Three Big Questions

FX and indices remain reluctant to break out of recent ranges as the euro, loonie, gold and the major indices were drawn back lower in Friday Asia & EU before stabilizing in the US session. We await some catalyst to break the recent ranges or reinforce them. As market volumes wind down ahead of the long weekend holiday in the US and UK, it's a good moment to outline the three major themes that will shape the future. And here is a chart from Ashraf illustrating the near perfect symmetry in stock market volatility achived by authorities.

1) US-China relations

On Thursday US Senators announced a bill that would sanction China over Hong Kong and that was quickly met by Beijing promising counter-measures. The news hurt broad sentiment and pulled the euro back below 1.10.It's now almost a certainty that the path of US-China relations will be increasingly antagonistic. The only question is how quickly and severely it deteriorates. Much of the prosperity and disinflation of this century has been a result of moving production to China for cheap labour and minimal regulation. Disentangling the supply chain doesn't necessarily undo that regime due to the availability of several other low-cost regions. One possible risk is that China and the US carve up the world into separate spheres in a 'with us or against us' battle. China's recent spat with Australia suggests it's not in a rush to make friends but top officials have repeatedly praised globalization and said it will continue. We're less sure but there's no reasonable path where this isn't a drag on global growth for the 2020s.

Interestingly, Emerging Markets strategists are feeling in the mood-- Citi EM team recommends buying EM FX as economies re-open, deeming them to be with the mist upside potential after the Covid-10 slump. Goldman Sachs went as far to say "buy the world's worst stocks because rebound is coming". And GMO told clients to buy the riskies of the risky: Argentina Debt.

2) The virus

We still know so little about the virus, from how many people have fought it off without symptoms to whether it can re-occur. Anti-body surveys have been over 20% in New York but are near 5% in hard-hit parts of Europe. There is no scientific consensus. The timeline and potential for a successful vaccine remains deeply uncertain. More importantly is a short-term read on how consumers will react. On Thursday, Starbucks said store sales were back to 80% of pre-COVID levels but is that a true sign of demand? Or a sign that small coffee shops don't have a drive-thru?3) The great loosening

Austerity is dead. Voters won't vote for it and politicians are increasingly enthusiastic about spending. We're undoubtedly entering an era of deficit spending but it's unclear how aggressive governments will be, or can be. At the same time, central banks have shifted to a regime where they will keep rates low until inflation has hit, or likely exceeded targets. This is a dangerous game that ends in inflation and currency debasement but Japan has demonstrated that it can go on for years before the costs are clear.All three are big, ongoing changes and add deep layers of volatility and uncertainty that we don't see reflected in markets. That won't last but for now markets are taking comfort in cheap, easy money as a remedy for everything.

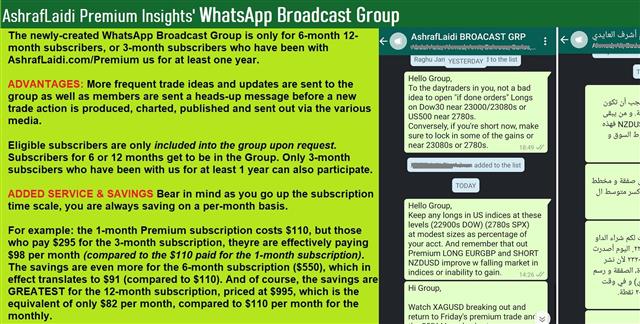

About our NEW WhatsApp Broadcast Group

Latest IMTs

-

30 yrs of Gold under 4 Minutes

by Ashraf Laidi | Dec 13, 2025 12:29

-

AAOI & the Fed

by Ashraf Laidi | Dec 11, 2025 19:22

-

3 Qstns for Today's Fed Meeting

by Ashraf Laidi | Dec 10, 2025 15:40

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19