Fast Times at Bitcoin High - Charting the Big 4

Bitcoin rallied more than 22% on Wednesday only to give half of it back in a heartbeat in wild trading. In FX majors, the pound is the highest performer, edging over the Aussie and Kiwi, while the CAD and JPY are the biggest losers. EUR firms after higher than expected (unharmonized) German CPI (1.6% over 14% and harmonized CPI holds at 1.3%). US jobless claims and final Q1 GDP revision is up next, followed by pending home sales.

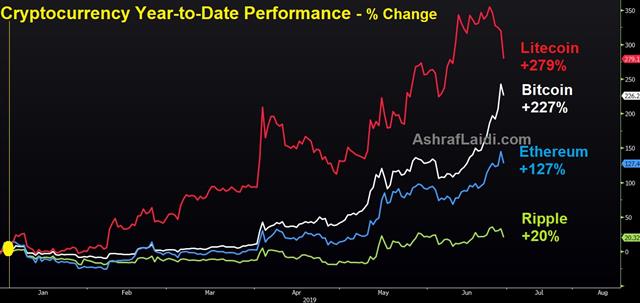

The Facebook move into crypto has sent Bitcoin parabolic in a move that has largely left the rest of the crypto market behind. At its peak on Wednesday it hit $13850 as part of an astonishing virtually one-way move that started in early April at $4000. However a further reminder of the risks came in a drop to $1800 drop in just 11 minutes at the end of the Wall Street trading day.

Technically, the reversal came just above the 61.8% level of the all-time peak to the December low.

Fundamentally, it's once again a market that defies explanation and is characterized by moves that would be unthinkable in most other markets. One notable change this time around is that data shows much of the buying interest is money being swapped into Bitcoin via Ethereum. That suggests it's mostly been fueled by crypto enthusiasts rather than new entrants to the market. If it can recapture the public's imagination, it could soar to new highs.

Elsewhere, US economic data continues to paint a mixed picture. The goods trade deficit missed estimates of a $71.8B deficit and instead expanded to $74.5B, leading to lower GDP estimates. However core durable goods orders were stronger, excluding soft Boeing orders.

Comments from the Fed's Daly planted her as a centrist at the FOMC. She highlighted a tight US labour market but fretted about low inflation and said a cut could bring it back to target. What we're looking for going ahead is an indication of whether they're thinking along the lines of an insurance cut or a cutting cycle. The G20 will hopefully provide some clarity.

Both of the two existing Premium trades are in the green, while the unfilled trade is about to be changed so that it gets filled. Ashraf is highlighing on Twitter Tuesday's trade and the solidity of the technical rationale behind the idea.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final GDP (q/q) [F] | |||

| 3.1% | 3.1% | Jun 27 12:30 | |

| Pending Home Sales (m/m) | |||

| 1.1% | -1.5% | Jun 27 14:00 | |

| Core Durable Goods Orders (m/m) | |||

| 0.3% | 0.1% | -0.1% | Jun 26 12:30 |

Latest IMTs

-

Gold Enters Week 9

by Ashraf Laidi | Oct 13, 2025 10:39

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33