Summer Stimulus on Standbye

Another week has gone by and US policymakers are deadlocked on further stimulus. White House economic advisor Larry Kudlow said that executive orders – to some extent – fill the need for a second stimulus package.

That comment sent a small shudder through the market but it was a soft bond auction later that sparked a US dollar bid and some stronger risk aversion.

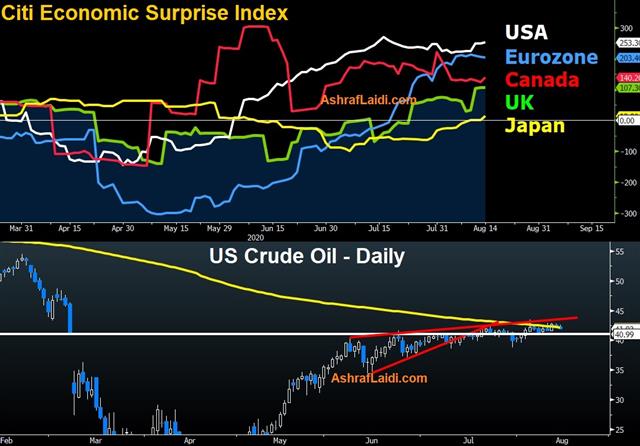

The number of trend changes this week has been notable – bonds, precious metals, and USD. Yet the broader theme of complacency around the recovery, the election and stimulus remains the dominant theme.

Initial jobless claims placated some of the worries on Thursday as they fell to a 21-week low of 963K compared to 1100K expected. However there are still 28.2m Americans on some form of unemployment benefit and the absence of the $600/week bonus has to be hurting consumers at the moment.

Keep an eye on #Covid19 developments as the numer of cases in France rebounds strongly, while Germany warns about Spain and Greece and in the meantime deaths in Florida jumped back up. Some express puzzlement at how the rise in new cases is not causing new deaths, which could suggest a sign of world-wide immunity.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55