Intraday Market Thoughts Archives

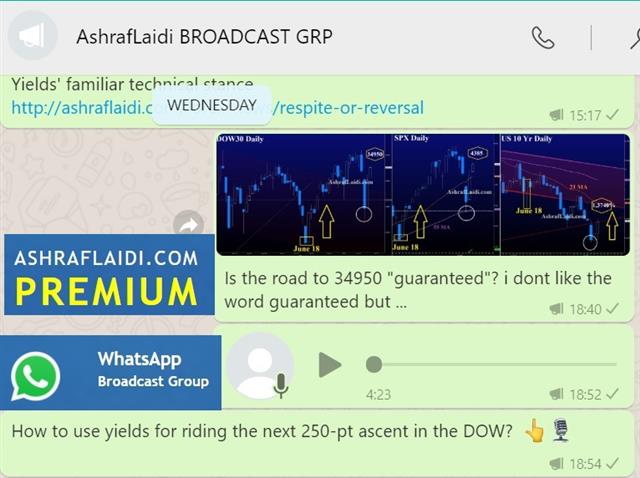

Displaying results for week of Jul 18, 2021Back From the Abyss & the 250-pt ride

The turnaround from Monday's pessimism has been impressive. The US CDC underscored covid risks on Thursday by highlighting a 53% week-over-week rise in cases and that some hospitals are reaching capacity. That led to a momentary drop in equities, yields and risk trades in general.

Once again though, the market shrugged it off. As we dwell on it, the ultimate question regarding covid is simple: Will vaccines work? Anti-vaccine sentiment is unfortunate but it's largely held by younger people who are totally active in the economy. They may get sick but they'll fully participate in the economy beforehand (and hopefully afterwards).

Of course, vaccine efficacy isn't a black/white question. There are degrees of success and problems – particularly in schools – if vaccines are spotty. The delta variant is problematic on many levels but data continues to show that all vaccines offer extraordinary protection. So unless (or until) there's a variant that truly beats the vaccine, then economic growth will recover. To be sure, the latest news could slow the trajectory of the recovery and stretch the timeline but we're confident that will be met with more fiscal and monetary support.

With regards to next Wednesday's FOMC meeting, there's talk of using the meeting as the start of real discussions on the timing and size of tapering, a topic that will be debated in more detail at the Jackson Hole symposium 4 weeks from now. The key then is how will Powell communicate this discussion at Wednesday's press conference.

There are challenges worth monitoring closely but AUD/USD is at 7-month lows, so much of that is surely priced in.China's crackdown on tech stocks is also weighing on the pair.

What's less clear is how strong the response will be in reopening economies. We will get two data points on that question on Friday with the Markit US services index and Canadian retail sales. The latter report is for May but Statistics Canada is also releasing month-ahead estimates, so key on those as June was an important reopening month for much of Canada.Euro awaits ECB Test

Risk trades continued the recovery on Wednesday in impressive fashion. Early in the day the euro and Australian dollar fell to new lows but turned around as New York arrived and finished at the highs. Treasury yields and equities also climbed with US 10s coming just short of the key short-term level of 1.30%.

A number of charts have shown some nice bounces but whether it's a v-shaped bottom, a bounce or the start of a period of consolidation remains very much up for debate.

US initial jobless claims and existing home sales in the day ahead will offer some evidence but the main event is the ECB decision. After the strategy review, it's unlikely there is any meaningful guidance change but Lagarde is under some pressure to offer dovish clues, particularly with delta cases climbing.

The flipside is that virtually everyone is bearish about the euro and Europe. Vaccinations meanwhile continue to rise and there is undoubtedly some pent up demand waiting to be released. If the ECB 'disappoints' by failing to deliver dovish surprise there will be a series of higher lows stretching back to November. That could be something for the bulls to build on.Respite or Reversal?

Buying the dips in risk assets has been the single best trade of the past 20 years and it as no different on Tuesday as a turn in yields helped to unwind some of Monday's fears.

Early in New York trading on Tuesday it looked like another spill could be in store as 10-year yields sank to a five-month low of 1.13% from 1.21% just hours earlier but sentiment shifted with equities recouping all of Monday's drop.

One of the triggers for the initial retreat were declines in US housing starts and building permits. Both were shy of estimates and that was an unwanted negative nudge.

Whether the rebound marks an interim or lasting bottom in sentiment will depend on covid developments. The UK case and hospitalization numbers will be particularly key in the days ahead. There are early positive signs elsewhere with cases in the Netherlands ebbing after the big reopening spike. In hard-hit Indonesia, cases are also leveling off at a high level.

With the market now focused on covid, there will be an ebb and flow in sentiment. A wild card could be a more-cautious turn from central bankers. Any hint at an easier stance will be a green light for commodity currencies, gold and risk trades.

On the technical side, we note the continued breakdown in cable and the possibility of a double top at 1.4250 with a measured target at 1.31. Even in the rebound in sentiment, GBP/USD struggled to get traction. After four days of selling, an inability to muster a stronger bounce on Wednesday would be a poor signal. EURGBP continues to show improving technicals.The Delta Hedge

For the past year, the trade has been to ignore covid and look towards the reopening but now that the US, UK and others are open, the price action is reversing. Perhaps that's the typical 'sell the fact' move with a strong economic recovery already priced in and risks surrounding the Fed and spending creeping in.

What's puzzling is that some of those concerns should have eased last week on a number of strong data points. One of them was Friday's US retail sales report, which showed sales up 0.6% compared to a -0.4% reading expected. Digging deeper, the reopening themes like food services and restaurants were strong, rising another 2.3%.

To be fair, everyone has been scratching their heads since Treasury yields sank in late June. What's staring right back is the virus, which is killing a record number of people in Russia, Indonesia and elsewhere.

In the Netherlands, cases were at 500 per day in late June as they reopened and have exploded to 11,000 per day, which is higher than all-but-a-few days from December. The delta variant is wreaking havoc.

We're sympathetic to arguments about lower hospitalizations and economies adapting to curbs but fear the market is turning its focus to long-term covid worries and the chance possibility it will be endemic but with ever-more dangerous variants emerging. The picture might be a new normal that is further from the old normal we're all hoping for than anticipated.

Moreover, traditional vaccines are losing traction and acceptance. Shares of Moderna have surged in the past week. Hopefully that's a signal of the wonderful potential of MRNA drugs but it can be read as a sign that only MRNA vaccines will be effective against covid and that we will need repeated booster shots.

For now, it remains early to be making judgement calls but the price action is making a more-compelling case by the day.