Beware of Seasonal Forex Reversals

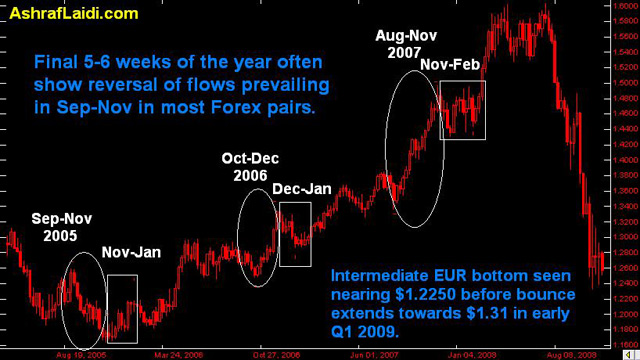

Although currencies ended up adopting their usual path of following the swings in risk appetite, it's worth explaining Wednesday's earlier spikes in EURUSD and GBPUSD. The moves were a result of broad dollar selling (also seen in a $25 rally jump in gold) on reports that Iran was pushing ahead with its nuclear program. The International Atomic Energy Agency found stated an increasing build up of enriched uranium stockpiles, which could be converted into weapons-grade material. Despite the Iran element of the dollar decline, caution is urged of renewed selling waves in the greenback vs. all majors except the yen as seasonal reversals in FX markets usually emerge in the last 5-6 weeks of the year, paring the flows prevailing in Sep-Oct. These reversals emerge from end-of-year position squaring, with dealing desks functioning on skeleton staffs. The chart below illustrates this phenomenon for EURUSD over the last 3 years. A repeat of these trends could see reversals in EURUSD, GBPUSD and USDJPY towards $1.33, $1.62 and 100.00.

One reason, however, that 2008 might prove an exception to these reversals would be for bank dealing desks to add in more hours than is usually the case in year-end in order to maximize trading revenues and ease the operating losses posted throughout the year. And as long as the laws of risk appetite continue to dictate Forex flows, proprietary desks will have no choice but to pursue lower yielding currencies, especially as stocks are resolved to retest the lows of October 2002.

FX Flows Remain Enslaved to Risk Swings

Despite GBPUSDs surge past the $1.5090 resistance onto a 1-week high of $1.52, I warned (CMC clients) that "caution is urged due to GBPUSD's knack for notorious pullbacks at the end of the London session". Ultimately, cable peaked out at $1.5245 before tumbling 300 points as risk aversion soared amid the 6% tumble in US stocks. Remarks from Bank of England's John Gieve indicating prolonged rate cuts due to the possibility of inflation falling below the 2.0% target in 2009 (from current 4.5%). Recipients of the IntradayThoughts were informed that $1.5275 would remain intact as it presented the trend line extending from the Nov 3 high. Similarly, EURUSD gave in at the trend line resistance of $1.2780 (4-hour chart) extending from the Nov 10-13 highs.

Falling inflation and contracting home building remains the hallmark of the current economic landscape as US CPI tumbled 1.0% in October (biggest on record) exceeding expectations of a 0.8% decline, while core CPI fell 0.1% vs. forecasts of a 0.1% increase. Year-on-year figures show a 3.7% increase in the headline and 2.2% in the core. October housing starts up 791K, building permits at 708K. Although the deepening price erosion in all inflation indicators could be perceived as a positive for US stocks on the basis of prolonged Fed easing, the negative impact on profit margins remain considerable, as pricing power disappears in an already poor demand environment. Adding the element of weak foreign demand and the negative impact of currency translation from lower non-USD currencies, US multinationals are set for a multi-dimensional earnings slump, thereby, adding to the fundamental argument of the equity selling.

Feds Forecasts Chase Reality

In stark illustration of another central bank outlook falling behind the real economy, the FOMC downgraded its economic projections for 2009 and 2010 from those made in June. The range of forecasts for 2009 GDP growth was lowered to -0.2% -1.1% from Junes 2.0-2.8%, core PCE was lowered to 1.5-2.0% from 2.0-2.3%, while the unemployment rate was revised to 7.1-7.6% from 5.3%-5.8%. The Fed's continued downgrades of the economy not only show the central banks miscalculation of the real economic risks to the economy, but once again underestimate their assessment ahead. The unemployment rate for instance is widely expected by private economists to reach 8% in 2009, a figure that isnt even included in the higher end of its forecasts. The forecasts highlight the increasing probability the Fed funds rate could reach 0% before end of Q1, a possibility already echoed by San Francisco Feds Yellen. But at least the Feds excessive preoccupation on inflation is diminishing markedly. The latest projections noted "The majority of participants judged the risks to the inflation outlook as roughly balanced, and a number of others viewed these risks as skewed to the downside--a marked shift from June, when the risks to inflation were generally seen as tilted to the upside".

The latest study from the World Gold Council showed an 18% increase in Q3 demand due to safe haven flows resulting mostly from financial market turbulence. Investment demand showed solid support from ETFs, jewelers demand advanced on falling prices, while industrial demand fell on broadening economic slowdown. Golds decline relative to most currencies has been primarily a function of the rising dollar emerging from the globalized nature of the economic slowdown and the massive liquidation in dollar shorts of the first half of the year. This point was especially highlighted by the $100 spike on September 17th when Lehman Bros failure and AIGs woes were considered a largely US-centric risk. Nonetheless, during the past month, gold continues to outperform oil prices, consolidating around the $740s is seen as a prime candidate for rallying on the earliest signs of stabilizing risk appetite and nascent signs of a recovery in Europe and the US.