Trump Hikes after Powell Cut, onto NFP

Trump announced a new round of tariffs on China Thursday in a surprise move that led to a flight to safety. The yen was the top performer while the Australian dollar lagged. The tariff news reverses any progress on trade and should reverberate for weeks. For those of view who entered the DAX trade featured in Tuesday's HotChart, congrats. Meanwhile, each of the existing 3 Premium trades are in the green, including EURNZD at +350 pts.

The market was digesting the Fed news Thursday when Trump tweeted that he was putting 10% tariffs on all $300 billion of Chinese imports that are currently tariff-free. They will go into effect on Sept 1, baring a change of heart. Trump also noted that tariffs could be raised further depending on how talks go.

The move damaged through all yen crosses with AUD/JPY closing at the lowest since 2011 in a 1.9% fall. WTI crude was already lower but in total it fell more than 7% in its worst one-day loss since 2015. US equity markets fell 0.9% with some retail stocks down more than 10%. Treasury yields fell 6-14 basis points to fresh 3-year lows, with all maturities touching fresh cycle lows. Gold jumped more than $30.

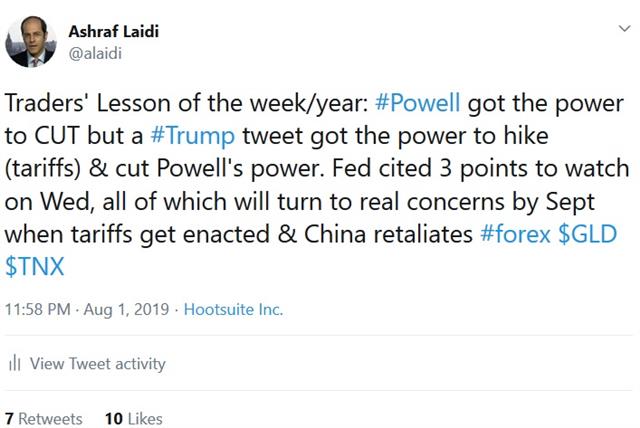

The announcement is a game-changer on almost every front (see Ashraf's tweet above). Powell yesterday specifically highlighted that trade tensions had diminished since May. The fresh escalation means the Fed is now more likely to ease in September. Global growth is also deeper in peril.

The next headline to watch for will be Beijing's response. They had recently pledged to buy more US agricultural goods but that could be reversed and China could retaliate in what would spark a deeper crisis.

One spot to watch is the Chinese currency as the offshore yuan neared 7.00. Allowing the currency to depreciate would signal that China is no longer keen on negotiations.

Not to be lost in all the Fed and tariff talks is that Friday includes the release of non-farm payrolls. The consensus is +165K with unemployment ticking down to 3.6% from 3.7%. Average hourly earnings above the 3.1% y/y expected could put the FOMC in a bind.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55