Point of No Return?

Markets are firmly in the green after Trump stated China wants to "make a deal" but no confirmation of such remarks emerged from China, except for the standard statement from Chinese Premier Liu that China opposes escalation and is willing to talk in a calm manner. Is that enough? The latest round of tariffs illustrates that there is no longer a way to de-escalate the trade war. Markets kicked off the week with cycle extremes in yields, gold and some yen crosses. CFTC positioning showed a growing divergence between low yielders. The Dow short Premium trade issued last Monday hit its final target for 900-pt gain while EURJPY was stopped out. There is currently one trade open.

Does the dramatic escalation in trade war rhetoric seen on Friday along with subsequent comments underscore that we've crossed the point of no return? Both sides are now fully politically invested in 'winning' the trade war, rather than working towards a deal.

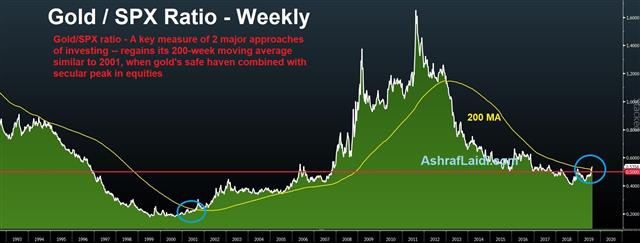

At best, this is the start of a long stalemate that eventually fizzles out with a new US administration. At worst, the nations are headed towards a full decouple in something akin to a new cold war. At stake is the global economy (not just stocks), but markets are already placing bets. Treasury yields opened the new week lower with the 10-year plunging to 1.44%. At the extremes, gold jumped $30 to $1555, a fresh six-year high. AUD/JPY briefly broke 70.00 for the first time since 2009.

There will be undoubtedly be an ebb and flow of economic data and sentiment. The yuan fixing wasn't as low as feared to start the week at 7.0570 compared to the offshore measure at 7.1926.

US Consumers - At what Point?

Figuring out whether the Fed will cut rates deeper shall depend on when will Powell detect credible signs of a danger to the US consumer. US autos have been hit, farmers have been damaged, so when will the US growth engine be next? There are no levers to pull that can cushion the blow to global growth from the trade war but after monetary policy reaches the limit then currency intervention will be in play. The months ahead will be harrowing.CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -38K vs -47K prior GBP -92K vs -96K prior JPY +31K vs +25K prior CHF -11K vs -13K prior CAD +13K vs +14K prior AUD -63K vs -63K prior NZD -18K vs -13K prior

The lack of interest in the Swiss franc even as money pours into the yen is increasingly curious. It highlights a market that's unwilling to fight the SNB – at least for now.

Latest IMTs

-

Of Gold Extensions مقياس إمتدادات الذهب

by Ashraf Laidi | Apr 15, 2024 16:38

-

Bitcoin performance & Miners Prehalving

by Ashraf Laidi | Apr 9, 2024 17:07

-

English Translation to Arabic Interview

by Ashraf Laidi | Apr 7, 2024 21:01

-

فشل الفدرالي في إقناع الأسواق

by Ashraf Laidi | Apr 6, 2024 14:17

-

Typical Errors on Gold, Silver, USD

by Ashraf Laidi | Apr 1, 2024 16:14