Golden View From the Mountain Top

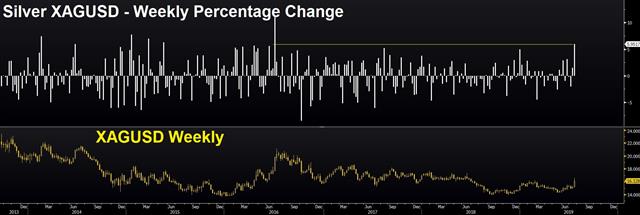

Ashraf released a revealing poll on Thursday, it asks what you would do if forced to make three trades before the end of the month. See below about the insurance rate cut topic. I choose gold longs as one because even if the Fed cuts 25 bps and doesn't offer any clear guidance going forward, there is still a tailwind in gold that will blow for years. Comments from key FOMC members opened the door for a 50-bp rate cut in addition to Trump's announcement of US striking an Iranian drone approaching a US ship near the Strait of Hormuz-- caused the US dollar to post its biggest decline in nearly four weeks and gave silver its fastest increase in over six months. So what's next. Our 3 of USD Premium trades, 2 metals and 1 index trade are in progress and all in the the money.

25 bps or 50 bps?

NY Fed's John Williams sent markets on a ride after comment suggesting the Fed should act more aggressively on the dovish side to beat back low inflation expectations. Also weighing on the USD were remarks from Richard Clarida, the vice president of the Federal Reserve, that: "recent global economic data have been softer than expected. We've had mixed data, but I do think the global data has been disappointing on the downside. Disinflationary pressures, if anything, are more intense than I thought six weeks ago.”Insurance Cut?

Another essential question is whether a rate cut this month will be an 'insurance' cut or the start of a cycle. I don't expect we'll get the answer this month because the Fed would want to see more data before making a decision in September or later in the year. Ashraf reminds us that the only time the Fed carried out an insurance easing was in autumn 1998, when it made 3 rate cuts of 25-bps each to stem the liquidity and confidence crisis of LTCM collapse and EM crisis. Every other rate cut over the last 30 years was the start of a protracted campaign.Both questions are relevant, but what's lost is that by cutting rates (25 or 50 bps), the Fed has essentially capped rates, confirming that the 2.25%-2.50% range shall be the top of the mountain for years.

So whether a big global slowdown comes now or later, the path of rates is eventually lower and it almost certainly ends in more QE, bigger deficits, more negative yielding bonds, more political instability and a high likelihood of a currency war. When that comes, it's a screaming buy for gold.

From a trading perspective, the timing is important but there is a positive technical setup as well. Last month, gold broke above the major $1380/$1400 zone and on Friday it climbed to a fresh six-year high.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55