Summer Backslide

The jump in Australian cases along with flareups in China and Japan show how difficult COVID-19 will be to contain. On the weekend US cases rose again but the market has so far brushed it aside. Some of that is because of lower mortality rates but there are also signs of complacency as summer hits.

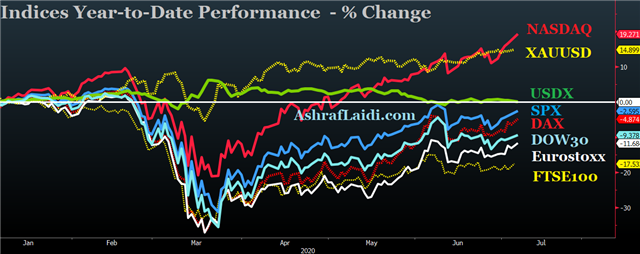

The tug-of-war between easy money and virus fears has turned into a summer stalemate. So far, the economic impacts of the lockdown and a rebound in economic measures on pent-up demand and massive government stimulus was predictable.

The more challenging task is figuring out the expiration of fiscal measures. Time certainly isn't on the economy's side in the pandemic, but no one is quite sure when time will run out. That should bring economic data to the fromt focus in the weeks ahead.

The Bank of Canada business outlook tumbled to -35.0 vs from 22.0, highlighting deeply negative coniditions across all regions and sectors due to the the pandemic and drop in oil prices.

Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35