The Powell Put is Alive

The simple message from the Federal Reserve:They're not eager to cut, but they will act if something goes wrong; yet if everything goes right, they're still not going to hike. The dollar jumped on the first part, then sank on the second. The Canadian dollar tumbled further as the BOC took a surprisingly dovish turn. A new Premium trade was issued after Powell's press conference, supported by 2 charts & 6 key notes.

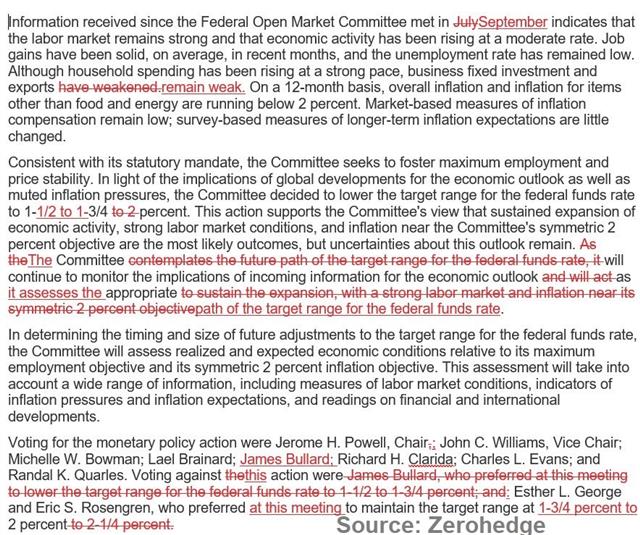

The dollar was whipsawed by the FOMC meeting. The early move was higher as the statement and early comments from the chairman indicated it would take a 'material' negative shift in the outlook to spark another rate cut. He highlighted trade and global growth as particular risks.

That means a December cut is much less likely than the 31% priced into Fed funds futures in the run-up to the meeting. As of now, Fed funds futures are pricing no chance of a December rate cut, and 1 rate cut by next June.

Nevertheless, the dollar turned around and sank on cautionary inflation comments. This pivot towards inflation has been quietly circulating for months and appears to be the lasting legacy of this rate cutting cycle. Powell said they “would need to see a really significant move up in inflation that's persistent before we would even consider raising rates"

That's an extremely dovish statement and will have lasting consequences for the Fed chair until at least Feb 2022. Even longer if it's adopted as Fed doctrine. Given that criteria, it's unlikely that Powell hikes again in his term.

So the message is: rates will remain at current levels, or lower indefinitely. That was already the baseline in markets, but if you paint an optimistic scenario of a US-China trade deal and a pickup in global growth, then it's a stance that's potentially very stimulative and dollar-negative, especially against emerging market currencies.

The Bank of Canada took a different view. Like Powell, BOC Governor Poloz highlighted resilience in the economy but said that resilience will be tested in the months ahead. The market was pricing in virtually no chance of a cut Wednesday but Poloz said they weighed an insurance cut. It means the BOC is paying far less attention to sizzling domestic employment data, 2% domestic inflation and a pickup in housing; and far more attention to global growth. If there is some kind of setback, the BOC may be quick to pull the trigger. That dovish shift weighed on the Canadian dollar across the board.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55