US Rides High into Non-Farm Payrolls

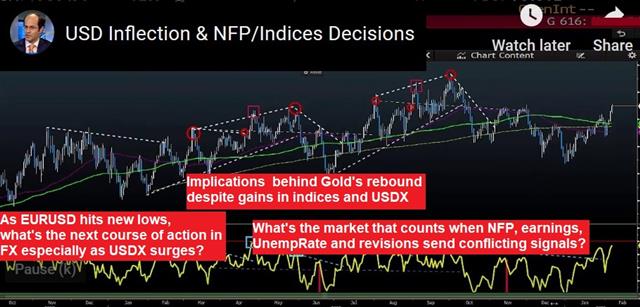

Markets were more settled Thursday and that's typical of the lull before non-farm payrolls. The US dollar was the top performer while the pound lagged. The Canadian jobs report is due along with the US report. Ashraf posted a Premium video ahead of NFP, addressing the 3 key points below.

The US dollar crosses some technical thresholds Thursday, but only tentatively. EUR/USD fell through 1.1000 and touched the lowest since October while USD/JPY rose above 110.00 for the first time since the coronavirus flare up on January 21. GBPUSD softened for the third time in four days this week and is now less than 30 pips from a fresh post-election low.

Even with the S&P 500 edging to a record, the commodity currencies remained tentative. The Australian dollar erased Wednesday's gain and USD/CAD briefly rose above 1.33 for the first time since Dec 3.

All the moves lacked genuine conviction and bonds were flat with no particularly market-moving news aside from OPEC chatter that ranged from a 600K BPD cut to simply extending the current quotas to year-end. Russia continues to be the reluctant partner.

The day ahead will be all about jobs with the US non-farm payrolls report forecast to show 165K new jobs. The market is probably priced 10-20K a bit higher after Wednesday's ADP beat. The dollar will need some measure of positive news to sustain its recent rally but it's tough to see this report as a game-changer no matter what the number is.

From a traders' point of view, USDX has pushed to news highs ahead of US jobs, while EURUSD is testing key support levels. By the same token, gold has recovered off its 1550s lows to climb along indices and stocks. Ashraf mentions some similarities with the current set-up and suggests possible inplications.

The Canadian jobs data released at the same time tends to be more volatile and it often results in a bigger kneejerk market move. The consensus is an unusually high +17.5K after a +27.3K reading in December.

Finally, the past two Friday's have featured a late-week selloff on coronavirus weekend worries. That's still a risk but with new cases now falling in China, it may not be a factor.

Latest IMTs

-

5 Stocks Worked for me Best in 2025

by Ashraf Laidi | Dec 5, 2025 14:42

-

Silver 150 Highly Plausible

by Ashraf Laidi | Dec 4, 2025 11:19

-

4264 Gold

by Ashraf Laidi | Dec 2, 2025 13:56

-

Bitcoin & 35 Pct

by Ashraf Laidi | Dec 1, 2025 11:10

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Nov 30, 2025 9:55