Testing Support on Trade War Fire, BoC Next

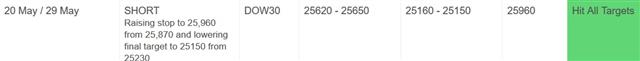

China has entered into a war of words that makes a quick resolution to the trade war less likely. This includes a report that Beijing may restrict the exports of its rare earths as a retaliation to the US. (more on this below). The Bank of Canada decision is up next. The short DOW30 Premium trade hit its final 25150 target, realizing 470 pts of gains. A new trade was issued at the start of the London session and is already 60 pts in the green.

A report in the South China Morning Post emphasized that the US side “kept adding new demands in the late stages of the negotiations”, including a demand requiring that China completely open its internet and change its laws to allow unilateral US sanctions.

We have no idea if that's true or if the leaked US version is true. What's important here is that China has entered into the war of words and propaganda. Before this, China had kept a lid on leaks and the domestic press. This aim of this move is at least party to harden domestic opposition to the US and that points to a willingness (or at least a bluff) that it's prepared for a long battle.

Rare Eaths Threat

Although China has retaliated with tariffs on $60bn of its imports from the US on every day merchandise such as eletronics and foodstuffs, newspapers reports are signalling a possible move towards limiting the sale of rare earths. This would be a serious blow to the US, which relies on China for about 80% of its rare-earth imports. China makes up more than 2/3 of the world's rare earths production. Rare earths is crucial in making smatphones and laptops faster and lighter and Apple is widely dependent on rare earths.US equity markets started the day in a positive mood after the long weekend but the bond market saw through it. Yields fell 4-5 bps across the curve and the 10-year is now just above the lower Fed funds band at 2.22%. The further inversion of the yield curve is a bright-red flag. Keep an eye on 2777, which is the 200-DMA of S&P500

Looking ahead, central bankers have to navigate these challenges. The BOC is up next and will undoubtedly hold rates, despite months of very strong domestic data and a resolution on metals tariffs. Expect Poloz to hike growth forecasts but continue to insist on patience to do low inflation and trade worries.

Latest IMTs

-

Everyone's Talking about this Risk

by Ashraf Laidi | Dec 24, 2025 14:08

-

2026 Difficult but not Impossible

by Ashraf Laidi | Dec 22, 2025 20:06

-

Bank of Japan Massacre or Yawn?

by Ashraf Laidi | Dec 18, 2025 20:50

-

EURGBP Eyes 8920

by Ashraf Laidi | Dec 17, 2025 19:31

-

Only One Stock سهم واحد فقط

by Ashraf Laidi | Dec 16, 2025 19:58