Euro's Falling Share of Reserve Allocation

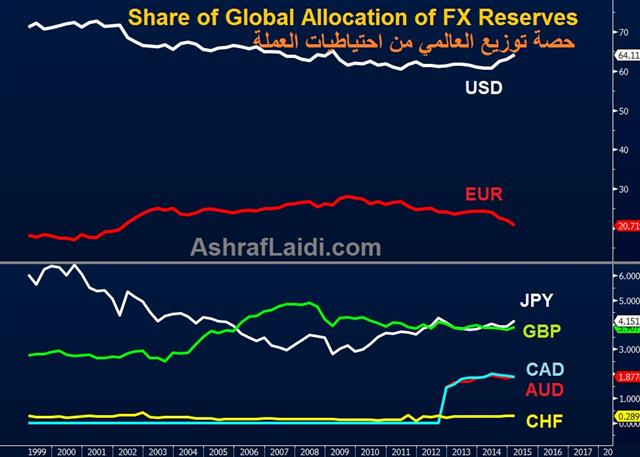

The IMF's latest quarterly FX reserves figures show central banks' euro share of global official currency reserves fell to 22.1% of total official reserve allocation in Q1, the lowest level since 2002. The US dollar's share of disclosed currency holdings rose to 64.1%, the highest since March 2009, which is the peak of the USD's rise during the global financial crisis.

The IMF notes these figures are a reflection of “allocated” reserves, defined as those identified by central banks as their specified currency holdings. There is no disclosure from the People's Bank of China –-the world's biggest holder of FX reserves, nor on the Chinese yuan.

The Role of Valuation

Notably, central bank allocation of foreign exchange reserves is largely determined by the overall change in the value of a currency, which explains the rise in USD allocation from Q3 2014 occurring simultaneously with the gain in the USD bull market during the same period. Similarly, the euro's fall accelerated in mid Q1, which occurred parallel to the decline in reported euro allocation.This also explains the rise in allocation to the Aussie and Canadian dollar in late of 2012-early 2013, in line with the rally in these commodity currencies following the Federal Reserve's renewal of QE.

Allocation to both GBP and JPY remain similar at about 4% of reported allocation. Interestingly, the rise in JPY allocation occurred despite the Bank of Japan's increase of its monthly asset purchases in October 2014. This phenomenon goes in line with the yen's appreciation of recent days during the Greece-triggered losses in global equities, which continues to emerge as a result of unwinding of the oldest carry trade in the FX market.

Latest IMTs

-

3 Qstns for Today's Fed Meeting

by Ashraf Laidi | Dec 10, 2025 15:40

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10