Sterling's 180° Turn

Is it finally catching up with GBP? The British pound defied gravity during most of the week, shrugging disappointing figures on inflation, retail sales and the CBI trend survey. A somewhat hawkish speech by BoE MPC member Ben Broadbent on Wednesday may have been among the causes behind the gains. The pound even managed to rally against the US dollar on Tuesday and Wednesday ahead of an expectedly hawkish set of FOMC minutes. Eventually, GBP saw the peak on Thursday evening with GBPUSD giving up at the near confluence of the 55-DMA and 200-DMAs at $1.5312 and $1.5336. Unfortunately, our short GBPUSD trade in the Premium Insights (opened on Nov 6) was stopped out at $1.5330, only 6 pips below the high of the week. After that, GBPUSD shed 1.5 cent to settle near $1.5200.

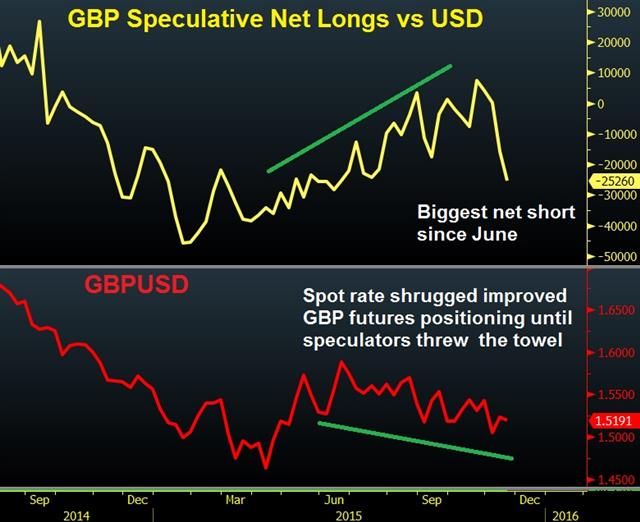

The latest figures from speculative futures' commitment report show sentiment continued to worsen in the week ending on Tuesday, following the 8,500% collapse (from 188 net long contracts to 8,488 net shorts) in the aftermath of aggressive downgrade in the BoE's quarterly inflation report. More interestingly, note the clear divergence between the steadily improved futures positioning since April and the downtrend in the GBPUSD spot rate since late June, which extended until the last two weeks. And just as GBPUSD seemed to mount its own positive divergence, Friday's sell-off happens.

Fortunately, we had two additional shorts in GBP, one of which, was locked in at a gain, the other allowed to progress. As for GBPUSD, a new note/trade will be issued for our Premium Insights subscribers ahead of Tuesday's inflation report testimony by governor Carney and chief Economist Haldane. Stay tuned.

Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35