Will Turkish Lira Fall Spread Further?

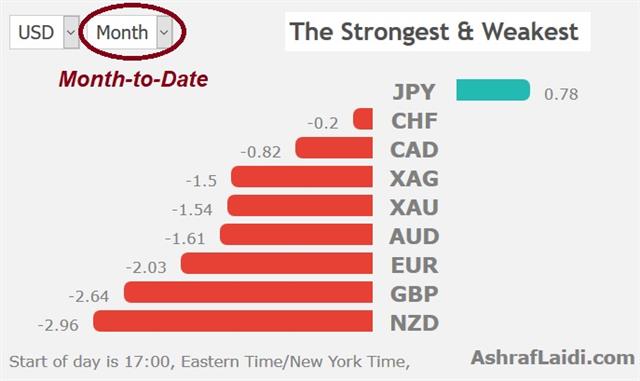

An emerging market economic crisis is nothing new but Turkey is the world's 17th largest economy and the dramatic drop in the currency raises bigger questions. The lira fell another 11% in early trading Monday to 7.15. CFTC positioning data showed more money going into US dollar longs. USDJPY held support at the confluence of the 55-DAY and WEEK moving average, while EURUSD held above its 200-week moving average. The yen remains the strongest of the week and the month ahead of the US dollar, while the franc holds firm. Macro data return this week with UK jobs (Tues), CPI (Wed), US retail sales (Wed), US indus production (Thurs) and UK retail sales (Fri).

Crisis and collapse are words that are too-often used in financial markets and economics but the current situation in Turkey is worth of both. The Turkish lira is down 50% this year and fell by as much as 16% on Friday before an 11% drop early Monday.

The country's large current account deficit (over 5% of GDP) and the inability of the central bank to control 16% inflation has exacerbated capital flight. It's a situation that has many historical parallels and often leads to a run on banks and terrible economic outcomes.

Erdogan on the weekend continued to plea with people not to take money out of the country but that kind of begging only underscores the lack of options. He also hinted at Plan B and Plan C, which sounded like a mixture between capital controls and tighter monetary policy. The problem with a hint like that is that it ensures a stampede to the exits before the banks lock down.

An implosion of the Turkish economy alone may not pose a risk to the global economy but could intensify pressure on emerging market indices. With GDP of about $850B, it sits between the Netherlands and Indonesia in the pecking order. That compares to $360B for Greece at its peak.

Like Greece, the issues isn't the local economy, it's contagion. Emerging markets with some similar strains to Turkey are also under major pressure. Currencies in Argentina, Russia, South Africa and Brazil fell 3-6% last week and most other freely-traded emerging market currencies fell more than 1%.

This is all leading to bids in the traditional safe haven currencies – the US dollar, yen and swiss franc. The most-obvious vector for contagion is via the financial system and European banks may be vulnerable and, by extension, the euro. The yen is higher across the board in early trading.

IMF or Currency Controls?

In our experience, these are some of the most unpredictable events. Yet, considering the looming threat of capital controls, it's not likely to be resolved before it gets worse but watch out for headlines about an IMF rescue. The latter would imply a bailout of as much as $40 bn but would necessitate higher taxes and lower spending, which Erdogan is sure to reject. The 10 Lira mark is considered a possible destination in the event of a continuation of the policy status quo in Ankara.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +11K vs +23K prior GBP -59K vs -47K prior JPY -63K vs -68K prior CHF -46K vs -44K prior CAD -25K vs -32K prior AUD -54K vs -51K prior NZD -25K vs -24K prior

Dollar bets generally increased but they were pared against the Canadian dollar and yen. What was left of euro longs was probably busted out late last week in the fall below 1.15 and yen shorts are now vulnerable.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Flash GDP (q/q) | |||

| 0.3% | 0.3% | Aug 14 9:00 | |

Latest IMTs

-

Technicals & Nature التحليل الفني و الطبيعة

by Ashraf Laidi | Jul 30, 2025 20:58

-

Pound Sterling Crisis or Stability

by Ashraf Laidi | Jul 14, 2025 21:21

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33