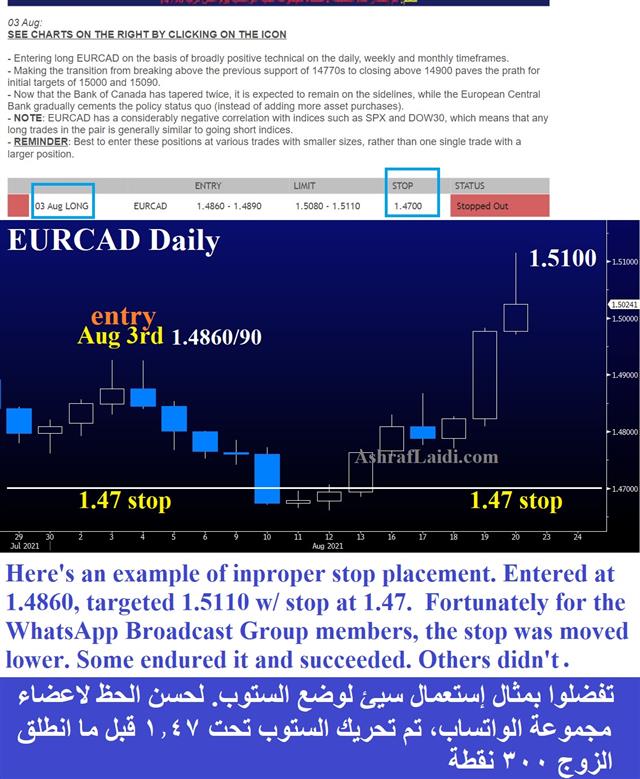

Here is an example of poor stop placement in our Premium trade of EURCAD longs. The market fell below the 1.4700 stop, bottoming out at 1.4660s before surging 400 pips. Luckily we told our WhatsApp Broadcast Group members we were staying in the trade and adjust the stop if they had to. Regardless of whether you go for a 3-1 or 2-1 reward/risk ratio, price entry is important, but heeding the technical importance of your stop is more crucial.

What’s Really Behind the Worries

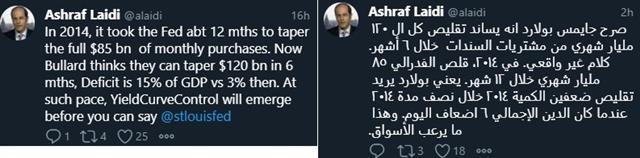

It remains tough to pin down whether the latest FX freakout is covid related or something else. Fed tapering talk is certainly a factor, but how much? You could make the argument that this is the taper tantrum.

At the July 28 FOMC press conference, Powell dismissed delta worries, and less than a month later economic forecasts are being cut as an increasing number of cases break through vaccines.

One argument is that this week's episode of fear is all about vaccine booster shots. First, they say the current regiment won't work. Second, it means we'll be fighting covid indefinitely. Third, it means that less-developed countries and others with slow vaccine rollouts will be in lockdowns for much longer periods.

So there's a whole new pandemic raging and central bankers – including the RBNZ's Orr this week – who don't get it.

Then again, what would you expect them to do if they are worried? QE is running at nearly peak-pandemic levels everywhere already. The bond market clearly isn't worried about inflation.

What's left is a lingering worry that growth in 2022 and beyond will be stunted. That a Japanification looms. Friday's data underscored the dismal Japanese prospects once again as CPI was at -0.3% y/y compared to +0.6% expected. Even with energy price spikes and bottlenecks, Japan still couldn't generate positive y/y inflation.

So where will tailwins growth come from? Perhaps the market is afraid it won't get another stimulus package from the US and that fiscal spending will tighten up elsewhere. China cut rates this month but doesn't appear to be in a rush to goose growth. On Friday, the PBOC left one-year lending rates unchanged for the 16th month, setting off more selling in risk FX. There was some speculation they may cut but at the moment, China appears to be in no rush to cushion the latest covid worries.

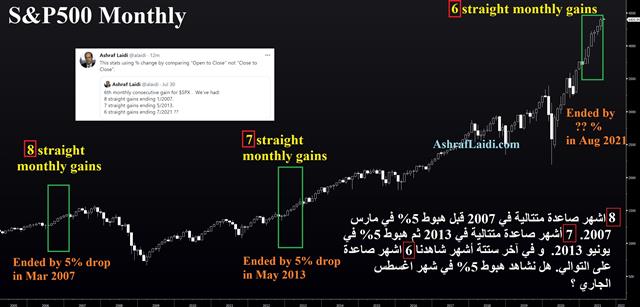

Whatever the combination of reasons: Covid, the Fed, fiscal policy, China – the charts are telling a compelling story. There are large head-and-shoulders patterns breaking in copper and CAD/JPY among others. AUD/USD has fallen into a technical gap. Many equity indexes are nearing critical levels.

Markets are optimistic by nature but until there is a positive catalyst like a dovish Powell or clear turn in delta cases, it's tough to fight these moves, particularly on a Friday.مؤشرات البورصة: إلى أين؟

هبوط جميع مؤشرات البورصة بأكثر من 2% من قممها، فهل حان وقت الشراء أم هناك المزيد من التراجعات؟ تعرّفواعلى التفاصيل في هذا الفيديو الحصري لخبير الأسواق العالمية، أشرف العايدى

Markets, USD Shrug FOMC Minutes

The Fed Minutes showed that 'most' participants judged that the substantial further progress goal had been met in regards to inflation but 'most' also said it hadn't been met on employment. The timing on employment is the big open question and 'most' see that being met before year end. That's what the market was expecting but, notably, 'several' don't see it being met this year.

Further, the Fed sees what everyone else is seeing around delta, markets and new risks from softening consumer data. That was underscored by Goldman Sachs on Thursday, who cut their Q3 US GDP forecast to 5.5% from 8.5% on the slowdown.

All that is USD negative and that's what unfolded initially but when Tokyo came online Thursday, a relentless dollar bid appeared. That was in spite of flat trading in bonds and equity futures, suggesting it was flow-driven.

The risk is that those flows begin to run stops. EUR/USD fell to 1.1667 in the dollar bid, which is the lowest since November. AUD/USD and NZD/USD also hit multi-month lows.

There's a high risk this dollar bid becomes self sustaining through a feedback loop of lower commodity prices, stops and risk aversion. Tread carefully around the release of weekly initial jobless claims at 1230 GMT.Orr's Hawkish Hold, FOMC's Hawkish Minutes?

As the dust settles on the RBNZ, we will be watching to see if the kiwi can hold above nine month lows. If so, it will be impressive resilience after one of the worst 24 hour periods of news a currency has faced this year. In that span, the country was hit by a covid case, a lockdown, six more covid cases and a surprise central bank move. Yet NZD is only down about 80 pips and it came in a tough moment for broader risk appetite. If that kind of brutal news flow can't decisively send a currency to 9 month lows, then what can? We should also ask whether NZD will become beholden to each new daily Covid case.

Meanwhile, the US is facing its own trial after the retail sales control group fell 1.0% compared to a 0.3% decline expected. Notably, US cases hadn't risen significantly in July so worse news is likely to come in August and special unemployment benefits for 8 million Americans will be cut off in early September.

That hardly sounds like a case for a rushing into a taper and there's a growing case that will be the message from Powell at Jackson Hole.

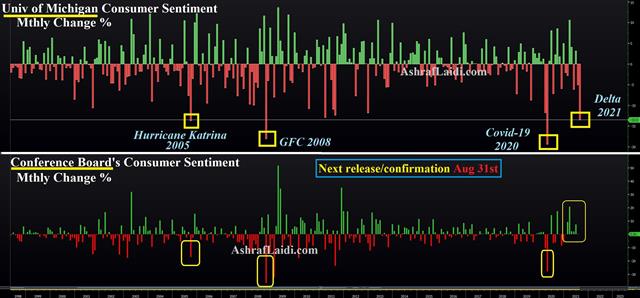

The FOMC minutes on Wednesday risk sending mixed messages as usual. For sure there was some talk of tapering and that will come through in the minutes but headlines from the minutes often trip up the market. Will the minutes be considered too hawkish and outdated after those disastrous Umich Confidence numbers?USD & Yen Firm on China & Delta

So the question is: will RBNZ still hike? I say YES. and that will trigger a rally in NZD...EVEN if a dovish hike.A new Premium trade was posted moments ago, backed by 2 charts and detailed entry/target/stop.

Chinese industrial production rose 6.4% y/y compared to 7.8% expected. Retail sales were up 8.5% y/y compared to 11.5% expected.

Those are big disappointments and shortly before the data was released, the PBOC announced a 600B yuan one-year lending operation in a sign that more help could be coming.

The entire Asia-Pacific region is struggling with delta so there's no near-term turnaround on the horizon. There was a slice of good news in Japanese Q2 GDP as the consumer held up better than anticipated. People have figured out how to live (and spend) with covid restrictions but the grand 2021 reopening that everyone was hoping for isn't coming to fruition and uncertainty about what 2022 will look like is growing.

Powell's appearance had shed no fresh light on the policy debate, but Wednesday's FOMC minutes should add plenty of of detail on the thinking/discussion inside the various members' leanings towards Q4 taper. Yields fell and the yen rallied as the likelihood of a quick series of Fed rate hikes next year fades. Advanced/decline readings of major US indices are firmly swayed into the red.The Illusion of Certainty

This decade so far has been completely unpredictable starting with a global pandemic followed by unprecedented stimulus leading to a remarkably quick recovery. Since then, a strong consensus has emerged that the recovery will continue with the main question about how inflationary it will be.

Friday's UMich sentiment survey was a reminder that the consensus can be badly wrong. The survey plunged to 70.2 from 81.2 in a move no economist came close to forecasting. Shockingly, sentiment was even worse than in April 2020 at the height of the pandemic.

Many market watchers were simply in disbelief but the survey takers pointed to delta risks and reality that the grand reopening has turned into a stumble in the US as hospitalizations and cases surge. New questions about safety and schools have soured great hopes and the political situation (which the UMich survey unfortunately tracks better than consumer spending) remains bitterly polarized.

Is the optimism misplaced? Probably not. Kids are at threat to delta but the numbers with serious illness are staggeringly low. In Europe, the Stoxx 600 rose for 10 straight days through Friday. The recovery may unfold more slowly and covid will remain a risk for years but consumer and business balance sheets are strong.

The numbers will give the Fed some pause and that diminishes the chance of a September taper or a quick taper once it starts. Because of that, selling the dollar was the right reaction for now.

With regards to Afghanistan, any sort of US military resurgence into the country is unlikely to weigh on markets. But if persistent news of escalating US hospitalisations and school closures emerge from the Delta variant, then this is likely to bring up other variables as a valid catalyst for risk-off, namely the Fed taper and Afghanistan.