Ahead of Powell's Testimony

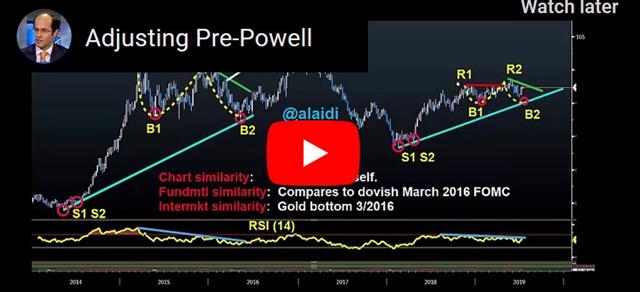

Thin summer trading volumes will sustain a brief jolt as Fed Chair Powell testifies to Congress today (testimony starts at 15:00 London time but speech is released 90 mins before i.e. 8:30 Eastern/13:30 London) and tomorrow. The testimony and ensuing Q&A will shed further light on the probability of a rate cut later this month. It may be too soon for Powell to hint at the magnitude of the rate cut for Jul 31, but is it too soon to guarantee a rate cut at all for this month? Below is the video for Premium subscribers, detailing yesterday's udpated 3 charts & analysis for one of the three USD trades.

FX traders bear in mind the following: Powell has already stated the economic slowdown goes beyond the retreat in global trade i.e. not limited to the trade war.

USD bulls argue that any rate cut would only be a one-time adjustment instead of an extended round of easing. USD bulls will also state that the magnitude of the rate cut does not matter because the ECB will inevitably follow with rate cuts and/or policy stimulus.

USD bears could point to the fact that the Fed has never conducted a policy easing shorter/smaller than two or three rate cuts over the last 30 years. Additionally, limited or no Fed easing will exacerbate the disinflationary challenge from USD strength. Powell can't afford to get his price stability objective off the markt. And don't forget the export-reliant sector of US companies desparate for relief valve from USD strength as the economy slows.

Regardless of Powell's message, it will be unlikely for him to be so committal 21 days before the Fed decision, during which we'll get a few more vital macro data points. While trading opportunities should return, no trend-breaking moves are expected.

As important as the speech will be, do not disregard the Q&A with congressmen today and tomorrow, which could lead to several potentially market-moving unscripted remarks/ansers from Powell. For the tradable implications of my extensive analysis, tune in to the Premium video.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings | |||

| 7.32M | 7.51M | 7.37M | Jul 09 14:00 |

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55