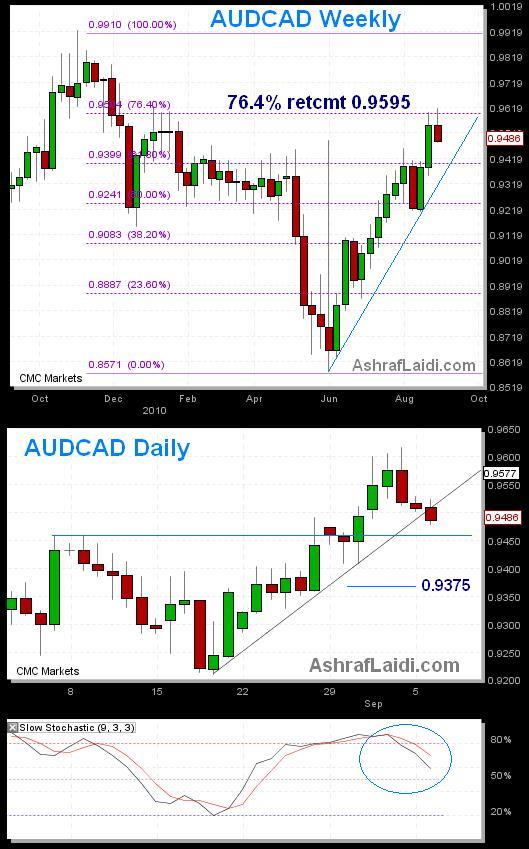

AUDCAD Where to from here?

AUDCAD has rallied 12% from its June lows as CAD descended in broad selling from an onslaught of weak US data. So will the tide start to turn? Tuesdays RBA decision is widely expected to keep rates unchanged at 4.50% while Wednesdays BoC decision is expected to produce a 25-bp rate hike to 1.00%. the RBA could well issue a cautiously positive assessment, that may give reason to anticipate 25-50-bps in tightening later this year. Nonetheless, I see more CAD upside ahead of the an actual rate hike from the BoC, in which case would drag the pair down to the prelim target of 0.9420, which is followed by 0.9370s. In the event that the BoC does NOT raise rates, we could see a run-up back above 0.9520s but capped at 0.9570s. Keep in mind, that both AUD and CAD gain significantly from improved risk appetite, with the former specifically driven by Chinese and Nth East Asian data and the latter (CAD) largely driven by US data. Also watch Canada AUUGUST JOBS DATA, expected to show a return to positive territory at 17.8K after -9.3%.

More Hot-Charts

-

DXY and Cable

Jul 24, 2025 14:20 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send a detailed note on the latest technical parameters to our WhatsApp Bdcst Group... -

Gold New Range

Jul 10, 2025 12:10 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send a detailed note on the latest technical parameters to our WhatsApp Bdcst Group .. -

Gold 30 mins

Jun 25, 2025 12:12 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send a detailed note on the latest technical parameters to our WhatsApp Bdcst Group...

GBPAUD whipsaws violently, starting w/ 250-pip rally in 6 hrs following RBA decision, only to later lose 90% of these gains in 8 hrs. soaring gold and improved risk appetite on solid EU UK US PMIs/ISM have been the main reason. 4hr charts shows we could drop back to 1.6330s, but DAILY chart continues to show positive stochastics calling for renewed bounce to 1.6450 and 1.66. WATCH FOR THURSDAYs AUSSIE JOBS REPORT (See calendar and bookmark it http://bit.ly/5pdFAN ) will be crucial in determining the med term course for Aussie

Ashraf

Ashraf

But GBPAUD is worth a look here. looking bullish. Double bottom & major daily candle means this is ready for take off. Will catalyst be RBA ?

Ashraf

Do you expect rate Hike on Aussii from RBA ? If yes then where will go AUD more ?

Thanks

congrats

@alaidi Those who ask abt $AUDCAD theres the RBA minutes in a few hrs & BoC CPI tmrow expected higher, so better play CAD vs weaker FX $$

@alaidi so better play CAD longs vs weaker FX such as GBP (hence short $GBPCAD play), NZD & even USD on dips but avoid exposur ahead of FOMC $$

Ashraf

What your view on AUDCAD