OPEC Cuts 10 Cuts Deep, Oil Unimpressed

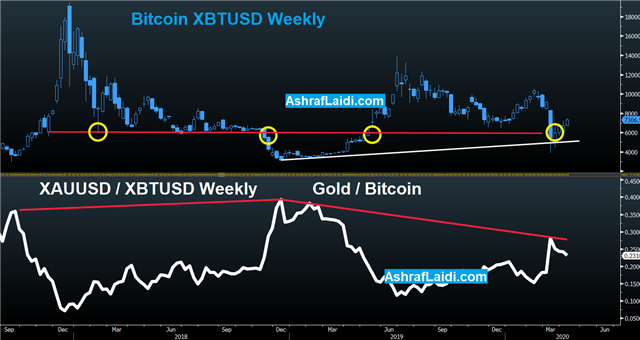

A few developments have occured last night since OPEC+ pledged to cut crude production by 10 million barrels per day starting in May as part of a global effort to balance the market. Mexico said it will not go with the cuts, before some OPEC members responded the deal will not go without Mexico. The Fed added $2.3 trillion in lending programs on a day when US jobless claims rose by another 6 million, accumulating to +16 million jobless in 3 weeks. The dollar lagged while AUD led the way. The Premium Insights' gold long hits its final 1690 target from the long 1540 entry. The chart below lays out Bitcoin's performance relative to gold ahead of next month's anticipated halving. The Premium Insight currently have a long on Bitcoin from 6200.

The war within OPEC ended Thursday as Russia and the group all pledged to lower production by 10 mbpd from April levels. Importantly, that cut includes the extra supply that's in the market this month, so it's not 10 mbps from Q1 levels. The deal is just for May and June but there is a tentative plan to cut from June to year end by 8 mbpd and 6 mbpd from Jan to April 2022.

The moves will go some ways towards balancing the oil market but the reaction in crude was telling. It peaked on the day at $28.36 on chatter about a 20 mbpd cut then fell to $23.19 to close near the lows of the day.

OPEC is looking for non-members to pledge to cut another 5 mbpd and the G20 will be tasked with that Friday. As always with the G20, commitments are soft.

In any case, the market remains easily oversupplied by 20 mbpd and more-likely 30 mbpd, so it will fall on the private market to do the rest – voluntarily or otherwise. There is no clearing price for crude once storage is full and there was a report Thursday of 25 oil tankers floating offshore in Europe. They had been expected to deliver crude but were asked to wait because refineries don't have anywhere to put it.

Political vs Economic Supply Action

Ultimately, this looks like a great political move that will shield OPEC and Russia from further criticism. They cut by 22% and until the rest of the world does the same, oil price are now their problem. It is important at this juncture to distinguish between political and ecomomic supply cuts. Cutting supplies for the purpose of reaching consensus and good faith, rathern than actual boosting of price.In the US, the huge jump in jobless claims was overshadowed by a series of new Fed programs, including one that will buy junk debt and another that will offer four year loans at 2.5-4% for 'main street' firms with less than 10,000 employees and $2.5B in annual revenue. The announcement gave a small lift to risk trades but was a big anchor on the dollar.

Gold rose $35 to $1684 and is now within easy striking distance of the March high. It also may have carved out an inverse head-and-shoulders pattern.

The EU also tentatively revealed a coronabond program. Without getting into the details, the takeaway is that government and central bank programs have crossed some new and extreme thresholds and that broad currency debasement is slowly becoming a reality.

Latest IMTs

-

Only One Stock سهم واحد فقط

by Ashraf Laidi | Dec 16, 2025 19:58

-

Gold During Recessions & Bear Markets

by Ashraf Laidi | Dec 13, 2025 12:29

-

AAOI & the Fed

by Ashraf Laidi | Dec 11, 2025 19:22

-

3 Qstns for Today's Fed Meeting

by Ashraf Laidi | Dec 10, 2025 15:40

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42