Shale & Powell Resistance Eyed

USD is up across the board, while GBP is at new 2019 lows on fears of no-deal Brexit despite the strongest rise in UK earnings/pay in over 11 years. An important US data report is due shortly, followed by several Fed speakers including Powell (see below). Will Powell's speech present new resistance to the US dollar as it did last week (as is Shale doing to oil)? The rise of US shale has changed all the rules for crude oil and trading around hurricanes is no exception. CFTC data showed an increasingly crowded GBP trade. Two new Premium trades are set to be issued this week.

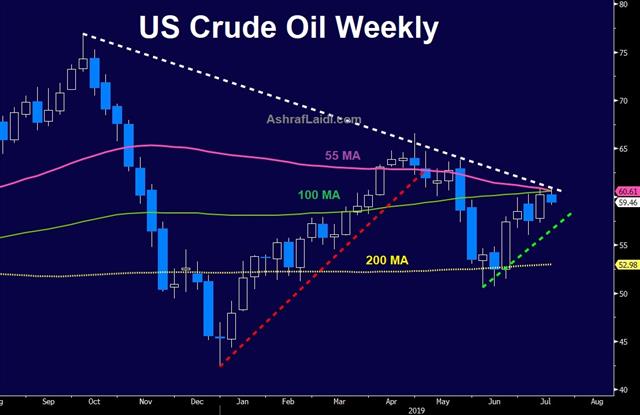

WTI crude rose to the highest since late-May last week as it climbed above $60. There was some concern heading into the weekend with Hurricane Barry threatening the Gulf coast. It ultimately made landfall as a Category 1 stor and underperformed most forecasts.

The start of hurricane season is a fresh reminder that old rules for US crude may not apply. A decade ago, the US imported roughly 5 million barrels per day of crude via the Gulf coast that meant that any disruption due to storms would leave the market undersupplied and prices would rise.

But due to the shale revolution, Gulf net exports are now roughly zero. That could leave gluts points and drive down prices, especially if refineries are forced to close. At the same time, there will still be offshore production shutdowns so global supply could be curbed, but the mechanics are no longer nearly as straightforward as they once were and the trade is often to fade any storm-related spikes.

Retail Sales, Powell et al

Looking ahead, Tuesday's release of US June retail sales (control group) is expected to show a 0.3% rise from a downward revised 0.4%. Fed Vice chair Bowman speaks 15 mins before retail sales, followed by Fed Chair Powell in Paris at 13:00 Eastern (18:00 London). Chicago Fed's Evans will speak 2.5 hr later.CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -36K vs -31K prior GBP -73K vs -64K prior JPY -4K vs -1K prior CHF -10K vs -11K prior CAD +9K vs +6K prior AUD -54K vs -58K prior NZD -22K vs -24K prior

The general theme over the past few weeks is US dollar longs headed to the sidelines but that's not the case in cable as specs bet that whatever is troubling the US will be overshadowed by relentless Brexit uncertainty.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bowman Speaks | |||

| Jul 16 12:15 | |||

| Fed Chair Powell Speaks | |||

| Jul 16 17:00 | |||

| FOMC's Evans Speaks | |||

| Jul 16 19:30 | |||

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55