Gold Cheers Global Central Bank Raid

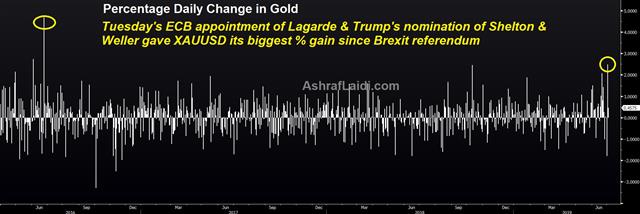

The politicization of major central banks reached a new level to the benefit of gold as European leaders made a surprise announcement to nominate IMF leader Christine Lagarde to lead the ECB, while Trump nominated Weller and Shelton to the Federal Reserve Board (both favouring easy monetary policy). This gave gold its biggest % gain since the Brexit referendum (more here). The pound remains weak across the board after BoE Governor Carney highlighted increasing downside risks in a further sign of a global easing cycle. US ADP disappointed with 102K vs exp 140k, US trade deficit widened to $55 bn and jobless claims fell by 8K. We turn to the key services ISM at the top of the hour ahead of Thursday's Independence Day Holiday and Friday's US jobs report. The events of late Tuesday in metals helped answer several subscribers' questions on why Ashraf went long silver on Monday.

Carney's comments echoed Powell's and Draghi's warning about trade risks and make it increasingly likely that we're in a global easing cycle. Gold responded with a $30 rise while the pound slumped to the lowest since June 18, taking out the 61.8% retracement of the June rally in the process.

In the bigger picture, the market has given back most of the Trump-Xi truce bounce. US Treasury yields are fractionally above cycle lows, oil sank 5% and USD/JPY has completely given up the week-opening bounce. Part of that is the US announcing fresh tariffs on Europe. The new action covers a relatively small $4B in goods but it's a sign of what's to come. Meanwhile, bond yields around the pursue their collapse.

Another sign of what's to come is increasing politicization of central banks. Europe didn't do itself any favors on that front by nominating France's former finance minister to lead the central bank. Those criticisms could make her less-inclined to push the monetary policy envelop if/when the time comes for more Eurozone easing. It will also make the central bank an increasing lightning rod within and outside of the eurozone.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Challenger Job Cuts (y/y) | |||

| 85.9% | Jul 03 11:30 | ||

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55