Forget Decoupling

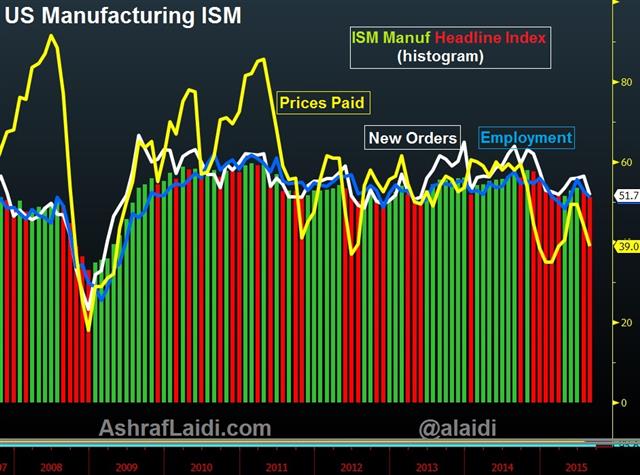

USD under renewed pressure from a combination of renewed China data disappointment, weak US manufacturing ISM and lingering chatter of a September Fed hike. US stock futures began selling off 6 hours before the release of China's manufacturing PMI, which showed the first contraction in six months and the lowest figure in three years. The largely-weaker than expected manufacturing ISM (lowest in 27 months) was accompanied by broader weakness in all components.

We reiterate since December that the Fed will NOT raise rates this year and any rate hike this year will be policy mistake.

The disinflationary impact of USD strength and inevitable depreciation of the Chinese yuan will continue to supress US inflation to the extent of shadowing declines in US jobless rate. Saudi Arabia, a key strategic partner of the US is already suffering from the combination of plunging oil prices, rising budget deficit and having its currency –riyal-tied to a strong USD. Not dissimilar from China FX situation.

We reiterate that the cyclical peak of the US dollar against both the yen and euro is already behind us. USDJPY will not return to the 125.00 yen highs and EURUSD will not return to the $1.0530 lows seen earlier this year.

No Decoupling again

In 2007, it was erroneously & widely predicted by pundits that emerging markets would decouple from G7 and escape the 2008-9 recession. Although BRICS recovered rapidly in 2010-2011, their decline in tandem with US, UK & Eurozone was notable in 2008-9.Today, the decoupling idea is being peddled again, based on US diverging away from China & EM. This will prove wrong again as the combination of trade and capital flows is stronger than ever.

EURUSD: more than just unwinding

While the recent stabilisation in EURUSD has been widely attributed to unwinding of euro shorts linked to escalating risk aversion, don't forget old fashioned fundamentals. The spread on German-US 10-year yields (Germany minus US) continues to improve in tandem with a stabilizing EURUSD rate. The chart below highlights the improving yield spread in favour of the euro, while US core PCE price index (Fed's target) diverges away from the 2.0% target as Eurozone core CPI holds steady at 1.0% --13-month highs.Draghi is back

We expect ECB president Draghi to re-emphasize his dovish stance in Thursday's press conference, subjecting euro to some pressure, especially if the governing council lowers its growth and CPI projections. Any pullback in EURUSD will be assessed ahead of Friday's release of the US August jobs report, expected at 205K from 210K. But take note that out of the last 15 releases of August NFP reports (due on September), 11 reports had negative surprises. And each of the last four August reports have undershot forecasts.| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI Manufacturing | |||

| 51.5 | 51.9 | 51.9 | Sep 01 8:30 |

| PMI Construction (AUG) | |||

| 57.5 | 57.1 | Sep 02 8:30 | |

| Markit Manufacturing PMI (AUG) | |||

| 53.0 | 52.9 | Sep 01 13:45 | |

| ISM Manufacturing PMI | |||

| 51.1 | 52.6 | 52.7 | Sep 01 14:00 |

| PMI (AUG) | |||

| 49.7 | 49.7 | 50.0 | Sep 01 1:00 |

| PMI (AUG) | |||

| 53.4 | 53.9 | Sep 01 1:00 | |

| PMI (AUG) | |||

| 51.5 | 53.9 | 53.8 | Sep 01 1:45 |

| PMI (AUG) | |||

| 47.3 | 47.2 | 47.1 | Sep 01 1:45 |

| Eurozone Spanish PMI Manufacturing | |||

| 53.2 | 53.9 | 53.6 | Sep 01 7:15 |

| Eurozone Markit PMI Manufacturing (AUG) | |||

| 52.3 | 52.4 | 52.4 | Sep 01 8:00 |

| Germany Markit PMI Manufacturing (AUG) | |||

| 53.3 | 53.2 | 53.2 | Sep 01 7:55 |

Latest IMTs

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58

-

4890 Hit, Now What?

by Ashraf Laidi | Jan 21, 2026 11:34