Macron Burns Sceptics by 36% Margin

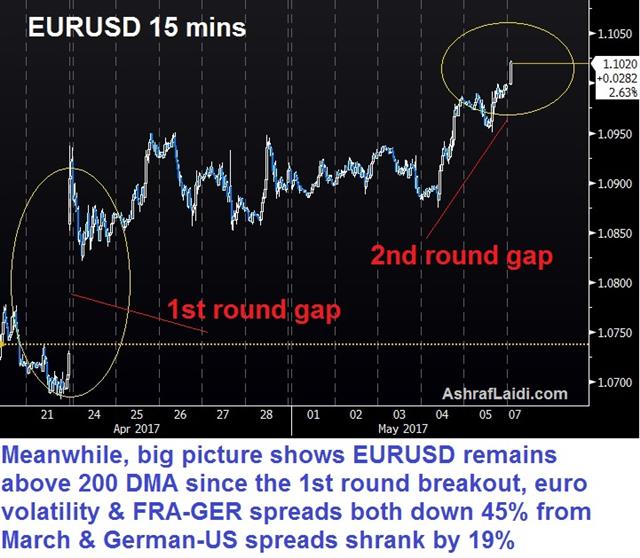

France elected Emmanuel Macron President with a larger-than-anticipated margin on Sunday and the euro opened above 1.1000. The euro was also the best performer last week while the yen lagged. CFTC positions showed narrowing GBP shorts. After closing our EURUSD long at a profit on Friday, we opened a new long ahead of today's elections, while sticking with the cable long from 2 weeks ago.

With most votes counted, Macron leads the election with more than 64% compared to 36% for Le Pen. His victory underscores how markets and many commentators failed to understand France. It's also a reminder that while the political sands are shifting globally, the regional differences are profound.

His win was no surprise although email leaks late Friday added some angst. There was always the minute risk of a shock win for Le Pen but more than anything, the reason for the small euro climb at the open was that the margin of victory exceeded the 60-40% anticipated.

At times like this, markets often focus on the message from the incoming President but we believe Le Pen's comments are more profound. She said her party must reinvent itself and there is talk that will start with a new name. But more important was a hint of what's to come from her father, who was the former partly leader. He said her message was undermined by threats to quit the euro and EU.

If he's right (and if he's reading the political mood correctly) then populist voices across Europe might begin to redirect their energy away from the euro and more towards immigration or economic nationalism. That will leave the currency far less vulnerable in future elections. In the short term, it's a better potential reason to buy the euro than Macron's win alone.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -2K vs -21K prior GBP -81K vs -91K prior JPY -23 vs -27K prior CHF -18K vs -17K prior CAD -48K vs -43K prior AUD +43K vs +43K prior NZD -12K vs -15K prior

The market continued to pile into Canadian shorts through Tuesday but the sharp retracement on Friday and bounce in oil prices showed the danger of joining in a crowded trade. Meanwhile, the exodus from cable shorts continues as it flirts with 1.30.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55