Clashing Narratives

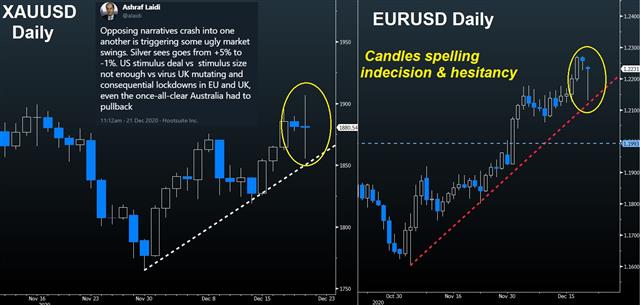

The horror film-like qualities of 2020 continued on the weekend as concern about a more-easily transmissible strain of covid-19 circulating in the UK led to some drastic actions.

A surge of cases and the new strain led to London and the southeast of England going into a Tier 4 lockdown, meaning that all non-essential shots including hairdressers and leisure most close. A new stay-at-home message was also introduced, urging people to work from home and mixing households is banned. Overnight travel of any kind is banned.

The Telegraph reports that that Tier 4 restrictions in the UK could last four months.

A multitude of countries have now banned all travel to the UK but there were confirmed cases of the new variant in continental Europe two weeks ago; raising the possibility that this winter will be even worse than feared.

The Brexit front also did no favours to sterling. Talks will continue but there was no breakthrough and time is running short. Fishing remains the main snag.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +142K vs +156K prior GBP +4K vs -6K prior JPY +44K vs +48K prior CHF +9K vs +10K prior CAD -16K vs -21K prior AUD -9K vs -10K prior NZD +14K vs +11K priorLatest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55