Risk Trades Calling Powell

Global equity indices are stabilising following Monday's 2% declines. Overnight, the S&P 500 touched below the February lows on fresh economic worries. Interestingly, The US dollar was among the big currency losers despite the stocks selloff with yen and gold rallying across the board. CFTC positioning showed yen shorts trimmed. The Dow30 Premium short was stopped out, forcing us to answer whether 22,000 or 25,000 ? Ashraf has issued a new Premium video highlighting the striking developments between the DOW30 and S&P500 to make his argument for the Fed outcome and upcoming Premium trades on FX and indices.

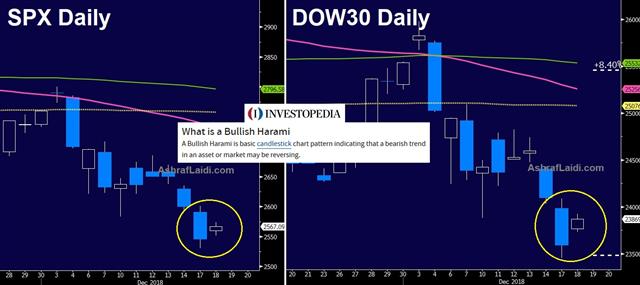

The S&P 500 hit the lowest since October 2017 in a 2.1% decline Monday. The selling came as a flood midway through the day after the index had been flat.The S&P500 broke below its 100-WMA, while DOW30 held above its 100-WMA. Both indices are down 13% from their autumn highs.

Reasons for worry included economic data. The Empire Fed fell to 10.9 from 20.0 which is the lowest since May 2017. Worse was the NAHB housing market index as it sank to 56 compared to 61 expected; two months ago it was at 67.

USD/JPY skidded to 112.25 from 113.30 as the pain ratcheted up in markets. Still, the pain in FX and bonds wasn't at the level of stocks, where the weakness is likely exacerbated by fund redemptions and year-end flows.

Technically, the bigger breakdown than stocks may have been oil. WTI had been trying to form a bottom above $50 but it fell 4% Monday to $49.13 and that leaves little support until $42.05.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. This week's report was delayed because of the US holiday.EUR -56K vs -61K prior GBP -42K vs -40K prior JPY -98K vs -110K prior CHF -18K vs -20K prior CAD -12K vs -13K prior AUD -46K vs -51K prior NZD -15K vs -21K prior

The moves were modest with the general theme a paring of US dollar longs. That could reflect position squaring ahead of year-end or of worries about the Fed. Overall, the market is still heavily long US dollar even against risk proxies like CHF and JPY.

Ashraf Tells me about the Bullish Harami

| Act | Exp | Prev | GMT |

|---|---|---|---|

| NAHB Housing Market Index | |||

| 56 | 61 | 60 | Dec 17 15:00 |

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55