More Injections & Brexit Chatter

The Fed injected another liquidity operation, in what still known as a "temporary" measure aimed normalizing liqudity shortage in the short-term funding market. Upbeat comments from the EU's Juncker sent the pound to 6-week highs on Thursday. The Swiss franc remains the top performer Comments from the Fed's Williams and Rosengren are due up next.

تحديث فني و استراتيجي لصفقاتنا (فيديو للمشتركين)

EU Commission leader Juncker said he sent documents to Boris Johnson outlining draft ideas for a new Brexit deal. The Irish border backstop remains the main hurdle and European leaders are waiting on the UK Prime Minister for fresh ideas.

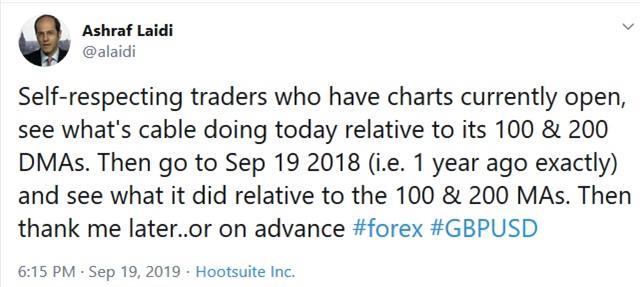

Along with that, Jucker expressed openness about making a deal and warned about the consequences of a no-deal Brexit. The uncertainty alone has been enough to encourage the crowded short-GBP trade to cover. That continued on Thursday as cable rallied to 1.2580 – the highest since July 14. Ashraf made the following observation fegarding GBP and RSI analog between today and exactly 365 days ago.

Equally important to note is how the pound has been able to hold its ground on occasional negative Brexit headlines over the past week. It's an impressive turn in sentiment and a complete reversal from the sour tone of June and July.

Elsewhere, US housing may be demonstrating the power of lower rates. August existing home sales rose 1.3% in the month compared to a 0.7% decline expected. It was the largest one-month gain in two years and follows a trend set by other recent housing indicators. Another month of strong data may give the Fed pause about cutting rates.

With regards to the Fed's latest liquidity injections, it seems inevitable that more injections are due next week when the US Treasury issues a fresh $45 bn in funding. This would prove to be an extra drain of liquidity, which will trigger fresh palpitations in the system, especially as we near quarter-end. Ashraf tells me the Fed has little choice but to formalize a process of systematic balance sheet accumulation.

In other economic news, the Philly Fed was slightly stronger at +12.0 vs +10.5 expected and Canadian ADP employment rose 49.3K (no estimate).

There were signs that China-US trade is creating fresh jitters. A hawkish interview from a White House China advisor in the South China Morning Post erased an early positive tone in US equity markets. With Chinese officials in Washington at the moment, risks are high now and into the weekend.

Economic data and news will be another important spot to watch. The Fed's Rosengren is expected to speak after his dissent and Williams has a speech scheduled as well. We would be reluctant to read anything into comments that weren't from Powell or a core governor but the market is jittery and may think otherwise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| -0.1% | 0.2% | 0.9% | Sep 20 12:30 |

| FOMC's Rosengren Speaks | |||

| Sep 20 15:20 | |||

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55