Trump Raises Trade Stakes

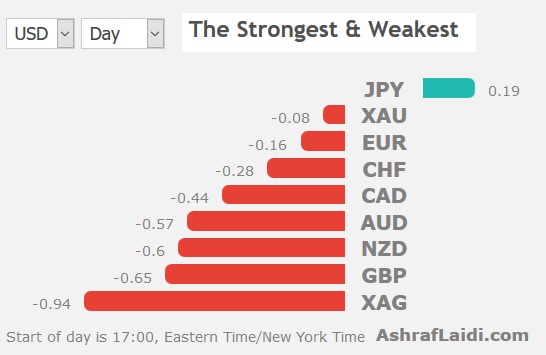

Global equities are down across the board and the yen is the only gainer versus the dollar after a series of weekend tweets by pres Trump threatening to ramp up US tariffs on Chinese goods one day before the Chinese delegation was due to arrive in the US. The pound was the top performer last week after local elections gave Labour and Conservatives a reason to work together. A new GBP long was issued late last week. And despite the tumble in stocks, last week's DOW30 short was stopped out by 40 pts before the sell-off ensued.

Trump delivered a shocker on Sunday announcing that the $200 billion in goods the US imports from China currently paying 10% tariffs will be hit with a 25% rate starting Friday. In addition, he said the $325 billion that's still at a zero rate will also be hit with 25% 'shortly'.

Previously, all the commentary from the White House had been positive and Chinese officials are headed to the US this week in what was expected to be the final phase of negotiations. But Trump said talks were moving too slowly and that China was attempting to renegotiate.

This is likely posturing, pressuring and political grandstanding for the domestic audience as the US tries to squeeze out some small concessions at the end of talks. The market may take that into account and blunt the reaction but the stakes have certainly been raised for this week's talks. This also puts the Chinese side in a tough spot because any concessions would reek of weakness at home.

The story will certainly upend markets to start the week and yen early will be the theme. The RBA will also undoubtedly consider this at the May 7 meeting where the market is currently pricing in a 40% chance of a cut.

Note that both the UK and Japan are on holiday to start the week so early trading will be thin.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -105K vs -105K prior GBP -5K vs -2K prior JPY -100K vs -94K prior CHF -40K vs -38K prior CAD -47K vs -47K prior AUD -59K vs -50K prior NZD -11K vs -5K prior

Latest IMTs

-

Retail Traders' Hastiness

by Ashraf Laidi | Jan 27, 2026 9:40

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55

-

Gold or Silver?

by Ashraf Laidi | Jan 23, 2026 17:42

-

40 on the Mint Ratio

by Ashraf Laidi | Jan 23, 2026 11:27

-

Trump's Golden Hit

by Ashraf Laidi | Jan 22, 2026 10:58