NZD, Impeachment Show Sign of Life

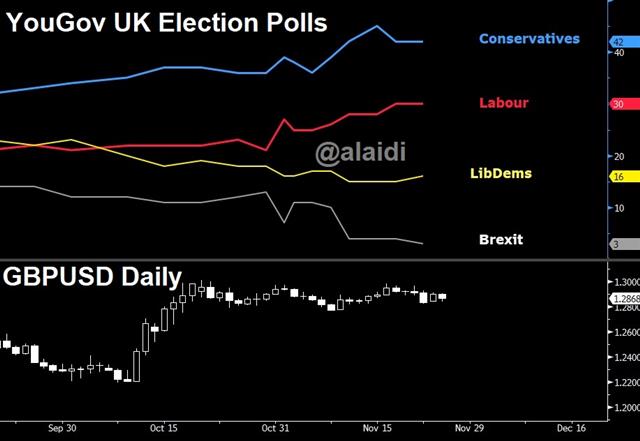

A strong Q3 retail sales report underpinned the RBNZ's shift to the sidelines and the potential upside for the currency. The pound gives up half of Monday's gains as various polls show a slight shrinkage in Tories' lead (see chart below). US new home sales rose in Oct showing the best 2 months in over 12 years, while consumer confidence fell for the 4th straight month despite US indices hitting new highs on 3 straight monthly gains. US-China trade talks took a backseat to developments in the Trump impeachment investigation after a US federal judge ruled that White House staff can be made to testify before Congress, rejecting the Trump administration's claims of immunity.

ماذا حدث لإشارة بيع السوق؟ (فيديو المشتركين)

New Zealand Q3 retail sales rose 1.6% excluding inflation, a far faster pace than the 0.5% climb expected. In the bigger picture, the news underpins the modest rally in the kiwi since October and the potential for a major long-term double bottom at 0.62.

It's still early days, but the RBNZ has signaled that it's done cutting for now and if trade tensions cool, and the global economy turns higher, the kiwi is particularly well-positioned. Moreover, the risk-reward is tilted to the upside. There's even the possibility of an inverse H&S on NZDUZD.

In the bigger macro picture, the market continues to wait on US-China news. Risk trades rallied, yen crosses climbed and US stocks hit fresh records Monday after China moved to strengthen IP protection and a report suggested that the broad outline of a phase one deal is in place.

Monday's rally in the pound came after the release of the Conservative manifesto but there is some reason for caution. A poll Monday showed the Tory lead over Labour down to +7. It led to a wobble in the pound and could be a one-off but if a second or third poll shows the same thing, expect GBP weakness.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (q/q) | |||

| 1.8% | 0.6% | 0.3% | Nov 25 21:45 |

Latest IMTs

-

Dollar Cannot Wait for Q1 to End

by Ashraf Laidi | Jan 6, 2026 12:40

-

Silver's Signal to Gold Full Explanation

by Ashraf Laidi | Dec 30, 2025 20:04

-

Gold Silver Next الذهب و الفضة

by Ashraf Laidi | Dec 26, 2025 17:15

-

Everyone's Talking about this Risk

by Ashraf Laidi | Dec 24, 2025 14:08

-

2026 Difficult but not Impossible

by Ashraf Laidi | Dec 22, 2025 20:06