The Problem With Dumping May

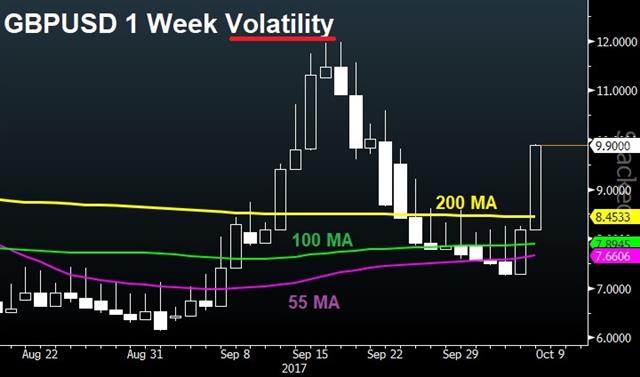

The pound has been battered alongside Theresa May's political career but there are reasons to think she will stick around. GBP continues to be the day's worst performing currency ahead of a speech from BoE's Haldane (13:00 London time) and the US/Canada jobs reports (13:30). Since US NFP will be skewed by the Hurricanes, the determinant factor will be on earnings, expected at 0.3% m/m from 0.1% and 2.5% y/y from 2.5% y/y.

Theresa May is increasingly unpopular, that's a bad thing for Conservatives but replacing her isn't exactly a good thing for the party. It doesn't change the impossible task of squeezing out a passable Brexit deal. The good news for the Conservatives is that they have four-and-a-half years before they need to call an election.

If you're a Conservative rival, this is an ideal situation. You can let Theresa May put together a Brexit deal – one that will almost-surely be unpopular – and then dump her with enough left to salvage an election win.

The worst thing could happen to a potential rival would be that she's forced out. In essence, that would mean that you forced yourself in. The good news is that you would be Prime Minister; the bad news is that you would still be forced to negotiate a Brexit deal, which would still be hopeless and would be the end of your political career.

The bottom line is that Conservatives are going to realize that someone (besides Cameron) is going to take the fall for Brexit, so it might as well be PM May.

At the moment, the pound is in freefall on the thinking that May will be forced out and some kind of civil war will take place as Barnier, Juncker and Merkel snicker to themselves. Anything is possible in politics but you have to assume Conservatives will tone down the backstabbing at some point.

That still leaves plenty of time for traders to refocus on the likelihood that Carney hikes rates this year. The question is: when does that happen? Right now the pound is flirting with 1.3070, which is the 61.8% retracement of the Aug-Sept rally. If that gives way, the bottom of the range is 1.2774.The next chapter will be written by non-farm payrolls and the USD side of the equation, so there's no sense in rushing in but we're probably at peak-May hysteria now.

Before the jobs report, the market will eye BoE chief economist Haldane at 13:00 London time for the latest assessment of odds of a November BoE hike, currently standing at 80%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Dudley Speaks | |||

| Oct 06 16:15 | |||

| FOMC's Kaplan Speaks | |||

| Oct 06 16:45 | |||

Latest IMTs

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16