More Twists & Turns Pre Trade Talks

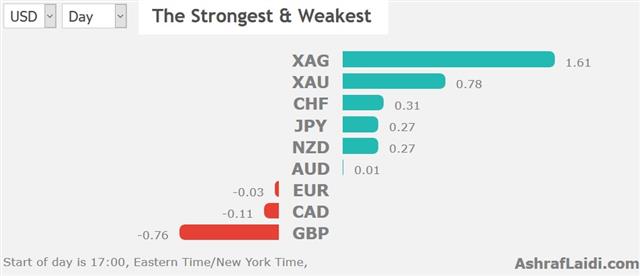

Just as China appeared not to be interested in the type of comprehensive trade deal that Trump wants, matters got worse for indices on re-emerging reports that the White House is studying proposals to limit US govt pension investments in Chinese stocks. A similar story was denied late last month, but seems to be making the round again. GBP is the worst peformer on mixed reports indicating the UK govt was readying for a no-deal Brexit. A new Premium trade has been issued moments ago. Markets await comments from Fed chair Powell later this evening.

Several reports at the start of the week indicated that China won't even discuss some of the issues the US is demanding like industrial subsidies and IP theft. That puts us back towards something akin to buying soybeans in exchange for lifting tariffs.

Last month, Trump said he wanted a comprehensive deal or nothing but on Monday he softened the tone, saying he would prefer a big trade deal. That difference could be splitting hairs as Trump isn't fond of subtlety and we're now at the point where a wait-and-see strategy beats jumping the gun on every headline.

The market was whipsawed Monday after a Fox Business report saying China was open to a smaller trade deal. That boosted risk trades but they later reversed when the report added that China wouldn't negotiate on IP.

Looking ahead, Fed chairman Jay Powell has an opportunity to manage rate cut expectations at an event at 14:30 Eastern (19:30 London) in Denver. There is a prepared text and Q&A so there will be plenty of opportunity for market moving headlines. At the same time, Powell will surely want to avoid tipping his hat before US-China trade talks conclude. The Fed funds futures market is currently pricing in a 71% chance of a cut on Oct 31 but that will swing about 30 percentage points depending on the results of trade talks.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Evans Speaks | |||

| Oct 08 17:35 | |||

| Fed Chair Powell Speaks | |||

| Oct 08 17:50 | |||

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55