Poloz Punts, USD Loses Grip

USD struggling to preserve its earlier gains of the day after some data disappointments (see below). Before we preview today's key speech from Bank of England's Andy Haldane (14:30 London), let's cover overnight speech by Bank of Canada's Poloz. The market initially interpreted comments from BOC Governor Poloz as dovish but he offered reason to think otherwise at a later press conference. The US dollar was the top performer and the New Zealand dollar lagged and touched a one-year low after the RBNZ decision to hold rates unchanged. A new index trade has been issued for Premium trades based on the same system as the last 2 trades.

A speech from BOC Governor Poloz was the highlight of the day and USD/CAD was held near 1.3300 in anticipation, despite another jump in oil prices and a broad rise in the US dollar. The talk was his last opportunity to clarify the outlook ahead of the July 11 decision.

After he spoke, the odds of a hike initially fell to 50% from 60%. The comments were mostly focused on BoC communication style and there wasn't much on the upcoming decision, but he did highlight a series of downside risks which will 'figure prominently' in deliberations. That's what sparked a rally to 1.3380 from 1.3310.

However, Poloz hosted a press conference later with a different tone. He said the BOC's narrative of growth and gradual hikes appears to be correct and that “one data point” below expectations – presumably retail sales – won't throw them off course. He also said the BOC won't consider trade hypotheticals in its decision.

All told, there was the clear impression that Poloz hadn't yet made up his mind on what's coming July 11 and that he's fine with the market unsure about what will happen. If anything, he endorsed that kind of volatility as a good thing.

Overall, he seemed to be leaning towards hiking. His final comments were much more explicit and that was reflected in a USD/CAD dip back to 1.3329. With some time to digest, it could fall even further but that might depend on how the USD dollar develops next.

USD is struggling to hold on to its earlier gains of the day after downward revision in US Q1 GDP to 2.0% from 2.2% and a 9K rise in US jobless claims.The USD was boosted on Wednesday by a smaller goods trade deficit and a large upward revision to April core durable goods orders. That sent the euro and pound within striking distance of the June lows.

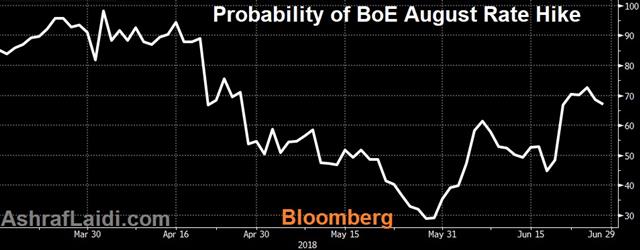

BoE's Haldane speech at 14:30 London will be crucial in swaying expectations of an August rate hike following his surprising vote in favour of a rate at last week's meeting. Odds of an August rate hike aere at 67% compared to 73% last week and 45% two weeks ago. GBPUSD is testing key support at 1.3050, while EURGBP broke above its 200-DMA for the first time in 4 months.

Elsewhere, the RNBZ held rates at 1.75%, as expected. The statement once again had a nod to possibly moving rates up or down and also highlighted trade tensions. Most of the weakness in NZD/USD came before the meeting in a broad-USD bid but the statement caused the break of a double bottom near 0.6800 and a fall as low as 0.6784 before a quick rebound. Technically, it will be a critical chart to watch on the weekly close.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bostic Speaks | |||

| Jun 28 16:00 | |||

| Core Durable Goods Orders (m/m) | |||

| -0.3% | 0.5% | 1.9% | Jun 27 12:30 |

Latest IMTs

-

EURGBP Eyes 8920

by Ashraf Laidi | Dec 17, 2025 19:31

-

Only One Stock سهم واحد فقط

by Ashraf Laidi | Dec 16, 2025 19:58

-

Gold During Recessions & Bear Markets

by Ashraf Laidi | Dec 13, 2025 12:29

-

AAOI & the Fed

by Ashraf Laidi | Dec 11, 2025 19:22

-

3 Qstns for Today's Fed Meeting

by Ashraf Laidi | Dec 10, 2025 15:40