Will Fed Raise the Discount Rate Today?

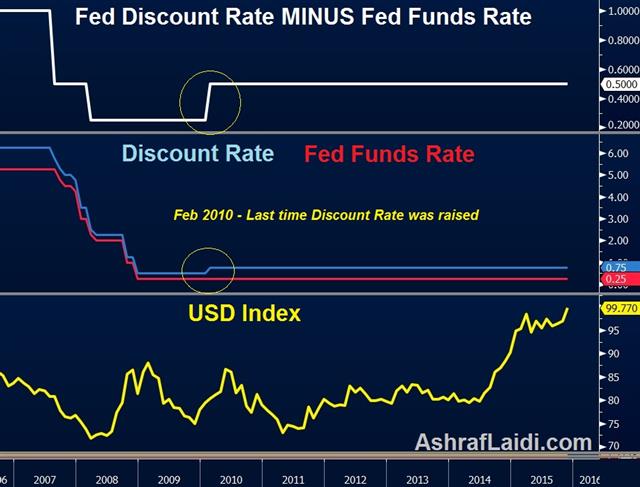

Will the Fed raise its discount rate at its previously unscheduled meeting for today? Thursday's post on the Federal Reserve's website that “an expedited, unscheduled meeting of the Board of Governors of the Federal Reserve to review the discount rate” will be held today (Monday) at 11:30 ET (16:30 London/GMT). The discount rate, the rate at which banks borrow from the Fed's discount window is set by the Board of Governors, rarely used by the banks. This must not be confused with the fed funds rates, which is set by the Federal Open Markets Committee.

Speculation that the discount rate will be raised today stems partly from the decision to schedule the meeting as recently as last Thursday. The other reason to expect a possible hike today is that 5 of the 12 district banks voted for a rate hike at the September meeting, with the hawks being the district banks of Philadelphia, Cleveland, Richmond, Kansas City, and Dallas. Will the balance be tipped in favour of a hike by New York and Atlanta?

The discount rate was last raised in February 2010, one month before the end of QE1, a program, which was followed by QE2 eight months later. Today, the discount rate stands at 0.75%, compared to the 0.25% for the funds target. If the Fed is intent on raising rates in December by 25 bps, it could well hike the discount rate to 1.00%, thus, maintaining the differential at 25 bps. Such strategy would bring about a highly telegraphed December hike in the Fed Funds rate, thereby, more likely to reduce any upward USD shock.

A rapid USD rally should be expected from a discount hike today–even if the rate is little utilized by banks—but it is uncertain whether such gains would last as the impact on equity markets must also be considered. If the discount rate is held unchanged today, the odds remain well above 65% for a December lift-off. But do not forget the upcoming reports on core PCE Price Index, the November jobs and the outcome from the ECB policy meeting.

I continue to expect a December rate hike is far from accomplished, regardless of today's decision on the discount rate.

Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35