G20 Countdown & Fed Optionality

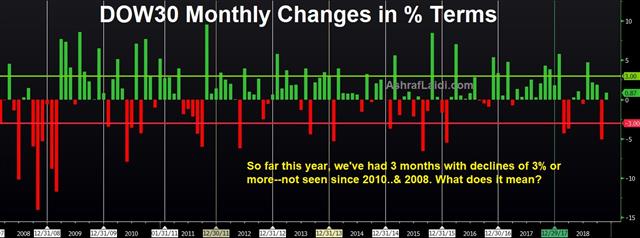

The Fed Minutes had something for everyone on Thursday while the euro shrugged off German CPI and dovish ECB comments and was the top performer. But all changed today amid month-end flows and a decline in Eurozone CPI to 2.0%, sending the US dollar higher against all currencies. The G20 begins on Friday in what could be a turning point for markets. A new Premium index trade was posted on Thursday evening, whose rationale is supported by 2 charts and key bullet points. When I asked Ashraf if it's a risk to leave the trade open into the weekend-G20, he said that's the point. The question posed in the chart below has crucial implications for next year. Stay tuned.

Fed gets into Optionality

The FOMC Minutes usually have a little something for everyone and Thursday's edition was no different. The hawks will note that almost all officials saw gradual hikes as consistent with Fed goals while the doves will highlight that many said it would soon be appropriate to put a greater emphasis on incoming data. More importantly, the minutes revealed members are working on optionality -- Altering the statement in a way that would facilitate them opting for a new course. Said differently, they are discussing whether to change language in the policy statement about the need for “further gradual” rate hikes.The US dollar didn't react to the Minutes but slipped earlier on Thursday as US PCE inflation missed targets and initial jobless claims rose to the highest since November 2017. Oil rebounded 2% on the day on a report that Russian oil companies are willing to cut output.

G20 or G2?

It's called the G20 but all eyes are on the G2 (US and CHina). Most markets were little moved on the day as we brace for the G20 meeting and month-end. Trump left for Buenos Aires with a mixed message. He said he was close to doing something on trade with China but that “frankly, I like the deal we have right now.” He also touted the revenue from the tariffs.The meeting with Xi is on Saturday so the risk of gaps into next week is substantial.

The question is: What's priced in? There is no reasonable expectation of a deal. China's goal is likely to run out the clock on Trump by making the minimum concession possible while avoiding an escalation in tariffs. That's a good baseline for what markets are looking for as well. The problem is that Trump's team has sniffed out that strategy. The WSJ reported that there's a deal on the table to lift some Chinese sanctions in exchange for no tariffs until May but it was highly uncertain if the US would accept it.

Elsewhere, German CPI was slightly below estimates. ECB Governing Council member Hernandez also said the eurozone economy was slowing more than expected. Impressively, the euro added to gains after Wednesday bullish reversal.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI Flash Estimate (y/y) | |||

| 2.0% | 2.1% | 2.2% | Nov 30 10:00 |

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55