Lessons as the Flash Crash Fades

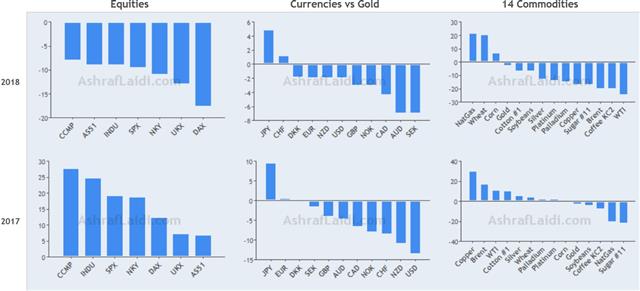

Last week's flash crash in currencies and subsequent recovery offers some valuable lessons about unusual market moves. The Swiss franc was the top performer while the yen lagged on Monday. Today, the US dollar is mostly bid in a day light on data. This morning's release of the US trade balance report has been delayed because of the continued government shutdown. The Dow30 long entered late last week is 650 points in the green and remains in progress.

More to Come

We fear that flash crashes like the one triggered by yen crosses last week will be more-frequent in the future so it's worth keeping in mind the lessons. But what are the lessons? In the the sterling crash of October 2016, the slide was a sign of a complete breakdown, helped by ultra thin liquidity. It came after many days of heavy selling and, importantly, the decline continued even after the crash abated.Aussie Reversal

Last week's episode bears some similarities. AUD/JPY, for instance, had been sold for many days and all they crosses were at least at medium term lows. Yet this time the selling hasn't onlly stopped, but the price has reversed sharply, especially in Aussie crosses. AUD/JPY has nearly completely retraced the losses and other pairs have also rebounded or are close to doing so.The yen crosses could easily track back lower but anyone who sold the drop is currently underwater. So what's the lesson? The main one should be the conditions before the crash and to stay on guard against consistently falling assets that are nearing extreme lows or technical support. Another is be extra vigilant in the quiet trading zone after the US close (17:00-19:00 Eastern, 22:00-Midnight GMT)

As for the direction after a crash, as long as fundamentals are behind the move, the price action shall prevail. In the GBP edition, nothing was changing and Brexit continue to loom. There was no scope for good news. Therefore, beware as we approach next week's Brexit vote in Parliament.

In this edition, the reversal was helped by coordinated action from the Fed, PBOC, White House and BOJ, especially with Powell signalling a pause in rate hikes as did Yellen in early 2016, which helped booost stocks in the 1st half of that year. Such are crucial reasons for the rebound. That said, negative developments could unwind the positivity quickly.

Looking ahead, the November US trader balance report is delayed because of the government shutdown. The report would have been particularly valuable given the ongoing US-China trade talks. We may be able to glean a sense of the US trade balance from data from partners, including Canada which releases its trade report Tuesday.

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33